Sponsored

The “New Oil” Has Triggered a Battery-Powered Fuel Revolution

Lithium is at the core of the shift to renewable energy. This white lustrous metal is vital to the batteries powering the electric vehicles and advanced energy storage systems we need for a cleaner, greener future.

But North America’s single working lithium mine — in Nevada’s famed Clayton Valley — is insufficient to meet our country’s needs. And continued dependence on Beijing for our lithium supply is a true national security issue.

One little-known lithium exploration company has snapped up assets in Nevada’s Clayton Valley lithium hotspot. Become familiar with Scotch Creek Ventures Inc. (SCVFF) now, before it becomes a key player in helping our country meet its skyrocketing need for the “new oil.”*

By J. Daryl Thompson

John D. Rockefeller founded the Standard Oil Company in 1870. He went on to become the richest person in American history.[1]

But part of Rockefeller’s legacy as an oil tycoon resulted from mass production of Henry Ford’s popular Model T auto, starting in 1908.[2]

Powered by the internal combustion engine, the Model T triggered a soaring demand for gasoline[3], made from crude oil (also called petroleum).[4]

What do you suppose Mr. Rockefeller would think about today’s growing calls to end our country’s dependence on oil?

After all, it’s the very commodity that made him wealthy.

And with the fuel revolution taking place today, I wonder what he would think about the high energy metal called lithium.

The white powdery metal hailed as…

The “new oil.”[5] The “white petroleum.”[6] The “new gasoline.”[7]

Yes, lithium has garnered comparisons to the fuel that has powered internal combustion engines for well over a century.

It’s not surprising…

The development of the lithium industry looks very similar to the beginning of the oil boom.[8]

Lithium involves complicated methods of extraction, just like oil.

And it will be a main factor in driving vehicles, just like gasoline.

In fact, lithium is at the core of our shift to renewable energy. Most electric vehicles and plug-in hybrids rely on lithium-ion batteries.[9]

And as these batteries overtake internal combustion engines to become the dominant power source for cars and trucks, automakers will continue to have a growing need for lithium.

Or what The Economist calls “an increasingly precious metal.”[10]

Of course, oil stocks created fortunes for countless investors, big and small.

But as we move away from fossil fuels to adopt sources of clean and renewable energy, investors have justifiable doubts about the future of oil stocks.[11]

That’s why they’re looking ahead.

Just like last century’s oil boom…

And just like last century’s auto empire that made Henry Ford one of the richest people in the world (with an estimated net worth of $200 billion in today’s dollars)[12]…

The lithium revolution could make some forward-thinking investors very wealthy.*

Just look at what has already happened with Elon Musk’s Tesla.

The lithium battery and electric vehicle manufacturing company rocketed to popularity and a place on the S&P 500 in 2020. Stock shares rose quickly, placing Tesla in the top ten most-valued companies on the index. This created a plethora of millionaires who describe themselves as “Teslanaires.”[13]

However, it’s now time to look elsewhere for stocks with great upside potential. As reported by Barrons, analysts believe Tesla is overvalued by a whopping $1 trillion.[14]

That’s why I’m looking at investments more closely related to the raw commodity so vital to the fuel revolution — lithium itself.

With that in mind, I’ve found the grassroots lithium exploration company Scotch Creek Ventures Inc. (SCVFF) is worth a serious look. Not merely because it’s a lithium company, but because this small-cap miner has the potential to become a source of critically-lacking domestic lithium.*

Desperate for Domestic Lithium

Just like oil, lithium shapes our geopolitics.[15]

According to a 2020 assessment by Benchmark Mineral Intelligence, communist China controls 80% of the global production of battery raw materials such as lithium.[16]

Beijing’s dominance over our lithium supply is a vulnerability that places the United States at a disadvantage when it comes to trade talks, politics, or even acts of aggression.[17]

Commodities billionaire Robert Friedland warns that access to battery metals is a national security issue. Wars, he noted, have been fought over oil — and future disputes could be over battery metals.[18]

As the Wall Street Journal noted in a March 2021 headline…

“A Good Battery is the Best Defense Against a Military Assault”[19]

Lithium batteries are found in nearly every weapon system used by the Department of Defense. This is particularly true for portable equipment.[20]

While on patrol, U.S. soldiers carry almost 20 pounds of lithium batteries. This is typically the second heaviest category of equipment after body armor.[21]

The military’s reliance on lithium batteries is projected to continue growing exponentially. That’s because the next generation of weapons — tactical ground vehicles, directed energy weapons, and unmanned systems — are designed to incorporate the low weight and high energy density of lithium battery technology.[22]

So it’s no wonder that former President Trump authorized the Defense Production Act to streamline construction of domestic mines and prioritize the expansion and protection of critical minerals such as lithium in secured supply chains.[23]

Then, in June 2021, battery industry leaders met with the Biden administration’s Secretary of Energy Jennifer Granholm about strengthening the domestic lithium battery supply chain.[24]

Their industry roundtable reported:

“Advanced, lithium-based batteries play an integral role in 21st-century technologies such as electric vehicles, stationary grid storage, and defense applications that will be critical to securing America’s clean energy future.”[25]

In line with stated priorities, industry leaders developed a National Blueprint for Lithium Batteries, with goal #1 being “secure access to raw and refined materials…”[26]

However, when it comes to gaining access to raw lithium in the United States…

We have a BIG problem.

That’s because, right now, there is only one operating North American lithium mine.

That’s Nevada’s Silver Peak mine, owned by behemoth Albemarle — with a market cap of $26 billion[28]. This mine has been producing lithium since the 1960’s.[29]

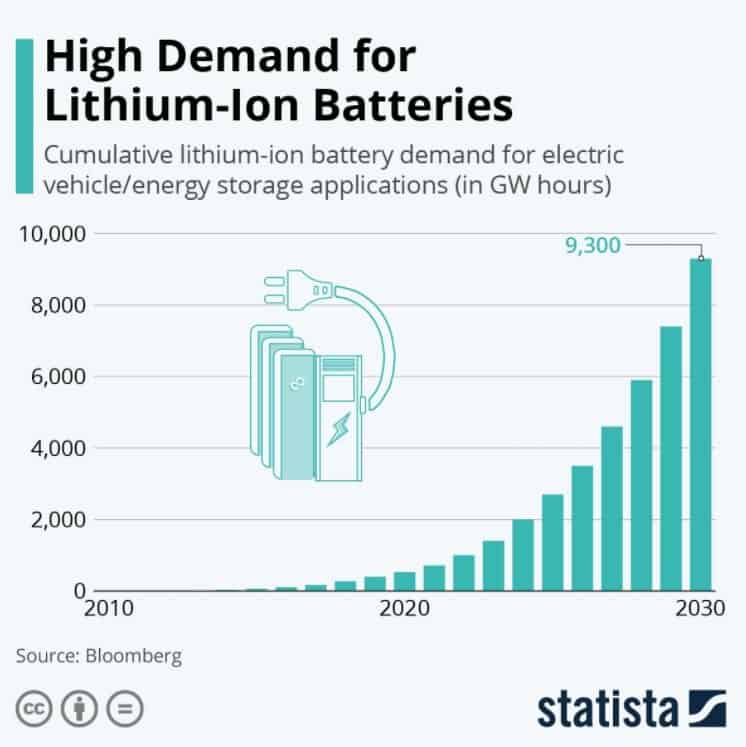

Unfortunately, Silver Peak produces a mere 5,000 tons a year — less than 2% of the world’s annual supply.[30] This level of production is not nearly enough to meet the expected demand, especially when it comes to lithium-ion batteries.

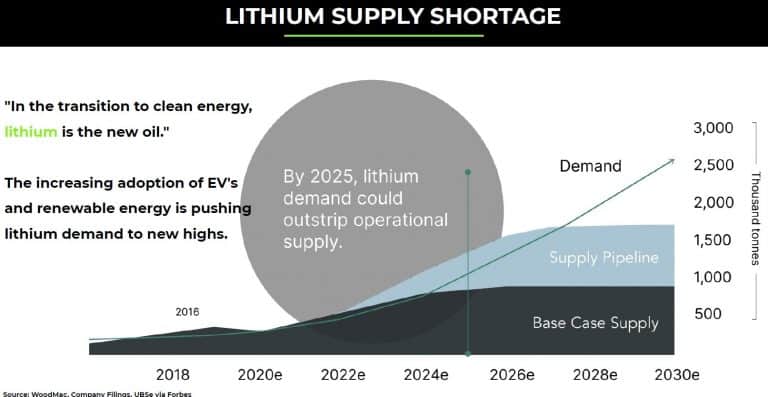

By 2030, projections show a lithium deficit from 455,000 and 1.7 million metric tons per year.[31]

That’s why I’m looking at Scotch Creek Ventures Inc. (SCVFF) — a next-door neighbor to the Silver Peak mine — as a potential new domestic resource for critical battery raw materials.

Growing Global Need for Lithium-Ion Batteries

Biden’s Electric Goals

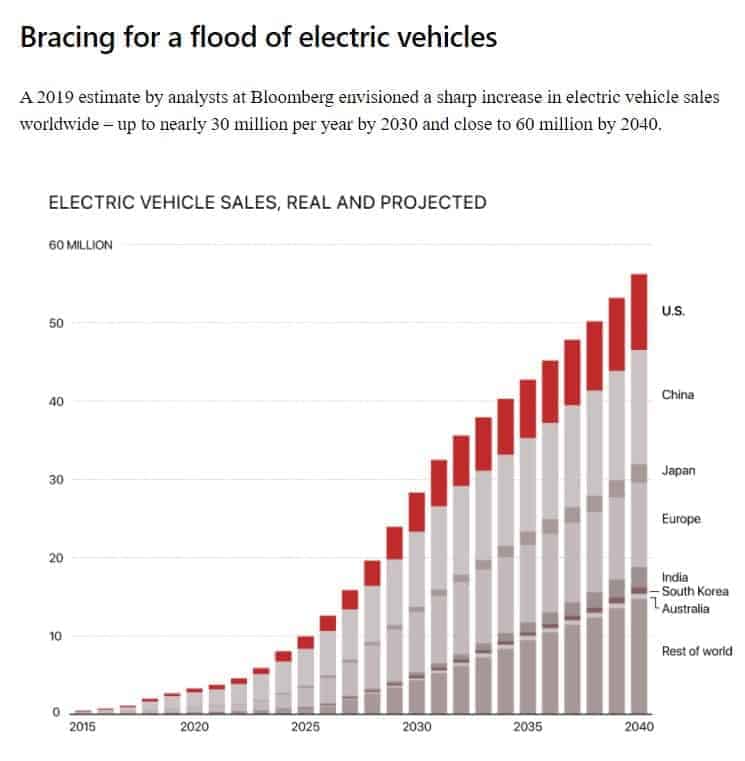

In August 2021, President Joe Biden signed an executive order with a lofty goal —50% of all new vehicles sold by 2030 should be electric powered.[34]

According to the New York Times, nearly all major U.S. automakers, many foreign automakers, and even the United Automobile Workers Union have endorsed this plan.[36]

In 2019, the U.S. government had 645,000 gas and diesel-powered vehicles, with about 35% of them operated by the U.S. Postal Service. In early 2021, President Biden signed an executive order to replace the government fleet with electric vehicles, demonstrating his commitment to a greener future.[37]

And that’s just the government…

According to Car and Driver, 19 electric vehicles were up for sale in the U.S. in 2021, together with many plug-in hybrids. And carmakers say they will be launching dozens of additional EVs over the next 10 years.[38]

Tesla sold 5,400 units of its pricey Model S in 2021.[39]

And each 70 kWh Tesla Model S battery pack, which weighs over 1,000 pounds, contains nearly 140 pounds of lithium.[40]

While some electric vehicles are far too expensive for the average American, other top-selling EVs in 2021 were more affordable, including the Nissan Leaf, Chevrolet Bolt, and the Hyundai Ioniq Electric.[41]

One thing is clear…

There’s no stopping this megatrend of electrifying vehicles, making the timing right to take a hard look at companies such as Scotch Creek Ventures (SCVFF).

Epicenter for North American Lithium

Junior lithium explorers like Scotch Creek Ventures (SCVFF) could be part of the solution to the domestic lithium resources the United States desperately needs.

This company could help pave America’s transition to clean energy — while helping to put the brakes on communist China’s lithium power grab.

Let’s take a more in-depth look at this grassroots lithium exploration company focused on acquiring and developing lithium properties in North America.

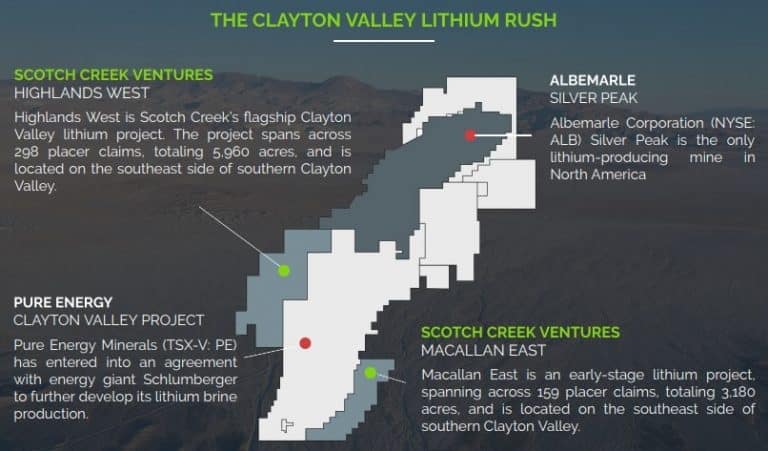

Scotch Creek Ventures (SCVFF) is a junior mining company with 100% interest in two properties in the hotspot of U.S. lithium — Nevada’s Clayton Valley.[42]

Of course, Nevada has historically been a mining friendly state.

According to the 2019-2020 Fraser Institute Survey of Mining Companies, Nevada was ranked #1 in the investment attractiveness index out of 104 jurisdictions worldwide.[44]

The state is also rapidly becoming the hub for manufacturing clean energy and energy storage, along with “green” transportation.[45]

Nevada governor Steve Sisolak has noted that “…Nevada is open for business as a renewable leader,” with a commitment to growing the clean energy economy.[46]

Here’s one example…

Tesla’s $4.5 billion Gigafactory for producing lithium-ion batteries is located in Sparks, Nevada — just 3.5 hours away from the Scotch Creek Ventures (SCVFF) properties.[47]

What’s most important for potential lithium investors to know, however, is this:

The U.S. Geological Survey calls Clayton Valley the best-known lithium deposit in the world.[48]

Well-situated, with a total of 9,140 acres on the high edge of Clayton Valley, Scotch Creek Ventures’ (SCVFF) 100%-owned[49] assets represent one of the largest under-explored land packages in North America’s only producing lithium jurisdiction.[50]

The Easiest Place to Find Lithium is Next to a Lithium Mine*

A famous criminal was once asked why he robbed banks. His answer was simple. “That’s where the money is,” he said.

The same rationale applies to lithium.

It’s not surprising that companies exploring for lithium look to Nevada’s Clayton Valley, with its proven lithium deposits.* Clayton Valley has demonstrated an enormous measured and inferred endowment of lithium.[51]

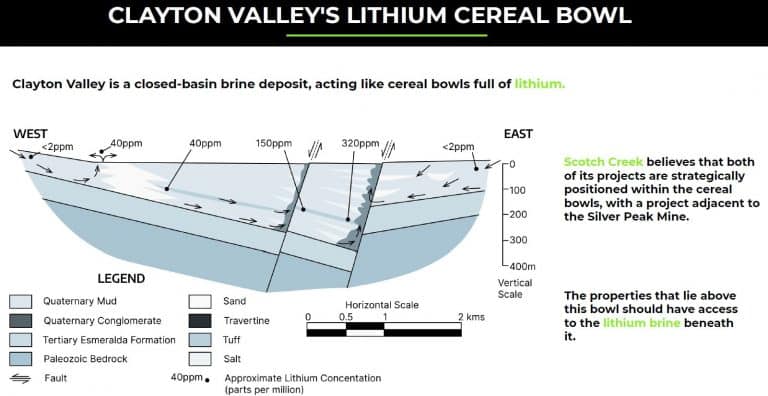

Getting down to the nitty gritty, Clayton Valley can be described as a closed-basin brine deposit, acting much like cereal bowls full of lithium.

Scotch Creek Ventures (SCVFF) believes that its two properties — Highlands West and Macallan East — are strategically positioned within the cereal bowls, with access to the lithium brine below.[53]

And that’s not all…

Scotch Creek’s flagship Highlands West project is directly adjacent to the Silver Peak mine, the only producing lithium brine operation in North America.[54]

Owned by multi-billion dollar company Albemarle, Silver Peak has been producing lithium carbonate for over half a century.[55]

The Highlands West project consists of 298 placer claims totaling 5,960 acres. A recent geophysics survey outlined multiple lithium drill targets on the property.[56]

In addition to its strategic location next to Silver Peak, Highlands West is also located among other top-tier exploration companies such as Pure Energy, Nickel Rock Resources, and Spearmint Resources. Pure Energy has already agreed to lithium production with a multi-billion dollar company.[57] And Spearmint Resources has completed a drill program with high-grade lithium intercepts.[58]

Scotch Creek’s second project, Macallan East, consists of 159 placer claims totaling 3,180 acres on the southeast side of southern Clayton Valley.

Macallan East borders Pure Energy’s property and lies below Cyprus Development Corp’s and Noram Ventures’ lithium projects. Scotch Creek’s Macallan East project is on trend with both companies’ current drilling programs.[59]

In addition, the Macallan East claim block is just six miles from Albemarle’s active lithium production facility.[60]

And recently, oilfield services giant Schlumberger’s New Energy division launched a new lithium brine extraction plant in Clayton Valley[61], located between Scotch Creek Ventures’ two projects.

With good infrastructure already in place, both Scotch Creek Ventures properties are accessible by paved roads from Tonopah and Goldfield, as well as the paved state route 265 through the small town of Silverpeak.[62][63]

Scotch Creek Ventures (SCVFF) intends to extract lithium from brine, as this type of deposit requires less capital and is faster to put into production. Typically, there are fewer geologic and logistical challenges to face with lithium brine than with hard rock mining.[64]

However, the company believes both its properties have the potential to host multiple types of lithium mineralization.[65] This makes claystone/mudstone mining an additional possibility for the future.

Here’s something else that really caught my eye when it comes to investment potential…

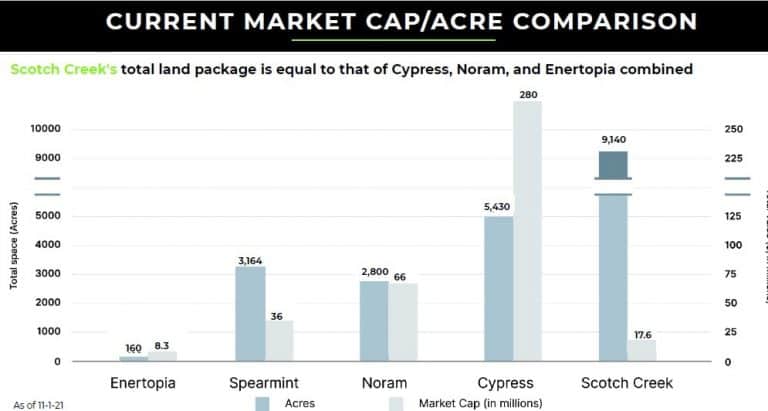

Scotch Creek’s land package is comparable to that of neighboring exploration companies like Noram Ventures, Spearmint Resources, and Cypress Development Corp combined.[66]

Here’s what I mean…

Based on acreage versus market cap, I believe that Scotch Creek Ventures Inc. (SCVFF) is clearly a bargain compared to its competitors — offering what I see as tremendous upside potential.*[67]

New Technology and Eco-Friendly Commitment

In line with the ESG [69] (environmental, social, and governance) approach to mining, Scotch Creek Ventures Inc. (SCVFF) is committed to use technologies at the highest level of resource conservation and minimal environmental impact.

This is important today, especially with an increased focus on environmental responsibility. As mining and minerals expert David Walker notes:

“…Investors are starting to look beyond financial statements and now want to consider the ethics, competitive advantage and culture of a mining organization.”[70]

Older techniques to extract lithium from brine through evaporation ponds have been criticized for land destruction, high water consumption, and potential contamination with impurities.[71]

It’s also a slow process. The traditional evaporation method of lithium extraction used by Albemarle at Silver Peak takes 18-24 months.[72]

That’s why Scotch Creek Ventures Inc. (SCVFF) plans to use the newer technique known as Direct Lithium Extraction (DLE), considered more environmentally friendly.

As a closed-loop system[73], DLE, returns the brine to the ground after the lithium is extracted, a recycling process that uses 85-90% less water.[74]

In addition, DLE is less expensive, and has a much higher lithium recovery rate than conventional processes.[75] Importantly, the DLE process happens in days versus the lengthy time it takes with the evaporation method.[76]

DLE is considered by its developers to be a…

“Clean, socially conscientious alternative that drives the green lithium extraction revolution.”[77]

Also, Scotch Creek Ventures (SCVFF) sees no current impediments on their ability to explore for lithium at a permitting or government oversight level.

The NI 43-101 technical reports on the two properties point favorably to exploration of this ground.[78]

Geophysical surveys have already been performed on both the Highlands West and Macallan East properties.[79] With a BLM permit already in hand, the company plans to drill a core hole in early 2022.[80] Seismic profiling is set to start in early 2022.[81]

If I haven’t convinced you that a small lithium exploration company such as Scotch Creek Ventures (SCVFF) merits your attention, let’s check out more of the megatrends of the green revolution that could lead to some amazing opportunities for everyday investors.*

The U.S. Power Grid Needs an Upgrade — And More Emergency Backup

In November 2021, President Joe Biden signed a historic bipartisan $1.2 trillion infrastructure bill.

The bill includes around $65 billion to help our country’s strained power grid system and to promote climate resilience.[82]

The reality is that our energy grids are woefully unprepared for the future.

According to Yale Climate Connections, “the U.S. electric grid is uniquely susceptible to power outages, a problem expected to get worse with climate change.”[83]

However, the crises related to climate issues may also spell opportunity for certain investors, especially with the projected lithium supply shortage.*

As you’ve seen, Scotch Creek Ventures (SCVFF) has the potential to help solve this little-known critical infrastructure problem.*

Lithium-Powered Battery Storage Systems

When he was still on the campaign trail, then-candidate Joe Biden included battery storage investments in his $2 trillion proposed plan to improve infrastructure in the U.S.[85]

His new bill passed in November 2021 funds the manufacturing of lithium-powered batteries to store energy[86].

American power companies are ramping up interest in huge lithium-containing battery packs and other technologically advanced storage technologies to balance power generation and utilization.

These power grid-level battery storage systems often span huge tracts of land. They can convert electricity into a storable form that can be converted back into electrical energy when needed.[87]

This is not only helpful during weather events and other natural disasters.

These massive battery systems also aid in balancing the output of renewable energy sources such as wind and solar.

These lithium-rich battery packs become complementary energy sources, able to offer bursts of electricity at peak time. They can then charge themselves during times of lower demand.[88]

“Among various battery technologies, lithium-ion batteries (LIBs) have attracted significant interest as supporting devices in the grid because of their remarkable advantages… Given their high energy density, LIBs will be an ideal choice for integration with renewable energy sources in grid-level energy storage systems.[89]

Homeowners Also Look to Lithium-Powered Energy Storage Systems

Home-sized versions of these huge grid-sized energy storage systems are also skyrocketing in popularity. They not only help overcome the issues of an unreliable power grid, but also provide a source of clean energy.[90]

One website focused on sustainability rated the Tesla Powerwall as the best integrated solar system for 2021.[91] And this is just one example of a rechargeable lithium-ion energy storage battery pack.[92]

Facing the challenge of power grid failure in the U.S. will require significant quantities of lithium.

And that’s just one of the reasons why I’m looking at Scotch Creek Ventures (SCVFF) to help meet this and other challenges.

Of course, any successful ventures requires a great team.

The Scotch Creek Ventures Inc. Management Team[93]

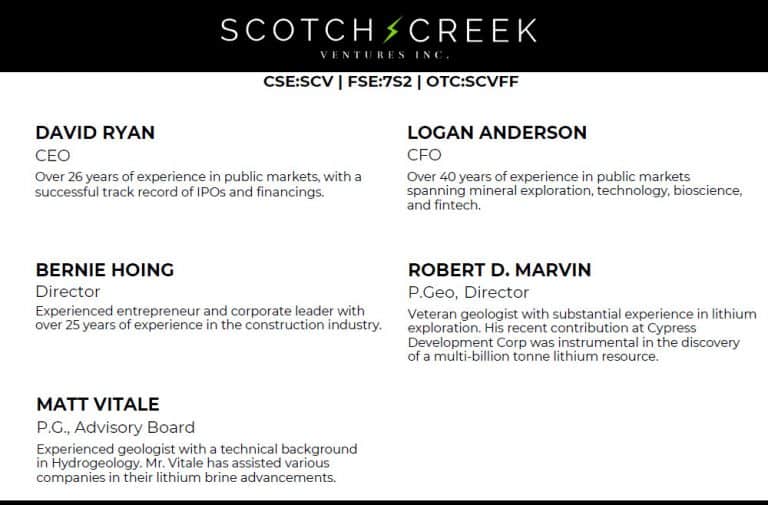

Scotch Creek Ventures Inc. (SCVFF) has assembled a team with over 80 years of combined experience (including two lithium experts) to advance its projects to the next stage.[94]

10 Reasons Why Scotch Creek Ventures (SCVFF) is Well-Positioned for the Lithium Fuel Revolution

The lithium exploration company Scotch Creek Ventures Inc. (SCVFF) is well worth your consideration. Here’s why:

- Soaring Overall Demand for Lithium. Lithium demand is set to skyrocket 1,000% or more by 2030, according to the Energy Information Administration.[96]

- Lithium-Ion Battery Market. The global market for lithium-ion batteries was valued at $36.7 billion US in 2019 and is projected to grow to $129 billion US by 2027 at a CAGR of 18.0% from 2020 to 2027.[97]

- Mining Mecca. Clayton Valley, Nevada is the epicenter for North American lithium. In addition to multi-billion dollar Albemarle, the only producing lithium brine operation in North America, other companies have had promising exploration results within the Clayton Valley district.[98]

- Eco-Sensitive Technology. Scotch Creek Ventures Inc. (SCVFF) intends to use newer technology known as Direct Lithium Extraction (DLE), considered more environmentally friendly.

- Unstoppable EV Trend. Just several years ago, there were less than one million electric vehicles being driven in the U.S. But by 2030, over 27 million EVs are expected to be in operation. Electric vehicle purchases could make up 20-30% of all vehicle sales.[99]

- Energy Storage Megatrend. According to Markets and Markets, the market for battery energy storage is projected to grow from 2.9 billion in 2020 to 12 billion by 2025 at a CAGR of 32.8% from 2020 to 2025.[100]

- Expert Management. Scotch Creek’s team has over 80 years of combined experience (including two lithium experts) to advance its projects to the next stage.[101]

- Infrastructure in Place. Both Scotch Creek Ventures (SCVFF) properties already have access to year-round roads and infrastructure.[102]

- Bargain Price. Based on acreage versus market cap, Scotch Creek Ventures (SCVFF) is currently a bargain compared to its competitors.[103]

- Buying Potential. Scotch Creek Ventures (SCVFF) is surrounded by companies with much higher market caps, including Albemarle and Cypress. This means the potential exists for a profitable buyout that could reward early investors.*

Lock In Your Position With Scotch Creek Ventures Inc.

(SCVFF)

Some analysts predict that the lithium-ion battery market could even hit $1 trillion by 2026.[104]

If you wish to have an opportunity to be among the early bird big winners in the coming lithium-based clean energy revolution, then you might want to show this report to your investment advisor or broker immediately.

Scotch Creek Ventures Inc. (SCVFF) is currently a junior lithium exploration company exploring in Nevada’s Clayton Valley, the epicenter of lithium mining in the United States.

While investing in their company has a potential for higher rewards than other larger mining operations, it also comes with higher risk. And, of course, past performance is no guarantee of future results.*

I am not an investment advisor. But my rule and caution to all my readers is never invest more than you can afford to lose. And do not chase losses. If prices slide, it’s important to resist the temptation to “average down.”*

And to minimize your risk, any investment you might make in Scotch Creek Ventures Inc. (SCVFF) should be part of a wider asset allocation strategy in your portfolio.

Regardless, I believe my analysis of the potentially huge reward of Scotch Creek Ventures is a good one.*

I wish you much success in all your investments.

J. Daryl Thompson

Investingtrends.com

* See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, atypical results, and more.

Still want more information on Scotch Creek Ventures (SCVFF)?

I’d like to offer you access to Scotch Creek Ventures Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.hbs.edu/faculty/Pages/item.aspx?num=47167#:~:text=Rockefeller%20(1839%2D1937)%2C,American%20business%20and%20economic%20history.

[2] http://www.autolife.umd.umich.edu/Environment/E_Overview/E_Overview3.htm

[3] http://www.autolife.umd.umich.edu/Environment/E_Overview/E_Overview3.htm

[4] https://www.infobloom.com/what-is-the-difference-between-oil-and-gasoline.htm

[5] https://www.hinrichfoundation.com/research/article/sustainable/lithium-new-oil-as-electric-vehicle-market-expands/

[6] https://www.forbes.com/sites/timtreadgold/2021/04/23/copper-and-lithium-compete-for-the-title-of-new-oil/

[7] https://www.economist.com/business/2016/01/14/an-increasingly-precious-metal

[8] https://www.wionews.com/world/is-lithium-the-new-oil-355492

[9] https://afdc.energy.gov/vehicles/electric_batteries.html#:~:text=Most%20plug%2Din%20hybrids%20and,%2Delectric%20vehicles%20(EVs).

[10] https://www.economist.com/business/2016/01/14/an-increasingly-precious-metal

[11] https://www.cnbc.com/2021/11/06/bill-gates-big-oil-companies-will-be-worth-very-little-in-30-years.html

[12] https://thesuccessbug.com/henry-ford-net-worth/

[13] https://www.bbc.com/news/business-55391571

[14] https://www.barrons.com/articles/tesla-stock-overvalued-1-trillion-51636053056

[15] https://www.wionews.com/world/is-lithium-the-new-oil-355492

[16] https://www.benchmarkminerals.com/membership/china-controls-sway-of-electric-vehicle-power-through-battery-chemicals-cathode-and-anode-production/

[17] https://aheadoftheherd.com/call-for-domestic-mining-of-critical-minerals-is-finally-being-answered/

[18] https://www.forbes.com/sites/timtreadgold/2021/04/23/copper-and-lithium-compete-for-the-title-of-new-oil/?sh=78a311df682d

[19] https://www.wsj.com/articles/a-good-battery-is-the-best-defense-against-a-military-assault-11617136935

[20] https://nma.org/2021/10/20/lithium-batteries-in-defense/

[21] https://www.nanograf.com/media/18650

[22] https://www.nationaldefensemagazine.org/articles/2018/11/8/offshore-battery-production-poses-problems-for-military

[23] https://www.federalregister.gov/documents/2020/10/05/2020-22064/addressing-the-threat-to-the-domestic-supply-chain-from-reliance-on-critical-minerals-from-foreign

[24] https://www.energy.gov/articles/icymi-secretary-granholm-industry-leaders-discuss-public-private-sector-efforts-develop

[25] https://www.energy.gov/articles/icymi-secretary-granholm-industry-leaders-discuss-public-private-sector-efforts-develop

[26] https://www.energy.gov/eere/vehicles/articles/national-blueprint-lithium-batteries

[27] https://www.scotch-creek.com/macallan-east-project/

[28] https://www.google.com/search?q=albermarle+market+cap&rlz=1C1CHBF_enUS920US923&oq=albermarle+market+cap&aqs=chrome..69i57j0i10l2.3729j1j15&sourceid=chrome&ie=UTF-8

[29] https://www.8newsnow.com/news/north-americas-only-working-lithium-mine-is-in-nevada/

[30] https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html

[31] https://www.morningbrew.com/emerging-tech/stories/2021/12/13/a-lithium-shortage-is-coming-and-automakers-might-be-unprepared

[32] https://reports.valuates.com/reports/ALLI-Manu-1G27/lithium-ion-battery

[33] https://reports.valuates.com/reports/ALLI-Manu-1G27/lithium-ion-battery

[34] https://www.nytimes.com/2021/08/05/business/biden-electric-vehicles.html

[35] https://andthewest.stanford.edu/2021/car-batteries-are-the-goal-lithium-is-the-quickest-way-to-make-them-does-a-global-good-require-local-sacrifice-in-the-southwest/

[36] https://www.nytimes.com/2021/08/05/business/biden-electric-vehicles.html

[37] https://www.cnbc.com/2021/01/25/biden-plans-to-replace-government-fleet-with-electric-vehicles.html

[38] https://www.caranddriver.com/features/g36278968/best-selling-evs-of-2021/

[39] https://www.caranddriver.com/features/g36278968/best-selling-evs-of-2021/

[40] https://electrek.co/2016/11/01/breakdown-raw-materials-tesla-batteries-possible-bottleneck/

[41] https://www.caranddriver.com/features/g36278968/best-selling-evs-of-2021/

[42] https://www.scotch-creek.com/about/

[43] https://www.scotch-creek.com/wp-content/uploads/2021/08/2-pager-black-1.pdf

[44] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[45] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[46] https://thenevadaindependent.com/article/sisolak-signs-milestone-bill-increasing-renewable-portfolio-standard-to-50-percent-by-2030

[47] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[48] https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

[49] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[50] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[51] https://www.scotch-creek.com/macallan-east-project/

[52] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[53] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[54] https://www.albemarle.com/locations/north-america/nevada

[55] https://www.albemarle.com/businesses/lithium/locations/north-america/nevada-silver-peak

[56] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[57] https://www.scotch-creek.com/highland-west-project/

[58] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[59] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[60] https://www.scotch-creek.com/macallan-east-project/

[61] https://www.reuters.com/business/energy/schlumberger-new-energy-develop-lithium-extraction-pilot-plant-nevada-2021-03-18/

[62] https://www.scotch-creek.com/macallan-east-project/

[63] https://www.scotch-creek.com/highland-west-project/

[64] https://www.visualcapitalist.com/a-cost-comparison-lithium-brine-vs-hard-rock-exploration/

[65] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[66] https://www.scotch-creek.com/projects/

[67] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[68] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[69] https://www.slrconsulting.com/en/news-and-insights/insights/esg-insights-what-does-esg-mean-mining-industry

[70] https://www.slrconsulting.com/en/news-and-insights/insights/esg-insights-what-does-esg-mean-mining-industry

[71] https://www.nrel.gov/news/program/2021/using-direct-lithium-extraction-to-secure-us-supplies.html

[72] https://www.reviewjournal.com/local/local-nevada/nevadas-next-boom-demand-poised-to-spur-silver-states-lithium-production-2451259/

[73] https://thenevadaindependent.com/article/is-reno-the-next-lithium-capital-companies-are-looking-to-nevada-for-white-gold

[74] https://thenevadaindependent.com/article/is-reno-the-next-lithium-capital-companies-are-looking-to-nevada-for-white-gold

[75] https://dxi97tvbmhbca.cloudfront.net/upload/user/image/Ezama-Hoyos-Cortegoso-Braun-Spent_Brine_Disposal-TMW_Paper20191128190251287.pdf

[76] https://thenevadaindependent.com/article/is-reno-the-next-lithium-capital-companies-are-looking-to-nevada-for-white-gold

[77] https://www.ibatterymetals.com/direct-lithium-extraction

[78] Call transcript pdf, p. 18

[79] Call transcript pdf, p. 12-13

[80] Call transcript pdf. P. 18

[81] Call transcript pdf, p. 13

[82] https://www.utilitydive.com/news/congress-approves-infrastructure-bill-funding-transmission-hydrogen-ev/609649/

[83] https://yaleclimateconnections.org/2021/02/why-the-power-is-out-in-texas-and-why-other-states-are-vulnerable-too/

[84] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[85] https://www.nbcnews.com/science/environment/one-texas-storm-exposed-energy-grid-unprepared-climate-change-rcna289

[86] https://www.utilitydive.com/news/congress-approves-infrastructure-bill-funding-transmission-hydrogen-ev/609649/

[87] https://link.springer.com/article/10.1007/s12209-020-00236-w

[88] https://www.economist.com/business/2016/01/14/an-increasingly-precious-metal

[89] https://link.springer.com/article/10.1007/s12209-020-00236-w

[90] https://www.treehugger.com/best-home-battery-storage-systems-5192244

[91] https://www.treehugger.com/best-home-battery-storage-systems-5192244

[92] https://www.tesla.com/sites/default/files/pdfs/powerwall/Powerwall%202_AC_Datasheet_en_northamerica.pdf

[93] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[94] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[95] https://www.scotch-creek.com/wp-content/uploads/2021/08/2-pager-black-1.pdf

[96] https://abcnews.go.com/US/nevada-sees-lithium-white-gold-rush-demand-set/story?id=77166661

[97] https://reports.valuates.com/reports/ALLI-Manu-1G27/lithium-ion-battery

[98] https://www.scotch-creek.com/about/

[99] https://www.morningbrew.com/emerging-tech/stories/2021/10/28/5-charts-explaining-the-future-of-ev-batteries-the-backbone-of-the-electric-transition

[100] https://www.marketsandmarkets.com/Market-Reports/battery-energy-storage-system-market-112809494.html

[101] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[102] https://www.scotch-creek.com/about/

[103] https://www.scotch-creek.com/wp-content/uploads/2021/11/Winter-2021-Scotch-Creek-Ventures-Inc-Corp-Presentation.pdf

[104] https://www.businesswire.com/news/home/20200117005306/en/Lithium-Ion-Battery-Markets-Expected-to-Reach-1-Trillion-By-End-of-the-Forecast-Period-2020-2026—ResearchAndMarkets.com

Ad References:

https://www.reviewjournal.com/local/local-nevada/nevadas-next-boom-demand-poised-to-spur-silver-states-lithium-production-2451259/

https://reports.valuates.com/reports/ALLI-Manu-1G27/lithium-ion-battery

https://www.nsenergybusiness.com/news/industry-news/us-critical-minerals-trump/

https://www.whitehouse.gov/briefing-room/statements-releases/2021/06/08/fact-sheet-biden-harris-administration-announces-supply-chain-disruptions-task-force-to-address-short-term-supply-chain-discontinuities/

https://abcnews.go.com/US/nevada-sees-lithium-white-gold-rush-demand-set/story

https://andthewest.stanford.edu/2021/car-batteries-are-the-goal-lithium-is-the-quickest-way-to-make-them-does-a-global-good-require-local-sacrifice-in-the-southwest/

https://www.hinrichfoundation.com/research/article/sustainable/lithium-new-oil-as-electric-vehicle-market-expands/

https://nma.org/2021/10/20/lithium-batteries-in-defense/

https://www.amprius.com/2021/11/5-ways-the-military-is-using-lithium-ion-batteries

https://www.c4isrnet.com/battlefield-tech/2020/07/22/the-department-of-defense-wants-better-batteries/

https://www.nytimes.com/2021/08/05/business/biden-electric-vehicles.html

https://www.morningbrew.com/emerging-tech/stories/2021/10/28/5-charts-explaining-the-future-of-ev-batteries-the-backbone-of-the-electric-transition

https://www.forbes.com/sites/timtreadgold/2021/04/23/copper-and-lithium-compete-for-the-title-of-new-oil

https://www.wsj.com/articles/a-good-battery-is-the-best-defense-against-a-military-assault-11617136935

https://www.benchmarkminerals.com/membership/china-controls-sway-of-electric-vehicle-power-through-battery-chemicals-cathode-and-anode-production/

https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

https://www.nanograf.com/media/18650

https://nma.org/2021/10/20/lithium-batteries-in-defense/

https://electrek.co/2016/11/01/breakdown-raw-materials-tesla-batteries-possible-bottleneck/

https://abcnews.go.com/US/nevada-sees-lithium-white-gold-rush-demand-set/story?id=77166661

https://www.hinrichfoundation.com/research/article/sustainable/lithium-new-oil-as-electric-vehicle-market-expands/

https://www.wionews.com/world/is-lithium-the-new-oil-355492

https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

https://www.energy.gov/articles/fact-sheet-biden-harris-administration-100-day-battery-supply-chain-review

https://www.wionews.com/world/is-lithium-the-new-oil-355492