Sponsored

MAJOR INVESTMENT OPPORTUNITY:

Flood Gates Open on an Untapped Cannabis Market of 740 Million People... 2x BIGGER than USA and Canada – COMBINED!

Investors on High Alert as One Little-Known Upstart Offers a Rare Opportunity to Profit in the NEXT Big Cannabis Boom!

(HINT: Cannabis stocks are back with a vengeance — just NOT where you’d expect!)

James DiGeorgia is the publisher, editor in chief and managing partner of WorldOpportunityInvestor.com. Among other credentials, he has 37 years of financial publishing experience.

While cannabis stocks in the U.S. remain mired down in legislative gridlock, a surprising sequence of events is igniting a powerful new “green rush” in the world’s largest cannabis market.

And it isn’t the U.S. or Canada…it’s Europe.

According to a new economic report:

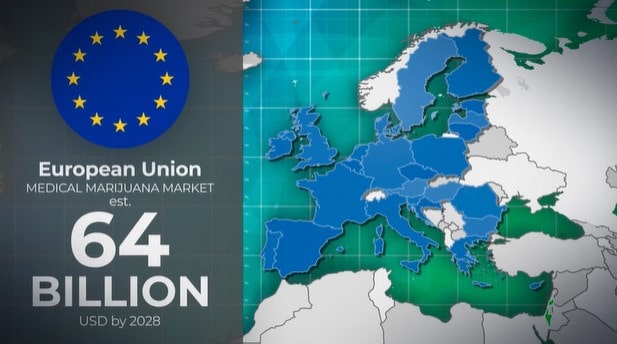

“With a market of 742 million people and total healthcare spend of €2.3 trillion, Europe will soon be the largest medical cannabis market in the world.”[1],[2]

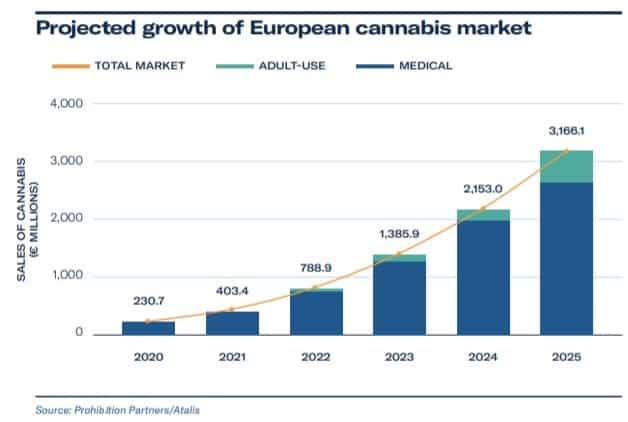

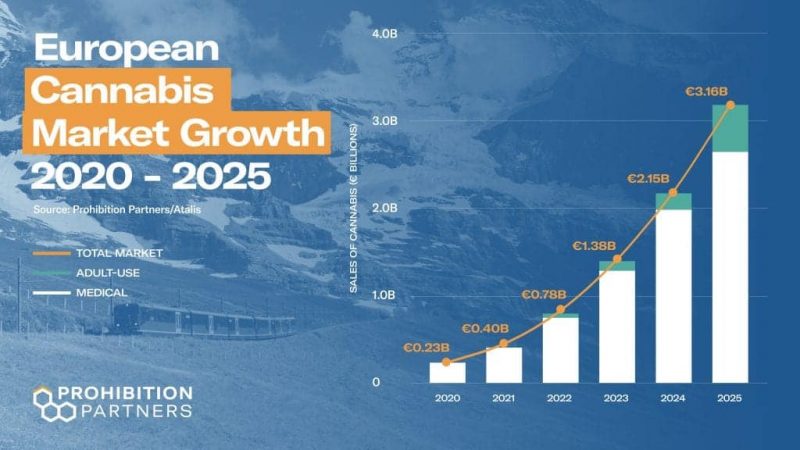

The European cannabis market is forecast to grow with a compound annual growth rate (CAGR) of 67.4% to reach €3.2 billion by 2025, a new report has found.[3]

Compare this to the U.S. cannabis market which is expected to grow at a much slower 14.3% during the next few years.[4a]

So not only is the European cannabis market TWICE as large as the U.S. and Canada combined… it’s reportedly growing 3.7 times faster.

And the cannabis stock that has me most excited is an under-the-radar microcap called Isracann BioSciences (ISCNF). Based on all the evidence I’ve seen (and it is extensive), I believe this cannabis company is ideally positioned to ride the crest of the next big Cannabis Boom – starting now.

Here’s what almost 99% of Investors Seem to Be Overlooking…

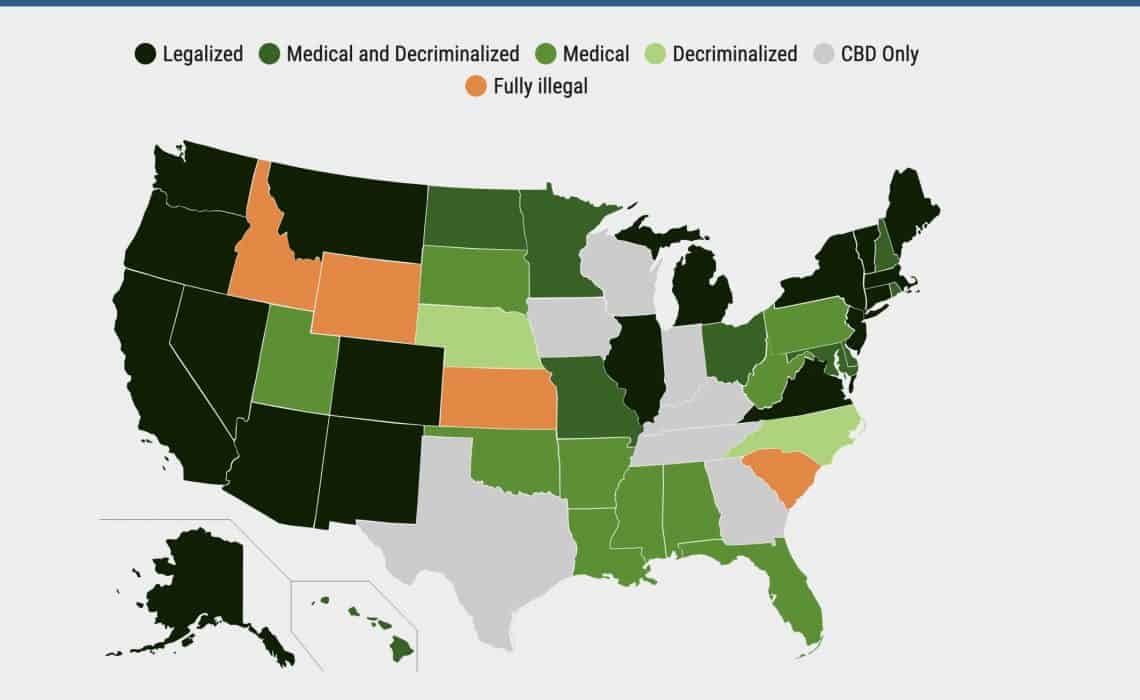

While the U.S. has moved forward with its patchwork of state-by-state cannabis laws, a similar movement has been occurring in Europe for years now. Several countries in the European Union have already established medical cannabis programs, including Norway, Sweden, Finland, Switzerland, Italy, and Portugal, to name a few.

But investors’ eyes have been focused on Germany, the EU’s largest member state, with 83 million citizens.

Now a new report is adding rocket fuel to one of the world’s biggest cannabis opportunities…

BREAKING: According to Forbes, Germany could soon become the second country in Europe to legalize cannabis (after Malta).

The potential implications are huge.

Germany legalizing cannabis, in 2022, would be an earth-shattering event that will create domino effects in Europe — Forbes

If Germany legalizes cannabis by the end of 2022, it would be the largest nation in the world to do so (after Uruguay, Canada, Malta and 18 states in the United States.[4b])

So as the “smart money” looks outside the saturated American and Canadian markets for outsized returns in the coming months and years…I firmly believe Europe is where fortunes will be made as Cannabis Boom 2.0 kicks into high gear.*

And Isracann (ISCNF), a sub – $1 company hiding in one of the world’s smallest countries…[5a]

Could be your way to tap into the new Cannabis Revolution.

So where will you find it?[5b]

Hi, I’m James DiGeorgia, editor of the popular World Opportunity Investor investment advisory.*

Over the years I’ve seen a lot. It’s why I’ve been a featured guest on CNBC, Fox Business, and am frequently quoted as an expert in The New York Times, USA Today, Los Angeles Times, Money magazine, The Chicago Tribune, and Barron’s, to name just a few.

I’m also the author of several best-selling books including The New Bull Market in Gold, The Rise of Gold in the 21st Century, The Global War for Oil, and The Trader’s Great Gold Rush.

And not to brag, but when President Trump’s good friend, and Mar-a-Lago member Christopher Ruddy found his financial division in a rut, he brought me into the inner circle to energize them. So, I am well-known for discovering stocks just as they hit the fast track for success. I’ve been discovering moonshot stock winners for Main Street and retail investors for the past 40 years.

Even so, I’ll bet there are some readers out there saying, “Jim, are you nuts… a penny stock?”

And I totally get it. Penny stocks are risky.*

But the fact is, investors won’t get a chance to get stinking rich by getting positioned in a pot stock opportunity that has already left the port…

In my professional opinion, it’s way better to identify an under-the-radar microcap with massive potential – and still trading below $1.

So it’s time to let the cat out of the bag about Isracann Biosciences (ISCNF), a company I call, The World’s #1 Most Lucrative Pot Stock Opportunity of 2022*…

Good News If You Missed the FIRST Cannabis Boom of 2014-2019

Up until now, America has been THE cannabis market.

Despite federal prohibitions, Cannabis has become bigger than football. Last year, cannabis sales in the U.S. hit $25 billion, blowing past NFL revenues of $12 billion.[6]

Medical marijuana is now legal in 39 states… and recreational use legal in 18 states (and Washington, D.C.)… [7]

Even better, smart investors believe that with a Democratic administration, federal legalization is on the horizon… and I agree.

Which could be why the Cannabis ETF (which tracks 30 pot stocks) jumped over 219% in the first four months after Joe Biden was elected president.[8a]

Despite the recent slowdown, CNBC is reporting that catalysts for cannabis stocks are once again adding up.

Just look at these double-digit increases in cannabis ETFs in just 10 days in February 2022[8b]:

- The AdvisorShares Pure US Cannabis ETF (MSOS) is up 22%

- The ETFMG Alternative Harvest ETF (MJ) is up 14%

- AdvisorShares’ Pure Cannabis ETF (YOLO) is up 16%

- The Global X Cannabis ETF (POTX) is up 21%

- The Amplify Seymour Cannabis ETF (CNBS) is up 20%

- The Cannabis ETF (THCX) is up 14%

‘Marijuana Madness: It’s Like the Internet in 1997’

But the next HUGE Cannabis Boom–I call it Cannabis Boom 2.0[9]—won’t be fueled by growing U.S. demand alone.

So I’m excited to tell you about a rare opportunity to get in on one of the most exciting cannabis pure-plays out there today. Isracann BioSciences (ISCNF) is aiming to become a premier supplier in one of the world’s fastest-growing cannabis markets.

And amazingly, its stock remains cheap… under $1 per share as of January 2022.

Here’s the thing. You WON’T find it in Colorado, California… or anywhere else you might expect.

The next big “pot stock moonshot” opportunity* is hiding in a place almost no one is looking…

But before I reveal its location, let me remind you what happens when “cannabis fever” grips Wall Street and sends publicly-traded stocks soaring to astronomical levels.

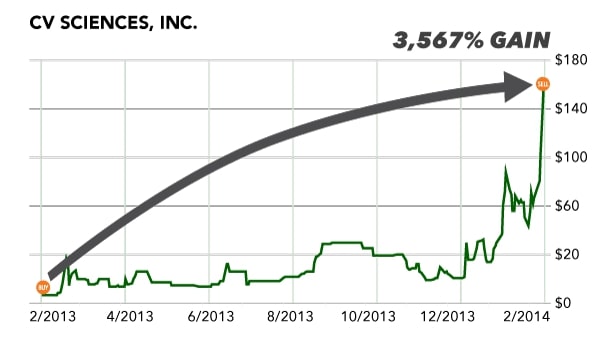

For example, investors had a legitimate shot at making a fistful of dollars when marijuana-based pharmaceuticals maker CV Sciences surged to a peak gain of more than 3,500% from February 2013 to February 2014.[10]

As the first Cannabis Boom moved on and further relaxations were instituted, many more lucrative opportunities emerged, like these:

- Max Gains +514%[11] on Tilray (TLRY); Aug.– Oct. 2018

- Max Gains +1,486%[12] on Aphria (APHA); June 2016 – Jan. 2018

- Max Gains +2,516%[13] on Canopy Growth (WEED); May 2016 – Sept. 2018

- Max Gains +9,033%[14] on Cronos Group (CRON); July 2016 – March 2019

- Max Gains +4,733%[15] on MariMed (MRMD); July 2016 – Oct. 2018

Today, they are big companies with massive capitalizations. Many are overfunded – certainly not where investors should be looking for the next breakout superstar stock.

Instead, cast your eyes to Isracann (ISCNF), the sub – $1 company as of February 2022 set to tap into the massive and fast-developing European market.

Global cannabis industry consultants, Prohibition Partners, say:

“The Cannabis Market in Europe will be Worth Billions by 2025”[16]

The European cannabis industry is still young — reminding some observers of the cannabis situation in the U.S. from a decade ago. Think about this…

Total medical cannabis sales in Europe in 2019 were less than half the sales that took place in the U.S. state of Arizona (population 7.3 million) that same year.[17]

But it’s growing FAST.

Medical cannabis or cannabis-derived drugs are already legal in over 20 European countries,[18] and could soon be available to most of Europe’s 714 million citizens.[19][20]

Plus, there are signs that liberalization of cannabis laws is accelerating quickly. 2021 saw a steady stream of good news stories for the cannabis industry in Europe. [21]

- The first patients received treatment under France’s pilot medical program… [22]

- Switzerland adopted new regulations regarding medical cannabis which has allowed for easier access by patients…[23]

- Portugal approved its first medical cannabis product.[24]

- Big countries like France and the UK improved patient access to medical cannabis, and will eventually represent a significant share of the European market. In fact, if regulations continue to progress as predicted, the UK medical cannabis market could show the most significant growth of any country in Europe by 2025.[25]

But for now, Germany remains the medical cannabis goliath in Europe thanks to progressive legislation and a large and affluent population. It will constitute over half of the European market until 2024. And imports of medical cannabis into the German market increased by 80% in the first half of last year, bringing the total to 9.8 tons of product in the first two quarters.[26]

Plus, in what could be a major catalyst for legalization, the European Court of Justice ruled that CBD is not a narcotic under EU law, allowing for the commencement of approval for CBD products on the continent.[27]

Now that the flood gates are opening in the gigantic European medical cannabis market, smart investors are beginning to look for an emerging cannabis stock powerhouse in this region.

And one under-the-radar company called Isracann BioSciences, Inc. (ISCNF) may be perfectly poised to profit from this coming cannabis revolution.

As a pure-play cannabis enterprise, Isracann (ISCNF) is focused on becoming a premier low-cost, high-quality cannabis producer in Europe.

In fact, the situation with ISCNF is so timely… so rich with opportunity*… and so potentially lucrative… that it reminds me of what happened with another cannabis superstar stock just a few years ago.*

You might remember it…

What Can Happen when a Tiny 25-Cent Cannabis Upstart Gains First-Mover Advantage in an Untapped $64 Billion Market?

I mentioned MariMed earlier.

They certainly caught the rising tide at the start of the U.S. cannabis boom a few years ago. Here’s what happened…

MariMed started trading at $0.12.[29]

Then the share price went up… and up… and up like crazy.

From 12 cents to an all-time high of $5.80.

Early investors sure are happy. They had a chance to make 48 TIMES their money. On a single stock. Now that’s a potential retirement saver.

A $5,000 investment could have turned into a $241,650 treasure chest.

Even if you weren’t lucky enough to get in at the bottom at 12 cents and out at the very top at $5.80… investors still had ample opportunity to make multiples of their money.

How often do investors get a second chance to make a tremendous return like that?

And the potential here is mind-blowing. Consider this…

While MariMed only has distribution in six U.S. states…[30]

The pot stock upstart I am telling you about today, ISCNF, is paving the way to become a premier, low-cost provider in over 20 underserved European countries.

Like I said, my indications are that Cannabis Boom 2.0 (in Europe) could be even bigger than what happened last time. Because medical cannabis could soon be available to most of Europe’s 714 million citizens![31]

With the European cannabis market set to grow by 29.6% per year between 2020 and 2027[32]… and up to $64 billion in revenue on the table… life-changing gains like this could happen again.* And soon.

Check out what Meb Faber, the CEO and chief investment officer of Cambria, told CNN Business recently that cannabis:

“Could be as lucrative as tobacco and alcohol companies were in the early days of those industries.”[33]*

So where do you look for a company preparing to dominate the underserved (but massive) European cannabis market?

In a very unusual place…

Why does U.S. News & World Report call Israel “the Holy Land of Marijuana”?[34]

Israel’s been recognized for decades as one of the most innovative nations on earth. Many people know it as a global leader in IT, premium agriculture and most recently — vaccinations.

Israel’s been recognized for decades as one of the most innovative nations on earth. Many people know it as a global leader in IT, premium agriculture and most recently — vaccinations.

But how did the 152nd largest country in the world,[35] slightly larger than New Jersey, and home to only 9 million people,[36] become a frontrunner in the coming European Cannabis Revolution?

Well, it’s all due to an “accident” that almost never happened…

Dr. Mechoulam is a Bulgarian holocaust survivor who immigrated to Israel and is considered by many as a founding father and icon for the cannabis industry. In 1964, while working as a faculty member at the Weizmann Institute of Science in Israel, Mechoulam and an associate, Yechiel Gaoni, isolated the THC molecule and established its structure.[37] (THC is the main psychoactive compound in cannabis that produces the high sensation.)

Dr. Mechoulam is a Bulgarian holocaust survivor who immigrated to Israel and is considered by many as a founding father and icon for the cannabis industry. In 1964, while working as a faculty member at the Weizmann Institute of Science in Israel, Mechoulam and an associate, Yechiel Gaoni, isolated the THC molecule and established its structure.[37] (THC is the main psychoactive compound in cannabis that produces the high sensation.)

It’s hard to believe that this one man and his body of research ended up jump-starting a new industry centered on the medicinal benefits of cannabis.

And instead of looking the other way, Israel is being smart and exploiting this tremendous achievement.

Unlike many countries, the Israeli government has given enthusiastic support to the industry for decades.

Today, Israel is one of only three countries in the world where cannabis research is sponsored by the government.

Israel was one of the first to approve use of medical marijuana in 1973. And on April 1, 2019, Israel decriminalized the use of cannabis for citizens over the age of 18 when used in private. Possession of a home-grown marijuana plant and buds are no longer a punishable offense.[38]

“The medical cannabis industry is expanding, fueled by Israel’s strong research sector in medicine and technology – and notably, by government encouragement.” – USA Today[39]

And the rest of the world is noticing…

At least 15 US companies have moved their entire R&D operations onto Israeli soil to escape onerous regulations on cannabis research in the US, where it is “easier to research heroin than cannabis”.[40]

ISCNF is continuing in this proud tradition…

Today, a small team near Tel Aviv has created Israel’s first pure-play cannabis enterprise in order to capitalize on the $64 billion European cannabis market.

In addition to being in the home of cannabis innovation and research with THC and CBD cannabinoid structure initiated at the Hebrew University of Jerusalem….

And able to access the top researchers in the field for the development of cannabis formulations and profiles… [41]

Isracann BioSciences is exploiting a unique advantage over all overseas competitors…

…ISCNF can tap into Israel’s perfect conditions for cannabis growth and cultivation.

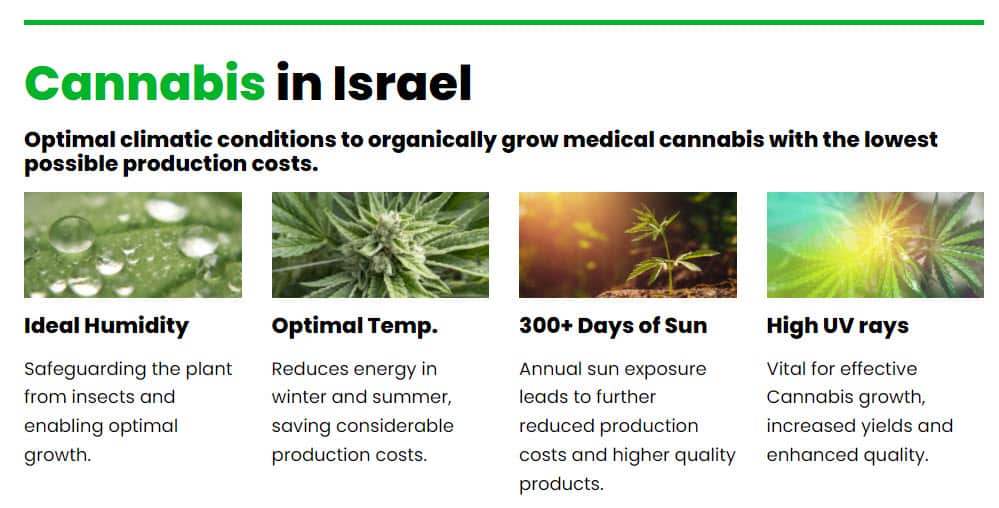

“Israel offers the perfect natural climate for cannabis cultivation, which many say is even better than California!”

- 320 days of sunshine a year[42]…

- ideal humidity safeguarding plants from pests…

- optimal temperatures significantly reduce energy costs…

- and high ultraviolet light levels…

IMAGE SOURCE [43]

So while other outdoor growers around the world, in less productive regions, are lucky to get one decent harvest per year…

The unique combination of factors in Israel means the cannabis growing season literally never ends — allowing for multiple healthy harvests per year.

In fact, production costs are estimated at approximately one-third of the cost of growing in colder climates such as Canada or Europe.[44]

For example, let’s compare ISCNF to the average North American producer.[45]

Due to the extremely high cost of using artificial production methods, plus the high cost of labor… the average cost for a North American producer to grow cannabis indoors or in greenhouses is quite high.

Recently, cannabis producer Aurora reported[46] a cost of $1.14 per gram. In the same month, producer Aphria reported a $1.43 cost per gram.[47]

Meanwhile, Isracann’s anticipated cost of production is only $0.40 per gram.[48]

Such a low cost of production is a major barrier to entry to competitors. So it’s no wonder that…

“Israel is banking on cannabis as its next big industry.” – Los Angeles Times[49]

While Isracann prepares for a major expansion into the booming European market, let’s not overlook that it has a huge and growing market right at home.

Owing to progressive cannabis policies and a strong cultural acceptance, Israel is one of the leading markets for cannabis in the world due to…

- Israel has the world’s highest ratio of cannabis users, with 27 percent of the population aged 18-65 having used marijuana in 2016.[50]

- In terms of medical cannabis, Israel has 108,013 patients as of November 2021. That’s an increase of 30% from 2020.[51]

- Israel is the largest importer of any country. By June 2020, Israel had imported six tonnes of cannabis, which is more than the entirety of German imports up to the end of September of the same year.[52]

This represents a massively underserved domestic market offering significant and immediate opportunities for expansion.

“Since our decision to enter the market sector in Israel, we have seen cannabis reform, including major advances in legalization, production and distribution. We’ve also seen the door opening up for export sales, and a wholesale shift in cultural acceptance.”[53]

But the BIG opportunity, as I’ve already shown you, lies beyond the borders…

An Extraordinary “Pure-Play” Cannabis Opportunity for the Massive European Market

As Isracann (ISCNF) focuses initially on the domestic market in Israel… refining and perfecting their operational expertise… the gigantic opportunity lies in mainland Europe.

- Prohibition Partners estimates that the European cannabis market will be worth €403.4 million by the end of 2021 and will grow at a compound annual growth rate (CAGR) of 67.4% from 2021 to reach €3.2 billion by 2025.[54]

The Medical Cannabis Market in Italy Grew 30% in 2020 | Reimbursed sales of medical cannabis in Germany grew by 34% in 2020

Operating from its strategic base outside Tel Aviv, ISCNF looks to be a prime beneficiary of the rapidly improving regulatory situation for medical cannabis throughout Europe.[55]

Isracann’s (ISCNF) flagship property encompasses two adjoining farms, across 2 million square feet of prime land[56] in one of Israel’s most fertile and productive agricultural regions.

This 2 million square foot tract of prime agricultural property is poised to meet the need not only of Israel’s domestic cannabis users… at a super-low production cost of just $0.40 per gram…

It also gives ISCNF a beach head into Europe’s massive medical cannabis market of 741 million people.

So you owe it to yourself to find out more about…

A Hidden $64 Billion Opportunity… and My #1 Most Surprising Pot Stock to Exploit It

The EU cannabis market is projected to be worth $64 billion [58] by 2028, and thanks to a recent development, Isracann (ISCNF) is making plans to be its premier supplier.

Up to now, companies in the Netherlands (Bedrocan) and Canada (Canopy Growth, Tilray, Aurora and Aphria) have supplied the vast majority of medical cannabis used in European countries.[59]

However, in a milestone initiative, Israel approved legislative framework for export of medical cannabis in January 2019 which positioned it as the third country behind Canada and Netherlands able to export medical cannabis.[60]

Image Source [61]

This opens the door for ISCNF to export into the massive European marketplace…

Remember, the EU medical market is estimated to be $64B USD by 2028.

With the export framework now in place, Isracann (ISCNF) aims to become a premier supplier to the European cannabis market (five times bigger than North America’s).[62]

The logical entry point is Germany, a medical market with extremely large potential. In 2018 German health care covered over $75 million of cannabis products. Germany imports cannabis from the Netherlands and Canada, and started importing from Israel in December of 2020.[63]

AND NOW GERMANY IS ON THE CUSP OF LEGALIZING THE SALE OF CANNABIS…

Image Source [64]

This groundbreaking development will no doubt set off a frenzy for investors to find the next breakout star in the European cannabis space. And at the moment (January 2022), Isracann (ISCNF) is trading below $1 per share.

It reminds me of what happened during the first big cannabis wave…

A few lucky investors bought Aphria (up 1,486%)…[65] Canopy Growth (up 2,516%)…[66] or Cronos Group (up 9,033%)[67] before they shot to the moon.

No guarantees, but it could happen again.* This time in Europe.

As Isracann BioSciences’ CEO Darryl Jones says:

“Our goal has been to establish infrastructural agreements aimed at launching Isracann onto the world stage as a truly international cannabis enterprise.” [68]

“We have been actively initiating and expanding our visibility and relationships across the region and onwards into Europe.”

Top 10 Reasons Why I Believe ISCNF is Poised to Succeed in the World’s Largest Cannabis Market

- Global cannabis use and acceptance is growing within all consumer segments, with an estimated global market size of $146.6B by 2025.[69]

- Europe is the world’s largest, untapped market of 740 million people.[70]

- EU medical market is estimated to be worth $64B USD by 2028.[71]

- Isracann, Israel’s first pure-play cannabis firm, is focused on becoming a premier, low-cost cannabis producer.

- It will offer a one-stop medicinal cannabis solution to all European countries where it is legal.

- Israel boasts the best growing climate for cannabis in the world… allowing Isracann to achieve low-cost production (est. $0.40/gram).[72]

- Israel boasts a history of innovation in technology and premium agriculture, and Isracann (ISCNF) plans to leverage that to dominate both the domestic and European markets.

- In a major milestone initiative, Israel approved legislative framework for export of medical cannabisin January 2019.[73]

- Initial entry point is Germany, a medical market with extremely large potential. In 2018 German health care covered over $75 million of cannabis products.[74]

- Besides me, very few analysts are following this fast expanding, under-the-radar cannabis opportunity in the European market.

I suggest you do your due diligence and find out more about Isracann BioSciences (ISCNF) now that Cannabis Boom 2.0 is kicking off with a vengeance.*

Feel free to show your investment advisor or broker a copy of my brand new sector report.

I suspect they will love this great high-potential story.

As always, though, investors need to be cautious when it comes to stories with tremendous potential but limited revenues – so far. They can carry a significant amount of risk. So it’s always important to read the risk disclosures and make an informed decision and to check with your investment advisor or broker before investing.

Plus, I urge all investors to observe my three rules for accepting microcap investing risk:*

- Risk Reduction Rule #1: Never invest more than you can afford to lose.

- Risk Reduction Rule #2: Do not chase losses. That means if prices slide you must resist all temptation to “average down.”

- Risk Reduction Rule #3: Don’t put all your dreams on one microcap. Allocate your risk capital among a handful of stocks.

With that, I wish you good luck. But before I go, let me remind you that Forbes is saying the cannabis industry is growing at a rate that is “larger and faster than the dot-com era.”[75]

So if you missed the first Cannabis Boom, this could be your second chance.

And remember, Europe is 2X bigger than the U.S. and Canada – COMBINED.

Don’t get left behind.

– James DiGeorgia

Daily Trade Report

ADVERTISEMENT DISCLAIMER

This paid advertisement includes a stock profile of Isracann BioSciences (OTCQB: ISCNF) (“ISCNF”). To enhance public awareness of ISCNF and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately nine hundred and sixty five thousand ($965,000.00) USD to cover the costs associated with this advertisement for a period beginning 1 December 2020 and currently set to end 31 March 2022. In connection with this effort, Promethean has paid the author of this advertisement, DiGeorgia fifteen thousand nine hundred and fifty ($15,950.00) USD in cash out of the total budget. The website hosting this advertisement, Daily Trade Report, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Daily Trade Report have been paid to host this advertisement. As a result of this advertisement, Daily Trade Report may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. James DiGeorgia is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Daily Trade Report website, some or all of Promethean, Daily Trade Report, Summit, or James DiGeorgia, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of ISCNF’s and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of ISCNF, increased trading volume, and possibly an increased share price of ISCNF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended.

To more fully understand the Daily Trade Report website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.consultancy.eu/news/2307/europe-to-become-the-worlds-largest-legal-cannabis-market

[2] Image from 1:27 mark of Isracann Investor preso: https://isracann.com/investors/

[4b] https://disa.com/map-of-marijuana-legality-by-state

[5a] https://finance.yahoo.com/quote/ISCNF?p=ISCNF&.tsrc=fin-srch

[5b] Chart inside box taken from Isracann Investor presentation. At 20-second mark of this video: https://isracann.com/investors/

[6] https://seekingalpha.com/news/3785876-us-legal-cannabis-sales-grew-40-in-2021-bofa

[7] https://disa.com/map-of-marijuana-legality-by-state

[8a] https://www.investopedia.com/markets/quote?tvwidgetsymbol=THCX Nov. 4 $9.28; Feb 10 $28.65

[9] For two quotes in box: https://www.wsj.com/articles/wall-streets-marijuana-madness-its-like-the-internet-in-1997-1537718400

https://www.nasdaq.com/articles/cannabis-stocks-may-be-2021s-big-winners-2021-01-07

[11] Tilray 2018 8/1/18: 23.58 9/19/18: 214.06 [12] https://www.tipranks.com/stocks/apha/stock-charts APHA’s price went from $1.08 to $17.

[13] Canopy 5/2/2018: 1.98 9/4/2018: 51.53 https://finance.yahoo.com/quote/WEED.TO?p=WEED.TO&.tsrc=fin-srch

[14] Cronos 7/3/2016: 0.185 3/3/2019: 29.15 CRON.TO quote

[15] MariMed 7/3/2016: 0.11 9/30/2018: 5.38 https://finance.yahoo.com/quote/MRMD?p=MRMD&.tsrc=fin-srch

[16] https://www.lab-worldwide.com/europe-cannabis-market-to-be-worth-32-billion-euro-by-2025-a-1013041/

[17] https://mjbizdaily.com/wp-content/uploads/2020/05/europe-2020-report-A4_FINAL-1.pdf

[18] https://cannigma.com/where-cannabis-is-legal-in-europe/

[19] https://www.statista.com/statistics/253372/total-population-of-the-european-union-eu/

[20] Image from 1:14 mark of Isracann Investor preso: https://isracann.com/investors/

[22] P23 of this report https://prohibitionpartners.com/2021/04/09/key-insights-from-the-european-cannabis-report-6th-edition/

[23] P23 of this report https://prohibitionpartners.com/2021/04/09/key-insights-from-the-european-cannabis-report-6th-edition/

[24] P23 of this report https://prohibitionpartners.com/2021/04/09/key-insights-from-the-european-cannabis-report-6th-edition/

[26] https://cbdtesters.co/2021/10/05/wheres-it-from-the-specifics-of-germanys-cannabis-import-market/

[28] Image source: P96 of this report https://prohibitionpartners.com/2021/04/09/key-insights-from-the-european-cannabis-report-6th-edition/

[29] https://www.thecannabisinvestor.ca/top-performing-cannabis-stocks-of-the-decade/

[30] MariMed is a multi-state operator operating in the states of Delaware, Illinois, Massachusetts, Maryland, Nevada, and Rhode Island.

https://marimedinc.com/locations/

[31] https://www.statista.com/statistics/253372/total-population-of-the-european-union-eu/

[32] https://www.businesswire.com/news/home/20200826005435/en/European-Cannabis-Market-Worth-37-Billion-by-2027-Rising-at-a-CAGR-of-29.6-Between-2020-2027—Research And Markets.com

[33] https://amp.cnn.com/cnn/2021/04/20/investing/cannabis-stocks-420/index.html

[35] https://www.nationsonline.org/oneworld/countries_by_area.htm

[36] https://datacommons.org/place/country/ISR?utm_medium=explore&mprop=count&popt=Person&hl=en 9.053M

[37] https://www.cannapatientcare.com/view/cannabis-2-0-in-israel-elevating-everything-

[39] https://eu.usatoday.com/story/news/world/2012/11/03/israel-medical-marijuana-drugs/1678641/

[40] https://wikivisually.com/wiki/Cannabis_in_Israel

[41] https://isracann.com/market/

[42] https://www.cannabissciencetech.com/view/cannabis-20-israel-elevating-everything

[43] Image from https://isracann.com/project/

[45] Cost comparisons: https://investfloragrowth.com/#:~:text=Due%20to%20the%20extremely%20high,and%20%240.88%20per%20gram%2C%20respectively.

[46] https://smallcappower.com/analyst-articles/aurora-cannabis-canadian-stock/

[47] https://www.leafly.com/news/industry/8-cent-harvest-cost

[48] https://isracann.com/project/

[49] https://www.latimes.com/nation/la-fg-israel-cannabis-medical-marijuana-20190529-story.html

[51] https://mjbizdaily.com/aurora-sends-its-largest-ever-medical-cannabis-shipment-to-israel/

[56] https://isracann.com/company/

[57] Image from 0:37 mark of Isracann investor presentation; https://isracann.com/company/

[58] https://www.newstimes.com/business/article/136-Billion-Reasons-To-Get-Into-The-European-14899337.php

[59] https://mjbizdaily.com/wp-content/uploads/2020/05/europe-2020-report-A4_FINAL-1.pdf

[61] Image from 1:03 mark of Isracann investor preso; https://isracann.com/company/

[62] Image from 1:08 mark of Isracann investor preso; https://isracann.com/company/

[63] Image from 1:22 mark of Isracann investor preso; https://isracann.com/company/

[65] https://www.tipranks.com/stocks/apha/stock-charts APHA’s price went from $1.08 to $17.

[66] Canopy 5/2/2018: 1.98 9/4/2018: 51.53

[67] Cronos 7/3/2016: 0.185 3/3/2019: 29.15

[69] https://isracann.com/wp-content/uploads/2018/11/Isracann-Presentation.pdf

[70] https://isracann.com/wp-content/uploads/2018/11/Isracann-Presentation.pdf

[72] https://isracann.com/wp-content/uploads/2018/11/Isracann-Presentation.pdf

[73] https://isracann.com/market/

[74] https://isracann.com/market/

[76] Image copy – based on Forbes article; https://ivn.us/2017/01/06/legal-marijuana-sales-bigger-dot-com-boom