Sponsored

It’s been in the making for 20 years and the explosion of Covid-19 only intensified it...

Massive U.S. Doctor Shortage Set To Leave Millions of Americans In Danger

Now, one emerging company with FDA-approved “first to market” technology could help avert this monumental and deadly crisis.

James DiGeorgia is the publisher, editor in chief and managing partner of WorldOpportunityInvestor.com. Among other credentials, he has 37 years of financial publishing experience.

Make no mistake: the physician shortage in the U.S. is real—and it could be creating a significant pocket of potential “profi-tunity” for investors.

First emerging in the year 2000, the shortage has grown exponentially. In June 2016, the federal government found 41.7 percent of the country was underserved in primary care.

This means longer wait times for appointments and procedures and the inability to access a physician when needed.[1]

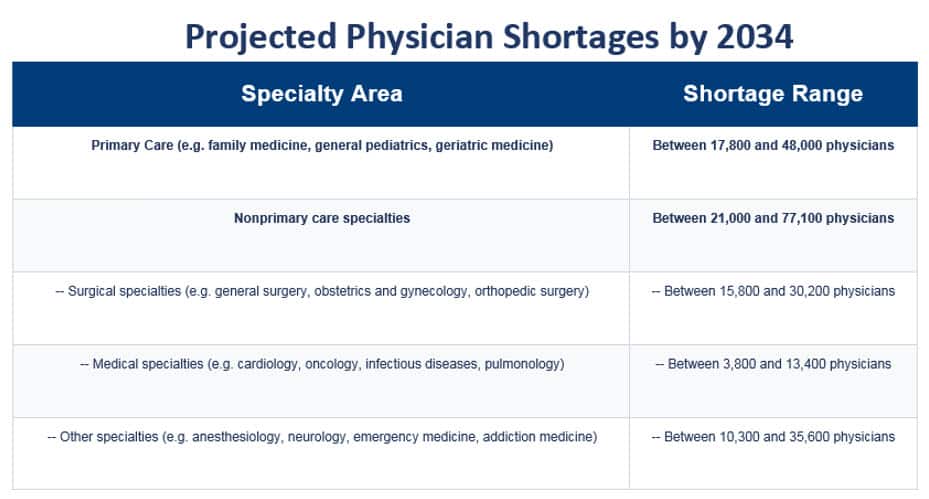

By 2034—just 12 years into the future—analysts predict the shortage will have reached as high as 124,000 reports the Association of American Medical Colleges.[2]

What’s fueling this shortage?

- A growing—and aging—U.S. population placing increasing demands on our healthcare system.[3]

- Millions of newly insured patients came through the Affordable Care Act.[4]

- Physicians and nurses burning out or retiring.[5]

- The number of federally funded residency programs has been capped since 1997.[6]

- Fewer medical students are choosing to practice primary care.[7]

- Primary care physicians earn lower salaries than specialists.

But this shortage is also giving rise to a spectacular potential profit making opportunity in the fast-growing telehealth sector—the answer to the physician shortage.

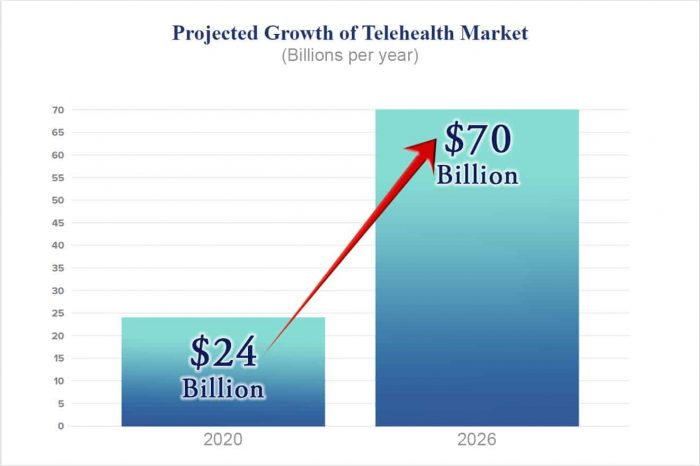

- Analysts project the telehealth market could explode from $24 billion to $70 billion by 2026 at a CAGR of 17.7%.[8]

- $250 billion of the US health care spend is estimated to potentially be shifted to virtual care.[9]

- It is projected 20% of emergency room visits could be avoided.[10] The average cost of an ER visit is $690 for those age 65 and older.[11]

- My latest stock pick, UniDoc (UDOCF), is an emerging company disrupting the telehealth market. Having developed and deployed “first-in” technology, UniDoc (UDOCF) is set to fill the gaping hole in healthcare and disrupt the system.

By James DiGeorgia

In 2020, the COVID-19 pandemic put the entire world into a state of mass hysteria. One of the 10 most deadly pandemics in history,[12] Covid-19 has taken nearly one million lives in the U.S. alone…

Hospitals, doctors, and health care workers were overloaded and exhausted, burning out at breakneck speed. Supplies including ventilators, pharmaceuticals, masks and hand sanitizer were almost impossible to find.

Millions of men, women, and children were unable to access—even denied—the health care they needed. Doctor appointments were canceled. Testing, diagnostics, screenings, and surgeries were postponed. Hospitals were full beyond capacity.

For many, access to health care was a matter of life or death. And adding fuel to the fire is the ongoing and growing physician shortage in the U.S.

At the same time, just like the real estate explosion during the pandemic which no one could have predicted…

COVID-19 created a mammoth opportunity to take telehealth to the next level.

Hi, I’m James DiGeorgia, editor of the popular World Opportunity Investor investment advisory.*

Over the years, I’ve been a featured guest on CNBC, Fox Business, and am frequently quoted as an expert in The New York Times, USA Today, Los Angeles Times, Money magazine, The Chicago Tribune, and Barron’s, to name just a few.

I’m also the author of several best-selling books including The New Bull Market in Gold, The Rise of Gold in the 21st Century, The Global War for Oil, and The Trader’s Great Gold Rush.

I’m well-known for discovering stocks just before they hit the fast track for success and have been doing so for the past 40 years. Of course, there are readers who say, “Jim, are you nuts… a penny stock?”

Yes, penny stocks are risky* but investors won’t get fabulously rich by waiting for a stock opportunity that’s already set sail…

In my professional opinion, it’s way better to identify an under-the-radar microcap with massive potential – and still trading below $1.50.

That’s why I must tell you about my latest digital health pick—UniDoc (UDOCF)—before it’s too late to get in and potentially reap healthy profits.* UniDoc (UDOCF) is on a powerful trajectory and was at the right place at the right time because…

Telehealth’s time to shine had just arrived.

Millions of people took to their computers, tablets, and smartphones for doctor appointments.[13] Telemedicine—the initial foray into telehealth—allowed people to connect with their doctors without the risk of going out in public and catching a deadly bout of COVID.

Providers rapidly scaled their practices and businesses as a massive acceleration in telemedicine occurred. Consumers quickly adopted telehealth in place of face-to-face visits.

Physicians and health care providers were seeing 50 to 175X the number of patients.[14]

By April 2021, a stunning 84 percent of physicians were offering virtual visits. Although this number has stabilized a bit, 57 percent of doctors still prefer to continue offering virtual care.[15]

According to The Motley Fool, one survey found 76% of Americans today are interested in using virtual health care providers. Compare this to the mere 11% who felt this way pre-pandemic.[16]

Consumers were suddenly ready to take the leap into the next generation of health care.

I believe telehealth companies could see exponential growth in their sales and bottom lines in the next few years. The current market opportunity for the sector in the U.S. alone amounts to $250 billion.[17]

That’s why UniDoc (UDOCF) is on my investing radar right now. This emerging small-cap has profit potential written all over it because of the market need it fulfills—and the technology, partnerships, and management team behind it.*

“Providence Medical Group reported that it experienced an increase from 700 telehealth visits a month to 70,000 visits a week after ramping up their telehealth platform…”[18]

Government regulations also enabled greater telehealth access during COVID. Prior to the pandemic, the regulatory and reimbursement environment had telehealth in a stranglehold.

Historically, physicians weren’t allowed to practice across state lines. A doctor in New Jersey for example couldn’t treat a patient in California. Virtual care was under the same constraints.

What’s more, unless a physician had already seen a patient in person, the physician couldn’t be reimbursed for a virtual visit with the patient covered by Medicare.

When the pandemic hit, these regulatory rules were lifted and some changes to procedural codes for physician fee billing were made permanent.[19] I expect we’ll see more rules permanently relaxed or revised.

As all of this was occurring, something else was taking place which would rock the investment community.

COVID-19 created a spectacular opportunity for companies to experience explosive revenue growth … and investors an unprecedented opportunity to potentially make money in one of the fastest emerging markets since the technology boom.

For example…

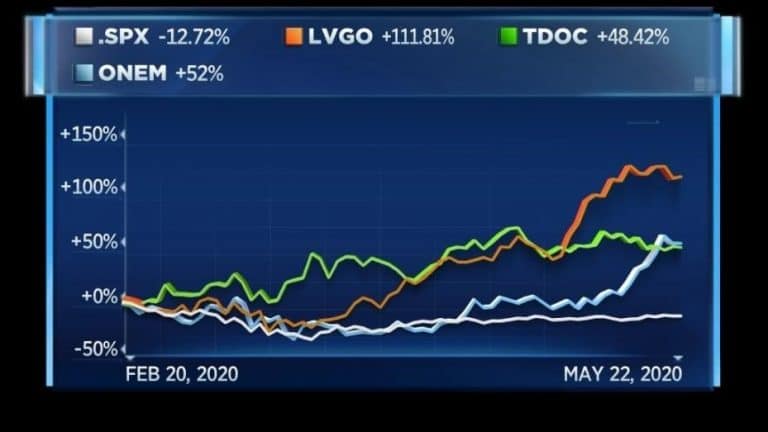

- WELL Health Technologies reported a 1,200% increase in digital services revenue year-over-year for the second quarter, according to Desjardins Capital Markets. This segment of the company’s health care business grew exponentially from 2% of total revenue to 22% of total revenue.[20]

- One Medical (ONEM) DOUBLED its share price from $18.00 to $36.00 in just 16 weeks.[21]

- Teledoc’s (TDOC) share price climbed 48% in just 12 weeks.[22]

- Livongo (LVGO) more than DOUBLED its share price in 3 months.[23] The company was later bought by Teledoc for $15.1 billion in the first half of 2020.[24]

- MDLive saw growth jump from 45% annually to 95% or more in 2020.[25] The company was acquired in February 2021 by Cigna’s Evernorth for an undisclosed amount.[26] However, the valuation of the company was estimated to be $1 billion.[27]

— Jake Dollarhide, CEO of Longbow Asset Management, which owns shares of Teladoc.[29]

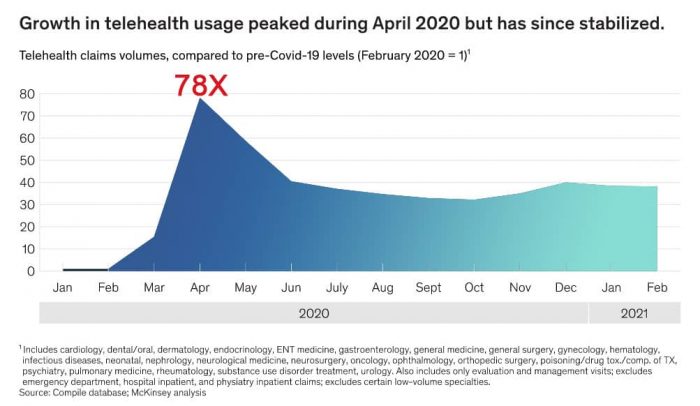

To say the telehealth industry exploded is an understatement. According to management consulting firm McKinsey & Company, overall telehealth use for office visits and outpatient care was 78X HIGHER in a 60-day period from February 2020 to April 2020.[30]

Earlier in the pandemic, news outlets reported telehealth appointments were soaring. According to research from Fair Health, telehealth claim lines increased by 4,347% nationally, from 0.17% of medical claim lines in March 2019 to 7.52% in March 2020.[31]

The future of health care is here now…

And it could be the most breathtaking shift in the sector since “doc in the box” came on-stream.

Telehealth is the bridge that consumers and health care providers desperately needed when COVID hit—and still need.

For investors looking for the next big thing, telehealth is a significant market development, the likes not seen since the high-tech revolution. McKinsey estimates $250 billion of the US health care spend could potentially be shifted to virtual care.[32]

Headlines have been screaming “buy now”…

![]()

TECH

Digital health stocks are surging because ‘suddenly now we’re in the future’[33]

Now is the time you could profit from the coming $70 BILLION market.*

If you take a “wait and watch” approach you could miss out on the biggest potential gains. UniDoc (UDOCF) is one of my top small-cap stock recommendations right now for good reason. The company is well-positioned for growth in this sector with a solution that could help close the gaping hole in the current health care environment and ease the burden on doctors, hospitals, and health care workers.

Investors could reap elephant-sized gains as the telehealth industry unfolds and UniDoc (UDOCF) enters new markets around the world.* The hole is so massive, analysts project the telehealth market could explode from $24 billion in 2020 to $70 billion by 2026.[34]

Because doctor visits, testing, and diagnostics were put off or canceled due to fear of the spread of COVID, people were forced to wait. This is especially problematic for those with chronic conditions, cancer or other deadly and debilitating diseases.

In my opinion, one company has emerged with a solution disrupting the entire industry. And I believe it could create a strong investment opportunity. Clearly, this is the future of medicine.

UniDoc (UDOCF) is closing the massive gap in telehealth with an incredible “first-in” investment opportunity.

UniDoc (UDOCF) has developed groundbreaking technology which puts the patient in charge … takes the strain off doctors and health care workers … allows for easy access to doctors, specialists, diagnostics, and testing … and delivers immediate results.

This is a revolutionary breakthrough in medicine and health care … the biggest market disruption since “doc in a box,” the walk-in medical centers, came to the healthcare industry.

No more waiting for doctors, tests, or results during the pandemic or any other time. UniDoc’s (UDOCF) revolutionary technology and diagnostic medical devices is already FDA approved and is here now, being installed in locations all over the world.

Special investor alert:

UniDoc (UDOCF) is currently the only company offering a complete solution comprised of both medical services, health care solutions and technology and is leading the way as “first-in” – a significant opportunity for investors. Think early Amazon, Apple, Tesla, and Netflix initial share prices and the gains investors smart enough to get in early have seen. This is your opportunity to get in early on UniDoc (UDOCF) where the most magnificent profits could be made.* As always, speak with your broker or financial adviser and do your due diligence.

UniDoc (UDOCF)’s innovative technology aims to disrupt the telehealth market and greatly improve North America’s under performing healthcare system.[35]

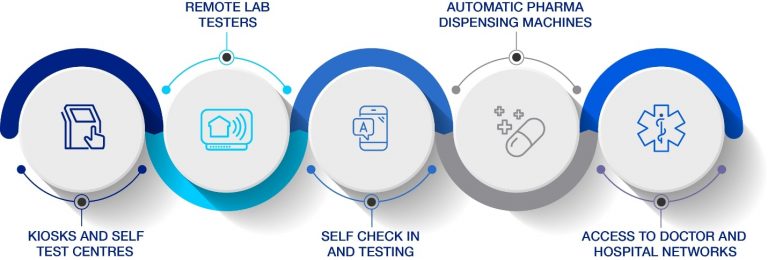

What does UniDoc (UDOCF) have that’s so unique, I’m issuing a “LOOK NOW” alert?

This Canadian-based company has developed a revolutionary new way for patients to interact with doctors: virtual health clinic kiosks.

UniDoc (UDOCF) kiosks break the barriers between patients and care providers with virtual live interaction doctor visits and fully integrated diagnostic tools located right in the kiosks.[36]

This is a huge advance over telemedicine, which is merely a doctor on screen talking with a patient.

UniDoc (UDOCF) wasn’t a knee-jerk reaction to COVID-19. The company has been building its business for the five years prior—well before COVID paralyzed the world.

In 2017, UniDoc (UDOCF) CEO Tony Baldassarre attended a meeting in Toronto spearheaded by a group of doctors where the topic was telemedicine and the accessibility of medical services.

Though leaders attending the meeting shared their vision to fully integrate doctors into telemedicine, they lacked an action plan. Baldassarre became determined to bring the vision to life. There was one major problem…

The doctors didn’t want to invest money into the project. However, their reluctance didn’t stop Baldassarre who continued to pursue the concept.

With Tony assembling a world-class team across several key disciplines, UniDoc (UDOCF) was established.

Little did the UniDoc (UDOCF) team know that just 3 years later their virtual health clinics would be exactly what the world would so desperately need in response to a deadly pandemic.

UniDoc (UDOCF) is a pioneer in the soon-to-be $70 BILLION telehealth industry.[37]

Telehealth delivers significant benefits: it can minimize hospital visits, reduce patient wait times, ease physical discomfort and help people heal faster because people can get the care they need without waiting.

According to McKinsey & Company research, a claims-based analysis suggests with virtual care like UniDoc (UDOCF):

✓ Approximately 20 percent of all costly emergency room visits could be avoided[38]

✓ 24 percent of healthcare office visits and outpatient volume could be delivered virtually[39]

✓ Up to 35 percent of regular home health attendant services could be virtualized[40]

✓ 2 percent of all outpatient volume could be shifted to the home setting with tech-enabled medication administration.[41]

These changes add up to $250 BILLION in health care spending or 20% of all office, outpatient, and home health spending across Medicare, Medicaid, and commercially insured populations.[42]

With these changes, health care becomes more efficient and the total cost of care for chronic populations can improve by 2 to 3 percent.[43] Once telehealth becomes widely adopted and the new norm in healthcare, the opportunity should be far greater.

Blowing the doors off the health care industry and changing the face of medical care.

UniDoc (UDOCF): a complete telehealth solution disrupting health care

UniDoc (UDOCF) brings doctors, hospitals, clinics, and results of diagnostics and screenings to the patients with its freestanding virtual health clinics in a kiosk which can be placed anywhere a need exists.

By virtualizing traditional bricks and mortar care, UniDoc (UDOCF) has reversed the traditional process of going to a doctor’s office, getting a test, and waiting for results.

Patients either make an appointment or simply walk into a UniDoc (UDOCF) virtual health clinic kiosk, get their vitals checked, get exams and if needed get Xrays, scans, or tests that may be needed and get results back fast.

There’s no waiting months, weeks, or even days. Appointments can be made through a pharmacy, for example.

Once inside the kiosk, a licensed nurse performs the same diagnostics and lab services the patient would get at their own doctor’s office. The UniDoc (UDOCF) model allows physicians to expand their practices beyond the bricks and mortar—with doctor’s having full access to patients’ clinical data.

A licensed nurse can draw blood, check the heart, lungs, ears, nose, and throat, take a temperature and blood pressure reading—just like at the doctor’s office.

Any diagnostic testing that may be needed is conducted on-site and immediately sent through the HIPAA compliant server for results using the same EMR system doctors currently use and is the industry standard. EMR (Electronic Medical Records) is the authorized system of medical practices and health clinics around the world.

Real-time readings for bloodwork, urine tests, and other labs are easily accessible.

Once the licensed nurse completes the visit with the patient, the information is immediately uploaded to a doctor. Should the doctor review the information and believe further investigation is needed, a specialist can be brought in immediately. No waiting weeks or months to be seen or receive results.

There is currently no other company in the world except UniDoc (UDOCF) doing this…not a single one.

UniDoc’s (UDOCF) kiosks are unique. They bring real equipment and real people to patients who are now in control of their health.

Think of the kiosks as complete medical centers only the kiosk is not physically in a doctor’s building. UniDoc (UDOCF) provides the hardware, enclosure, soundproofing, platform, and compliance.

UniDoc (UDOCF) kiosks are geared to help millions of people access the care they need especially when shortages of medical personnel and facilities occur as we’ve seen with COVID.

UniDoc’s (UDOCF) virtual health clinics are convenient, accessible, and make health care more efficient.

This company has covered all the bases and frankly, I’m impressed.

Billing takes place through the EMR system exactly like it does from a doctor’s office. UniDoc (UDOCF) kiosk services accept all insurance plans that the doctor accepts today. UniDoc’s (UDOCF) impressive management team has already received all the necessary approvals.

Kiosks can make all types of tests available as well as screening done by doctors including general practitioners, internal medicine specialists, ophthalmologists, OB/GYNs, ENTs, dentists, cardiologists, vascular doctors, and others.

Currently, UniDoc (UDOCF) kiosks have over 400 approved different devices available to patients. I can’t stress enough: these are the same FDA-compliant diagnostic tools doctors use in their offices and clinics.

Should a patient be admitted to the hospital and need follow-up care, pre-op and post-op care can also be done through the kiosk.

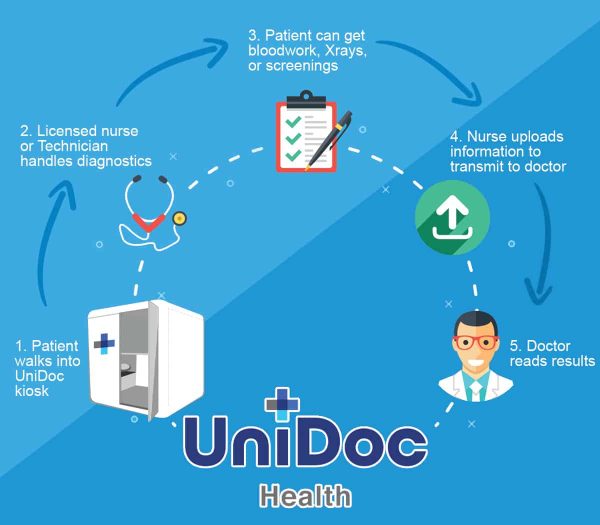

How UniDoc (UDOCF) Virtual Health Clinic Kiosks Work

1. Patient walks into UniDoc (UDOCF) kiosk

2. Licensed nurse or Technician handles diagnostics

3. Patient can get bloodwork, Xrays or screenings

4. Nurse uploads information to transmit to doctor

5. Doctor reads results

Since the company’s inception in 2017, UniDoc (UDOCF) has raised $3.5 million to continue strategic growth.[44]

UniDoc (UDOCF) is already up and running with kiosks being tested in international locations.

Currently, UniDoc (UDOCF) has 3 fully functioning kiosks at OnPharm in beta testing.

UniDoc (UDOCF)’s Highly Experienced Management Team[45]

Tony Baldassarre

CEO, President and Director

Mr. Baldassarre has over 30 years of experience in the Security, Information Technology and Communications industries. He’s held senior management and director positions of new business start-ups and established multinational organizations.

With leadership skills in management of international operations, shareholder exit strategies, and overall business development, he has utilized a wide range of strategic programs to maximize organic growth. Mr. Baldassarre is also the President of LRG Security Canada Inc. and LRG Security Europe.

Franco Staino

Director

Mr. Staino has over 40 years of experience in the pharmaceutical industry. He is deeply experienced in drug safety, traceability, and anti-counterfeiting measures. Mr. Staino has designed and implemented programs for the Italy National Health Service, the Ministry of Health and the Polygraphic Institute, and State Mint.

Mr. Staino currently holds multiple positions including President of the Board of Directors of Topharmacia, a company that deals with the integral management of pharmacies throughout Italy.

Dr. Sazzad Hossain, PhD

Chief Scientific Officer

Dr. Hossain is the former Chief Scientific Officer of InMed Pharmaceuticals Inc., a leading public Canadian bio-pharmaceutical company. Previously, he worked as Senior Scientist at Biotechnology Research Institute of National Research Council Canada.

Working with the Canadian government, he helped establish the pharmacology laboratory to evaluate safety and efficacy of cannabinoid-based and other drugs under development for cancer, cardiovascular and ocular diseases.

Sina Pirooz

Director

Mr. Pirooz is a registered and practicing pharmacist and has been a professional member of the College of Pharmacists of British Columbia since 2003, with over 20 years of pharmaceuticals and pharmacy management experience.

Mr. Pirooz is also the CEO and a director of Genix Pharmaceuticals Corporation, a company listed for trading on the TSXV.

Partnering with billion-dollar companies to rollout the future of telehealth.

UniDoc (UDOCF) has spent the past five years building its technology infrastructure and support systems, including partnering with some of the biggest internationally recognized names in health care, including:

Partner 1: AMD Global Telemedicine

AMD Global Telemedicine is a 30-year pioneer of telemedicine and an industry leader in telehealth solutions using the latest advancements in digital technology.

The company’s telehealth solutions include software platforms, integrated medical devices, and telemedicine bundled kits that empower healthcare[46] providers to deliver the highest possible level of care to any patient, anywhere, regardless of the circumstances.

What makes AMD stand apart is the software the company engineers to aggregate and deliver the information from a remote patient examination, in 100% real-time.[47]

Partner 2: Dedalus

Dedalus is a billion-dollar healthcare company with extensive experience in connected care including hospital IT. Dedalus possesses pharmacies across North America and supports over 5000 hospitals and 4800 laboratories worldwide.[48]

Market potential is STAGGERING with pharmacies alone.

UniDoc’s (UDOCF) virtual health clinics are being developed and designed to target placement in pharmacies and publicly accessed spaces.[49]

The potential in the pharmacy market alone is explosive.

Number of U.S. Pharmacies 68,000+ [50]

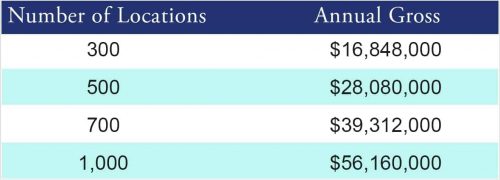

Let’s look at how much revenue this market could bring UniDoc (UDOCF) in a hypothetical model.

Assume the cost of a visit to a UniDoc (UDOCF) kiosk is $37.50. If the kiosk at pharmacy “A” is open 5 hours a day, 6 days a week. This could result in approximately 16 visits a day or 400 visits a month.

If one kiosk results in 400 visits a month at $37.50 a visit, the company would realize $4,680 in revenue a month or a gross of $56,160 a year—for one UniDoc (UDOCF) kiosk.

Backing out equipment costs, commissions and a percentage of shared revenues to the pharmacy, UniDoc (UDOCF) might net close to $29,155 per kiosk location.

Now let’s look at what hundreds of locations could look like. This is a hypothetical situation based on the number of visits per month and cost per visit. I merely want to give you an idea of potential growth.

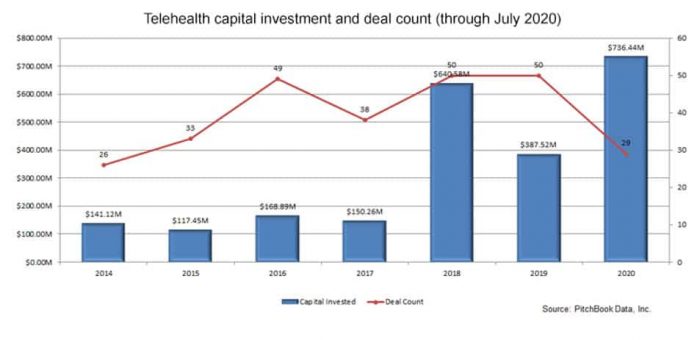

Investing activity is surging in telehealth.

Now is the time to look closely at UniDoc (UDOCF)*

If you’re looking for a sector that is expected to surge and keep surging…

Telehealth is one to take a serious look at for your portfolio. According to PitchBook, telehealth is on pace for a record-setting year in terms of both the number of venture capital deals and capital raised in those deals.[58] I don’t expect that to return to pre-pandemic levels.

Investor activity in the virtual health space is accelerating like crazy.

In Rock Health’s H1 2021 digital funding report, the first half of 2021 showed total venture capital investment in the digital health space at $14.7 BILLION.[59]

That’s more than all of 2020 when the total venture capital investment was $14.6 billion—twice the investment in 2019. These figures reflect an annualized investment of $25 billion to $30 billion in 2021.[60]

Here’s the kicker:

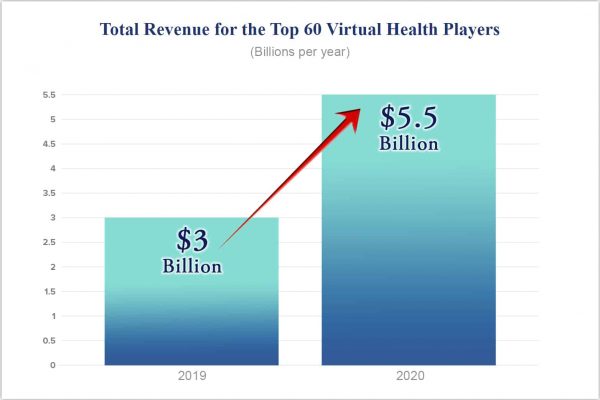

Total revenue for the top 60 virtual health players increased from $3 billion in 2019 to $5.5 billion in 2020—nearly DOUBLE.[61]

I fully expect investing in virtual health companies like UniDoc (UDOCF) to continue at record levels. Telehealth is poised to remain a robust growth sector, particularly with innovative companies like UniDoc (UDOCF) leading the way.

Remember: a broader “digital front door” is opening, creating an unparalleled convenience factor. Consumers can easily get the health care they need when they need it without costing an arm and a leg like an emergency room visit.[62] Do your research or ask your broker about UniDoc (UDOCF).

Access to doctors and specialists can be radically improved.

Growing U.S. physician shortage will continue to drive the rapid adoption of telehealth.

This positions UniDoc (UDOCF) for potential massive growth and you don’t want to miss out.*

According to new data published today by the AAMC, the United States could see an estimated shortage as high as 124,000 physicians by 2034, including shortfalls in both primary and specialty care.[63]

“The COVID-19 pandemic has highlighted many of the deepest disparities in health and access to health care services and exposed vulnerabilities in the health care system,” said AAMC President and CEO David J. Skorton, MD.[64]

Skorton continued…

“The pandemic also has underscored the vital role that physicians and other health care providers play in our nation’s health care infrastructure and the need to ensure we have enough physicians to meet America’s needs.”[65]

This is another reason UniDoc’s (UDOCF) virtual health clinic kiosks will become even more vital to the healthcare system.

“The physician workforce shortages that our nation is facing are being felt even more acutely as we mobilize on the front lines to combat the COVID-19 national emergency,” says AAMC President and CEO David J. Skorton, MD. “The increasing physician shortage over the last two decades, and now the COVID-19 pandemic, has demonstrated that we need … ensure we can care for patients in the near-term and in the future.”[66]

10 Reasons to Invest in

UniDoc (UDOCF)

- First to market in North America with a virtual health clinic kiosk where patients can undergo a comprehensive consultation, testing and diagnostics as if they were in a doctor’s office or hospital.

- Unrivaled medical access can be made available to communities even in remote areas with no waiting for appointments, diagnostics, testing or results.

- Ability to scale, customize and deliver across the world, placing UniDoc (UDOCF) kiosks virtually anywhere—from pharmacies and schools to long-term care facilities, college campuses, grocery stores, and many other places.

- UniDoc (UDOCF) virtual health care clinic kiosks fill a gaping hole in the North American health care system. Consumers are ready and eager to adopt telehealth. One survey found 76% of Americans are interested in using virtual health care providers. Compare this to the mere 11% who felt this way pre-pandemic.[67]

- Addresses growing physician shortage in the U.S. shortage as high as 124,000 physicians by 2034, including shortfalls in both primary and specialty care.[68]

- Virtual health clinic kiosks developed by UniDoc (UDOCF) eliminate commuting and scheduling impediments.

- Increases the rate of communication between doctors and patients. Both parties can access the information they need when they need it most.

- Market growth in telehealth is expected to be spectacular, soaring from $24 billion to $70 billion by 2026.

- All UniDoc (UDOCF) medical devices are FDA and Health Canada approved and registered.

- UniDoc (UDOCF) has assembled a powerhouse management team with heavy experience in healthcare, technology, and pharmaceuticals.

Savvy investors know investing comes with risk. That’s why I urge you to check the company carefully and do your diligence because young companies with great stories can carry a significant amount of risk… that risk ranges from being under-funded to having a small number of shares available to the public.

I’ll also never shy away from alerting you about the risks associated with investing in young companies, new to the stock market. That’s why I urge you always observe my three rules for accepting microcap investing risk:

Risk Reduction Rule #1: Never invest more than you can afford to lose.

Risk Reduction Rule #2: Do not chase losses. That means if the prices slide you must resist all temptation to “average down.”

Risk Reduction Rule #3: Don’t put all your dreams on one microcap. Allocate your risk capital among a handful of stocks.

All that said, I think you and your financial advisor will end up in agreement, UniDoc (UDOCF) could be 2022’s top headline-making telehealth stock.

The time to act on UniDoc (UDOCF) is now if you believe as I do…

The ongoing COVID-19 crisis and doctor shortage has created tremendous investment opportunity in the telehealth sector. An opening to modernize health care has been created and telehealth appears poised to scale at a magnificent rate.

Being first to market in the U.S. with remote virtual health clinics within a private kiosk combined with an integrated Revenue Sharing Solution, UniDoc (UDOCF) is positioned for strong growth. Being an early bird can position you to potentially be a big winner in the telehealth stock sector.*

I urge you to share this report with your investment advisor or broker without delay and finally, be sure to minimize your risk. UniDoc (UDOCF) should be part of a broader, diversified portfolio.

I wish you much success in all your investments.

– James DiGeorgia

Daily Trade Report

P.S. Still want more information on UniDoc (UDOCF)?

P.S. Still want more information on UniDoc (UDOCF)?

I’d like to offer you access to UniDoc Health Corp.’s Investor Presentation, which you can have at no charge.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the InvestingTrends newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

This paid advertisement includes a stock profile of UniDoc (UDOCF). To enhance public awareness of UDOCF and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately two hundred forty-nine thousand nine hundred eighty-five ($249,985.00) USD to cover the costs associated with this advertisement for a period beginning 9 December 2021 and currently set to end 30 April 2022. In connection with this effort, Promethean has paid the author of this advertisement, DiGeorgia, eight thousand ($8,000.00) USD in cash out of the total budget. The website hosting this advertisement, Daily Trade Report, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Daily Trade Report have been paid to host this advertisement. As a result of this advertisement, Daily Trade Report may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. James DiGeorgia is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Daily Trade Report website, some or all of Promethean, Daily Trade Report, Summit, or James DiGeorgia, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of UDOCF’s and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of UDOCF’s, increased trading volume, and possibly an increased share price of UDOCF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended.

To more fully understand the Daily Trade Report website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce.

[2] https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

[3] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce.

[4] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce.

[5] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce.

[6] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce

[7] https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce

[8] https://www.businesswire.com/news/home/20200805005586/en/Telehealth-Industry-Expected-to-Grow-from-26.4-Billion-in-2020-to-70.19-Billion-by-2026-at-a-CAGR-of-17.7—ResearchAndMarkets.com

[9] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[10] https://UniDoc (UDOCF)tor.com/investors/

[11] https://hcup-us.ahrq.gov/reports/statbriefs/sb268-ED-Costs-2017.jsp

[12] https://www.vox.com/future-perfect/21539483/covid-19-black-death-plagues-in-history

[13] https://www.healthcareitnews.com/news/study-365m-people-reveals-huge-jump-pandemic-telehealth-use

[14] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality [{Pg 11/20]

[15] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality [{Pg 6/20]

[16] https://www.fool.com/investing/2021/02/17/the-3-best-telehealth-stocks-to-buy-now/

[17] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[18] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[19] https://www.federalregister.gov/documents/2021/11/19/2021-23972/medicare-program-cy-2022-payment-policies-under-the-physician-fee-schedule-and-other-changes-to-part

[20] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[21] https://www.marketwatch.com/investing/stock/onem/download-data?startDate=1/24/2020&endDate=02/23/2022 [used 1.31.20 and 6.1.20]

[22] https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

[23] https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

[24] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[25] https://www.fiercehealthcare.com/tech/mdlive-banks-50m-equity-investment-to-scale-up-telehealth-services

[26] https://www.crunchbase.com/organization/mdlive

[27] https://financhill.com/blog/investing/why-did-cigna-acquire-mdlive#:~:text=We%20do%20not%20know%20the,valuation%20close%20to%20%241%20billion.

[28] https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

[29] https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

[30] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality [{Pg 1/20]

[30b] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[31] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[32] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[33] https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

[34] https://unidoctor.com/company/

[35] https://unidoctor.com/

[36] https://unidoctor.com/wp-content/uploads/2022/01/UniDoc-InvestorPres-V14-24-Jan-2022.pdf

[37] https://unidoctor.com/company/

[38] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[39] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[40] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[41] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[42] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[43] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[43b] https://unidoctor.com/wp-content/uploads/2022/01/UniDoc-InvestorPres-V14-24-Jan-2022.pdf

[44] https://unidoctor.com/unidoc-health-ceo-message/https://drive.google.com/file/d/1Ll9ECgZXx2P-IFL0eVSbBPv4mRLpe8HO/view?usp=sharing

[45] https://unidoctor.com/wp-content/uploads/2022/01/UniDoc-InvestorPres-V14-24-Jan-2022.pdf

[46] https://unidoctor.com/wp-content/uploads/2022/01/UniDoc-InvestorPres-V14-24-Jan-2022.pdf

[47] https://amdtelemedicine.com/what-we-do/

[48] https://unidoctor.com/company/

[49] https://unidoctor.com/company/

[50] https://unidoctor.com/company/

[51] https://www.ibisworld.com/industry-statistics/number-of-businesses/supermarkets-grocery-stores-united-states/#:~:text=There%20are%2063%2C419%20Supermarkets%20%26%20Grocery,of%20%2D1.1%25%20from%202021.

[52] https://unidoctor.com/company/

[53] https://unidoctor.com/company/

[54] https://www.ahcancal.org/Assisted-Living/Facts-and-Figures/Pages/default.aspx#:~:text=%E2%80%8BT%E2%80%8Bhere%20are,in%20the%20United%20States%20today.

[55] https://www.usnews.com/education/best-colleges/articles/how-many-universities-are-in-the-us-and-why-that-number-is-changing

[56] https://www.care.com/c/nursing-homes-in-america/#:~:text=According%20to%20the%20Centers%20for,occupied%20by%201.4%20million%20patients.

[57] https://www.edweek.org/leadership/education-statistics-facts-about-american-schools/2019/01

[58] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[59] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality [Pg 7/20]

[60] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[60b] https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

[61] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[62] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[63] https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

[64] https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

[65] https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

[66] https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

[67] https://www.fool.com/investing/2021/02/17/the-3-best-telehealth-stocks-to-buy-now/

[68] https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

Ad References:

https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

https://www.marketwatch.com/investing/stock/onem/download-data?startDate=1/24/2020&endDate=02/23/2022 [used 1.31.20 and 6.1.20]

https://www.cnbc.com/2020/05/23/digital-health-stocks-are-surging-amid-coronavirus-pandemic.html

https://www.cdc.gov/nchs/fastats/emergency-department.htm

https://consumerhealthratings.com/how-much-does-er-visit-cost/

https://www.businesswire.com/news/home/20200805005586/en/Telehealth-Industry-Expected-to-Grow-from-26.4-Billion-in-2020-to-70.19-Billion-by-2026-at-a-CAGR-of-17.7—ResearchAndMarkets.com

https://www.aamc.org/news-insights/press-releases/aamc-report-reinforces-mounting-physician-shortage

https://ballotpedia.org/Physician_shortage_in_the_United_States#:~:text=In%20healthcare%2C%20a%20physician%20shortage,assessments%20of%20the%20physician%20workforce

https://www.businesswire.com/news/home/20200805005586/en/Telehealth-Industry-Expected-to-Grow-from-26.4-Billion-in-2020-to-70.19-Billion-by-2026-at-a-CAGR-of-17.7—ResearchAndMarkets.com

https://www.cdc.gov/mmwr/volumes/70/wr/mm7046a5.htm

https://www.marketwatch.com/investing/stock/onem/download-data?startDate=1/24/2020&endDate=02/23/2022 [used 1.31.20 and 6.1.20]

https://rsmus.com/what-we-do/industries/technology-companies/the-telehealth-explosion-has-changed-health-care-delivery.html

https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality