Sponsored

BREAKING NEWS:

Alpha Lithium (APHLF) Management Secures $30M Investment in Mining Property at a Potential $604M Valuation[1b]

- Alpha Management took Tolillar Mining Property from $2M to $200M in under 2 years

- Alpha has an additional property that could be worth even more than the Tolillar Property

- Alpha CEO says, “This sort of milestone is rarely achieved by a company with less than two years of operations and with a valuation at this level.“[1b]

Read below for details on why this could be the most important opportunity for your portfolio.

The “Green Energy Revolution” is Creating Massive Global Demand for Lithium — its Most Precious Commodity

Unfortunately, 80% of the World’s Lithium Market is Currently Controlled by Communist China [1a]

The Biden Administration’s $2 trillion clean energy plan proposes a huge investment in lithium-powered electric vehicles and battery storage systems — while acknowledging the need to reduce China’s stranglehold on American lithium supply.[2]

The European Union has issued a plan to reduce dependence on Chinese-supplied lithium batteries as it works to “build a green-energy economy that isn’t largely made in Beijing.”[3]

One little-known junior mining company, with world-class assets in Argentina’s world-famous Lithium Triangle, is looking ahead to make the leap from exploration to production. Get to know Alpha Lithium (APHLF) now — before it helps edge China aside in the race to meet the world’s growing need for the “energy metal.”

By James Hyerczyk

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and has been providing quality analysis for professional traders for 38 years.

EXCITING ALPHA LITHIUM (APHLF) UPDATE!

According to Brad Nichol, Alpha’s President and CEO, “Exercising the Earn-in Right [option] implies a value at Tolillar [an Alpha Lithium mining site] of US $529 million, not including any Additional Consideration.”

On November 29, 2021, Alpha Lithium (APHLF) announced that multi-billion-dollar conglomerate Uranium One Group has agreed to invest US $30 million in exchange for a 15% non-operated equity stake in Alpha’s 100% owned, 27,500-hectare Tolillar Salar in Argentina’s famed Lithium Triangle. Uranium One Group will also earn an option to acquire another 35% of Tolillar for US $185 million. If the option is exercised, Alpha would retain a 50% interest in Tolillar.

This transaction, expected to close January 31, 2022, is good news for potential investors, as it could speed up the timeline toward production. It would leave Alpha with approximately $45 million in cash, free to focus expansion and developmental efforts on their nearby assets in the Salar del Hombre Muerto, one of the world’s most significant sources of lithium.

According to Brad Nichol , Alpha’s President and CEO, “This early-stage asset has attained a truly game-changing breakthrough for our shareholders. This sort of milestone is rarely achieved by a company with less than two years of operations and with a valuation at this level.”

EXCITING ALPHA LITHIUM (APHLF) UPDATE![1b]

On November 29, 2021, Alpha Lithium (APHLF) announced that multi-billion-dollar conglomerate Uranium One Group has agreed to invest US $30 million in exchange for a 15% non-operated equity stake in Alpha’s 100% owned, 27,500-hectare Tolillar Salar in Argentina’s famed Lithium Triangle. Uranium One Group will also earn an option to acquire another 35% of Tolillar for US $185 million. If the option is exercised, Alpha would retain a 50% interest in Tolillar.

According to Brad Nichol, Alpha’s President and CEO, “Exercising the Earn-in Right [option] implies a value at Tolillar [an Alpha Lithium mining site] of US $529 million, not including any Additional Consideration.”

This transaction, expected to close January 31, 2022, is good news for potential investors, as it could speed up the timeline toward production. It would leave Alpha with approximately $45 million in cash, free to focus expansion and developmental efforts on their nearby assets in the Salar del Hombre Muerto, one of the world’s most significant sources of lithium.

Brad Nichol commented, “This early-stage asset has attained a truly game-changing breakthrough for our shareholders. This sort of milestone is rarely achieved by a company with less than two years of operations and with a valuation at this level.”

On day one of his administration, President Biden fulfilled his promise to rejoin the Paris agreement, already adopted by 196 parties in an effort to adapt to a changing climate.[4] Also on his first day, President Biden stated his intention to eliminate all greenhouse gas emissions in the U.S. by 2035.[5]

In August 2021, the Biden administration announced an interim goal: 50% of all new vehicles will be electric powered by 2030. This shift to lithium-filled battery power is considered vital to defend against a fluctuating climate and “keep pace with China.”[6]

Of course, some disagree over the degree of human involvement in what is commonly called “global warming.” However, strategies to deal with climate change have undoubtedly become a major force in international politics.[7]

As has the need for more lithium…

In 2020, lithium appeared on the European Union’s list of critical minerals for the first time. With the EU’s Action Plan noting clear concerns about China’s dominance in lithium battery production, the EU is looking to “build sustainable and responsible strategic partnerships with resource-rich countries.”[8]

Currently, U.S. politicians are wrangling over a pair of infrastructure bills, with a key goal of defending against climate damage. One bill allocates $27 billion to help harden our nation’s aging electric grids against extreme weather events.[9]

Lithium -containing battery storage investments are being encouraged as a solution to help aid these grids by balancing power generation and utilization.[10]

The United Nations prioritizes battery and energy storage system technologies as a way to adapt to clean energy and renewable power.[11] One U.N. bulletin characterizes lithium-ion batteries as a “pillar for a fossil-free economy.”[12]

Lithium — The Fuel Powering the “Green Energy Revolution”

The “green revolution” relies heavily on raw materials, particularly the silvery-white mineral lithium. As the lightest metal on earth, lithium also has a high density, which makes it able to store more energy.

This is an important reason why investors should keep their eyes on Alpha Lithium (APHLF).

Since 2015, lithium has been in high demand as a source of lithium-ion batteries.[13] These batteries are necessary to run our smart-phones, laptop computers, cameras, and other devices.

But by 2025, about 70% of all lithium will be used in electric vehicles (EVs), e-bikes, energy storage, and traditional batteries — making lithium the “uncontested fuel of the green revolution.”[14]

Of course, Elon Musk’s Tesla has been on the leading edge of this mega-trend, developing batteries, electric vehicles, as well as home and commercial energy storage systems.

However, the share price in companies such as Tesla has already skyrocketed. These stocks have made millionaires out of average investors, strictly because they bought at the right time.[15] Timing is everything, and unfortunately, it’s too late to chase these stocks.

I have come to believe that the best way to capitalize on the budding green revolution is by investing in the commodity most vital to its two main proposed solutions — electric vehicles and energy storage.

That commodity is lithium.

As someone who has spent nearly four decades involved in stock and futures market analysis, I can attest to the power of getting into an early-stage lithium mining company such as Alpha Lithium (APHLF).[16]

By the way, as a reminder, my name is James Hyerczyk.

I’m a noted technical analyst, market researcher, educator, and trader. I’ve been providing quality analysis for professional traders for 38 years.

I started my career in the markets in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange.

And with my background, when I look at Alpha Lithium (APHLF), I see a company with a low, affordable price that could have a long way to run, especially when compared to large established mining companies, whose huge growth spurts are well behind them. And especially, when you see how far this junior mining company has come in just 18 months — actually producing lab-scale quantities of lithium.

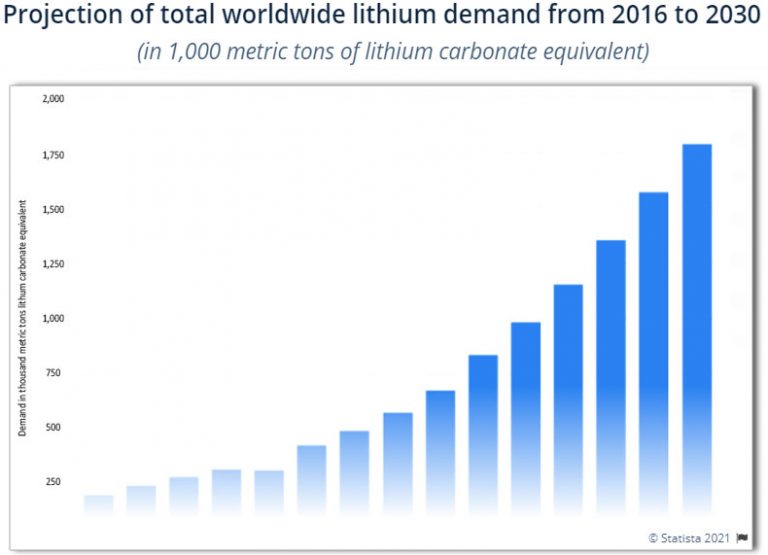

The global lithium market is projected to grow by 500% over the next 35 years, and Argentina looks to play a key role in supplying global requirements.[17]

That’s why I was excited when I first saw Alpha Lithium (APHLF) snag a set of potentially massive lithium deposits in South America’s world-famous Lithium Triangle.

Argentina Loaded With “White Gold”

The vast Lithium Triangle is made up of corners of Argentina, Chile and Bolivia. These pieces fit together like a jigsaw puzzle.

According to 2021 data from the U.S. Geological Survey, this is where 58% of the world’s identified lithium resources can be found.[19]

The abundance of lithium in this South American region is, in large part, due to its vast salt flats (called salars). This is where the “white gold” is extracted from pools of brine via an evaporation process aided by the sunny, arid climate.[20]

Compared to other forms of lithium mining, brine projects are more likely to get funding due to their lower cost structure.[21]

According to Americas Society/Council of the Americas, Argentina ranks 3rd in terms of the top proven global reserves, 4th in lithium production, and 1st among U.S. sources of lithium imports.[22]

While the pandemic has slowed mining projects, Argentine President Alberto Fernández has announced his intention to boost lithium carbonate equivalent (LCE) production nearly sixfold (6X) in the short-term.[23]

In late 2020, the Fernández government lowered the tax on mineral exports from 12% to 8%. And to further attract investment, the government has hinted at implementing a progressive tax starting at a lower rate for new projects.[24]

A 2019 report by the Inter-American Development Bank states that Argentina has the best potential of the three Lithium Triangle countries for exploration and development, due to a regulatory framework more receptive to investment.[25]

All of this is great news for Alpha Lithium (APHLF) — and its shareholders.

That’s because Alpha Lithium (APHLF) may be one of the last and largest lithium project opportunities in this highly productive and world-renowned region.

Alpha Lithium Owns 100% of Argentina’s Tolillar Salar

Within the Argentine part of the Lithium Triangle, Alpha Lithium (APHLF) took possession of assets located in the undisturbed Tolillar Salt Flats, in Salta Province. The property covers roughly 68,000 acres.[26]

The Tolillar Salar is one of the last remaining, undeveloped salars in Salta Province, an area that holds the world’s biggest lithium deposit.[27]

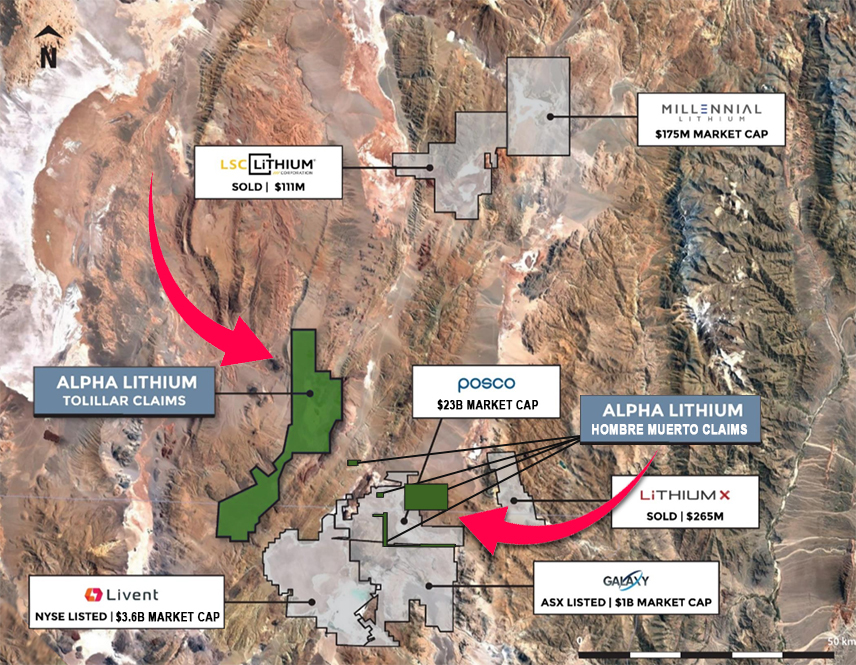

Surrounded by multi-billion dollar lithium assets, its neighbors are a “Who’s Who” of lithium miners.

The Tolillar project area has never been extensively explored. Yet it is uniquely located close to a concentration of major players representing some of the largest producers of lithium, who collectively service a large percentage of the growing global demand.[29]

In fact, this Alpha Lithium (APHLF) asset is practically “next door” to Livent [30], which has a market cap of over $3.6 billion as of August 2021.[31]

Also nearby is South Korean company POSCO, with a staggering market cap of around $23 billion.[32] POSCO purchased their lithium asset from Australian lithium miner Galaxy Resources (also nearby) for $280 million in 2018.[33]

With its approved drilling licenses, Alpha Lithium (APHLF) has already drilled six wells, taken samples, matched geology to seismic imaging, and flow tested.

In June 2021, Alpha Lithium (APHLF) announced that, after weeks of bench testing raw brine samples from its wholly-owned Tolillar Salar, their efforts yielded ACTUAL lab-scale quantities of Lithium Hydroxide and Lithium Carbonate.[34]

Brad Nichol, Alpha’s President and CEO, commented:

“We are elated to have actually produced both Lithium Hydroxide and Lithium Carbonate from the Tolillar Salar, less than 18 months after founding the Company. While this is limited bench scale production, it showcases our strategic goal to achieve production and our proven ability to operate at an incredible pace in Argentina.”[35]

Currently, Alpha Lithium (APHLF) is nearing drill completion, which is a step closer to publication of an NI 43-101.[36] In keeping with industry standards and best practices, this important report provides a factual summary of material scientific and technical information concerning a company’s mineral activities, making it understandable for the investing public and their advisors.[37]

In addition to this rapid progress on the Tolillar salar, there’s even more positive news for Alpha Lithium (APHLF)…

Alpha Lithium Shareholders Score a “Free Ride” on a Second Argentinean Asset: Hombre Muerto Salar

Since acquiring their flagship asset in Argentina, Alpha Lithium (APHLF) has continued to work toward increasing shareholder value.

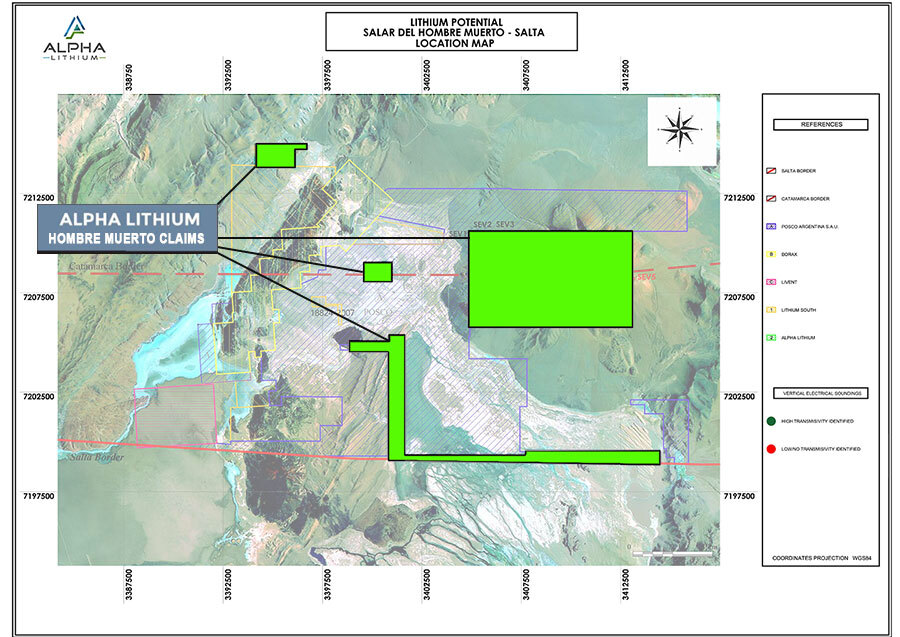

With this goal in mind, they recently acquired a 100% working interest in three strategic high-value assets in the heart of the Hombre Muerto Salar, roughly six miles away from their Tolillar Salar project.[38]

Hombre Muerto is split between Salta province and Catamarca province.

With the company’s landholdings in Hombre Muerto now totaling about 12,300 acres, Alpha Lithium has become the second-largest landholder on the Salta side.[39]

This is an important distinction. Salta province has consistently been rated as “friendlier” than Catamarca when it comes to mining.

The Fraser Institute Annual Survey of Mining Companies 2020[40] ranked Salta as the top Argentinean province when considering mining-related policies, rated higher when it comes to the availability of skills and labor, socioeconomic agreements, and community development conditions.

What’s more, this world-class salar of Hombre Muerto houses one of the most desirable lithium brines in the world, rivaled only by Chile’s Salar de Atacama.[41]

This is huge, since the Salar de Atacama and Salar del Hombre Muerto combined provide 50-70% of the world’s lithium supply.[42]

Unfortunately, Chile’s Salar de Atacama has been plagued by environmental concerns, such as worries over the local flamingo population.[43]

Located 4,400 meters above sea level, in the dry, ancient lake bed of Hombre Muerto, Alpha Lithium (APHLF) anticipates no environmental impediments such as those plaguing the Chilean mine.

The unique chemistry of the Hombre Muerto salar is ideal for the production of high quality, battery grade lithium.[44]

In fact, Hombre Muerto is the highest quality, longest producing salar in Argentina.[45]

Alpha Lithium’s project is strategically located about 6.2 miles from Livent’s high-quality/low impurity Fenix Project.[46] Livent, one of the world’s major lithium players, has been producing for nearly 25 years from less than five wells, all of which are less than 100 meters deep.

Alpha Lithium (APHLF) also expects to benefit from the extensive infrastructure developed to support nearby Livent Corporation’s many years of production history.[47]

When it comes to infrastructure, Alpha Lithium (APHLF) is well situated, with a 600-megawatt power line, a natural gas line, and a well-maintained road network nearby. There is a rail line between Salta, Argentina and the Pacific coastal port of Antofagasta, Chile. Fuel and medical services are also within a reasonable driving distance.[48]

With its high lithium concentrations, exceptional brine flow rates, and minimal impurity levels, Hombre Muerto has attracted billions of dollars in investment from the likes of previously mentioned Livent Corporation, Galaxy Resources, and the Korean giant POSCO, among others.[49]

Alpha Lithium (APHLF) is already making preparations for a drilling campaign in Hombre Muerto, and expects to commence drilling shortly, after all necessary permits are obtained.[50]

“Our team has set a pace in Argentina that is unmatched. They have hundreds of years of combined experience in Hombre Muerto, Tolillar and all the major salars in Argentina and Chile. The progress we have made in the last year is a result of our team relying on their experience and strong, established relationships. This is a clear benefit to our shareholders – and it will continue to be so as we increase our presence in Hombre Muerto, now our second core area. We are excited about developing this world class asset, surrounded by numerous lithium giants.” - Brad Nichol, President and CEO of Alpha Lithium[51]

Speaking of teams, Alpha Lithium (APHLF) is fortunate to have David Guerrero as their Country Manager on the ground in Argentina. With 20 years of international experience in the mining industry, David was formerly the Country Manager for Australian-based Galaxy Resources. He played a key role in Galaxy’s $280 million merger with POSCO to become one of the largest lithium companies in the world.[52] Born and raised in the town of Salta in Salta Province, he brings indispensable local knowledge and has been an excellent resource, especially during the COVID-19 pandemic, when travel to Argentina has been badly hampered.

If you’re not yet convinced that a small company with huge lithium assets such as Alpha Lithium (APHLF) merits your attention, let’s dig a bit deeper into the megatrends of the green revolution that help create such potential for this junior miner.

The EV Megatrend Challenging Lithium Supply

Of course, it’s not red-hot news that electric vehicles are the headline makers driving the unrelenting demand for lithium.

But it is sometimes daunting for investors to ponder just how big the trend is now — and how massive it is poised to become.*

That’s because the current acceptance of EVs across the globe is nothing compared to the future explosion.

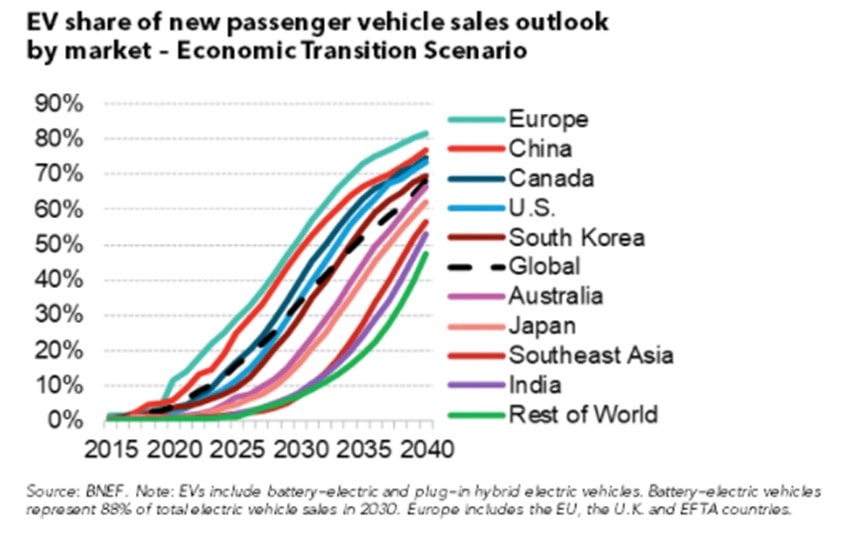

According to a study by Bloomberg NEF, the cost of EV production is expected to reach parity with internal combustion vehicles by 2026.[53]

And by 2032, at least 50% of passenger vehicle sales worldwide will be made up of electric vehicles powered by lithium batteries, according to DNV GL, an energy consultancy.[54]

Europe is expected to reach an 85% market share of battery-powered electric vehicles (excluding hybrids) by 2035.[56]

That’s why I want you to stay ahead of this megatrend — but to also understand the biggest and best trend is likely to be lithium.* That’s because the whole darn market fails without it.

As one lithium insider puts it:

“You can’t have electric cars without batteries and

you can’t have batteries without lithium.”[57]

And that could help put Alpha Lithium (APHLF) center stage in the supply chain. It’s all due to a single fact — there’s no stopping the EV megatrend juggernaut now.

Today, Even Truckers are Going Green

In 2020, Amazon announced their purchase of 100,000 electric delivery vehicles as part of The Climate Pledge. The company committed to achieve net-zero carbon operations by 2040 — a full decade ahead of the Paris Agreement.[58]

According to Bloomberg NEF’s Electric Vehicle Outlook 2021, adoption of EVs in the commercial van and truck market is picking up speed. With more models available, rising corporate fleet commitments, favorable economics, and increasing concern about urban air quality, the scale is set to tip the light commercial-van segment over to electrification within the next few years.[59]

Some surprise twists have made the megatrend even bigger. And, in turn, added extra stress to the lithium supply chain.

High-Performance Luxury EVs — Zero to 60 in Three Seconds or Less

Now you can stir serious luxury and high-performance cars into the EV mix. That’s something lithium suppliers hadn’t really counted on.

The luxe brands, such as Porsche, have learned how to make technically advanced lithium-ion batteries that can drive their EVs to speeds that will top 150 MPH.

However, these high-performance batteries need to be huge – 95kWh and larger. That’s because it takes a lot of lithium to power a car from zero to 60 mph in three seconds or less.

By comparison, the average “underpowered” EV uses between a 10 kWh and 30 kWh Li-ion battery setup, depending on its range. Generally, 10 kWh translates to 100 miles.

And this is what is driving today’s sudden supply anxiety.

Because the smallest EV, the Nissan Leaf, uses 20 pounds of lithium in its battery, while a big EV, such as a Tesla, uses more than 350 pounds of lithium.[60]

Simply put, luxury vehicles with larger batteries need more lithium.

Besides Porsche and Tesla, Luxe Digital includes models from luxury automakers BMW, Audi, Jaguar, Mercedes-Benz, Lotus, and others among the 17 best electric cars of 2021.[61]

All these supply chain surprises are a big reason why a small company, with a huge lithium property, such as Alpha Lithium (APHLF), merits your attention.

In fact, a supply/demand crisis could quickly transform this company from a junior miner into a market moon shot.*

And if that wasn’t enough…

Keep Your Eye on Lithium-Rich Battery Energy Storage — Another Major Emerging Trend

Massive lithium-containing battery packs and other innovative storage technologies are increasingly being touted as the solution to balance power generation and utilization.[62]

According to Markets-and-Markets, the battery energy storage system market is predicted to grow from $2.9 billion in 2020 to $12.1 billion by 2025.[63]

Spanning huge tracts of land, grid-level storage systems convert electricity into a storable form that can be transformed back into electrical energy when necessary.

This is not only helpful during severe weather events and other natural disasters.

These lithium-ion power grid batteries also help stabilize the grid by balancing output of renewable energy sources such as wind and solar. For example, they can offer more electrical power during peak times and then charge themselves at times of lower demand.[64]

According to Wood Mackenzie, over 99% of U.S. storage capacity installed in the third quarter of 2019 used lithium-ion batteries.[65]

This is yet another reason why lithium could be one to the top investments for the foreseeable future.* And it’s why a young company like Alpha Lithium (APHLF) should be on your radar — right now.

In addition to these massive grid-sized storage systems, consumers are looking to home-sized versions.

Tesla’s Powerwall, for example, is a battery system for residential or light commercial use. Its rechargeable lithium-ion battery pack provides energy storage to aid solar power and provide a clean, reliable source of backup electricity.[66]

And, it should be noted, Tesla’s Powerwall uses around 85 pounds of lithium![67]

As demand for lithium storage batteries is growing so quickly, the biggest winners among the newer companies could be the lithium miners such as Alpha Lithium (APHLF), who are ready to expand immediately.

That is why I see…

Eleven Solid Reasons Why Alpha Lithium (APHLF) Could Be the Best Lithium Play For 2021

- Lithium Powers the Green RevolutionBy 2025, around 70% of all lithium will be used in electric vehicles (EVs), e-bikes, energy storage, and traditional batteries — making lithium the “uncontested fuel of the green revolution.”[68]

- Ending China’s Lithium Market Domination Data from BloombergNEF suggests that, when it comes to the lithium-ion battery supply chain, China controls 80% of lithium raw material refining, 77% of lithium cell capacity, and 60% of lithium component manufacturing globally.[69] In early 2021, President Biden warned about China’s dominance when it comes to lithium-reliant renewable energy and electric vehicles. “If we don’t get moving, they’re going to eat our lunch,” he said.[70] Getting China out of the driver’s seat when it comes to lithium market domination has become a priority for not only the U.S., but for the E.U. as well.[71]

- Increasing Global Lithium DemandThe global lithium market is projected to grow by 500% over the next 35 years[72], and Argentina looks to play a key role in supplying global requirements. The world requires many more lithium mines, with the unprecedented lithium-ion battery demand to fuel electric vehicles, storage systems, and energy-hungry devices.

- Located in a Mining Sweet SpotWith its properties in Tolillar Salar and Hombre Muerto, Alpha Lithium (APHLF) now controls a total of 80,000 acres within the Argentina section of the world-famous (and mining friendly) Lithium Triangle, surrounded by multi-billion dollar lithium assets. According to 2021 data from the U.S. Geological Survey, the Lithium Triangle holds 58% of the world’s identified lithium resources.[73]

- Multiple Assets With Proven LithiumAlpha Lithium’s flagship Tolillar Salar project is located in the northwest region of Argentina near the heart of the Lithium Triangle, surrounded by multi-billion dollar lithium producers with decades of active lithium production. Alpha has already produced both Lithium Hydroxide and Lithium Carbonate from the Tolillar Salar, less than 18 months after founding the Company. [74] In addition, Alpha Lithium (APHLF) has recently established the second-largest position in Salta Province in Hombre Muerto, Argentina’s best, and one of the world’s most coveted, lithium brine salars. This is primarily due to significantly high average in-situ lithium concentrations, naturally low levels of undesirable impurities, and high permeability and flow rates from producing wells. Nearby Livent has over 20 years of production history from a small number of wells shallower than 100 meters.[75]

- Infrastructure Already in PlaceAs Argentina’s only major producing salar for more than two decades, extensive infrastructure already exists. This includes international roadways, rail lines, airstrips, natural gas pipelines, electricity distribution, and access to shipping facilities.[76]

- Experienced Management With a Local Team in PlaceThe management team at Alpha Lithium (APHLF) comprises industry professionals and experienced stakeholders with years of expertise in mining, exploration, and capital markets. This well-connected team employs a proven approach to global lithium mining that primes the company for significant growth. As a result of David Guerrero’s in-country presence, knowledge and relationships, Alpha’s Argentine team has firmly established the Company as a major property holder in Hombre Muerto, sharing the same salar with multi-billion-dollar companies such as POSCO, Galaxy Resources/Orocobre and Livent Corporation.[77]

- Well-Financed — With a Great Track RecordWith a market cap of over $54 million[78], Alpha Lithium (APHLF) is well positioned to aggressively pursue production and growth in the Salta province of Argentina’s Lithium Triangle. With their proven skill sets and reputation for speed and efficiency, Alpha has accomplished everything described in this report in only 18 months. This junior mining company has proven its dedication to creating shareholder value.

- Juniors Explore, Majors BuyAlpha Lithium (APHLF) is surrounded by major players such as Livent, POSCO, Galaxy, and others. Because of that, the potential exists for a buyout to amply reward Alpha Lithium’s early investors.* As an example, Millennial Lithium Corp, has recently gotten into a bidding war with several “suitors” and offered $300 million (USD) for their assets.[79] Another “neighbor,” Lithium X, was sold for $209 million (USD) in 2018.[80]

- EV Megatrend Accelerates With Commercial and Luxury VehiclesAfter holding their noses at under-powered lithium batteries, Porsche, Audi, Jaguar, and other automakers have developed cutting edge motors that turn their EVs into high-performance rockets. These new motors need big batteries that use hundreds of pounds of lithium. In addition, companies such as Amazon, Daimler Trucks, and Volvo Trucks are stepping up adoption of commercial electric vehicles.[81]

- Energy Storage Trend Relies on LithiumLithium-filled batteries are being used more and more in both commercial and residential energy storage systems to help shore up failing power grids and balance out electricity during peak times. The battery energy storage system market is predicted to grow from $2.9 billion in 2020 to $12.1 billion by 2025.[82] I don’t see this “green revolution” trend stopping or slowing anytime soon.

The Smart Play Is To Look Into Alpha Lithium (APHLF) Now — Before The Looming Demand Crisis Starts*

I believe Alpha Lithium’s stock is currently undervalued given their potential — but that situation likely won’t last much longer*, especially with their acquisition of a second asset in proven lithium-rich Hombre Muerto.

Take your position now in Alpha Lithium (APHLF) for a chance to put yourself among the earliest and biggest winners.*

But before you do, make sure to show your investment advisor or broker a copy of this brand new sector report.

I fully expect they will love this great high-potential story; however, a word of caution is in order. Most companies with great stories and unlimited upsides are young and have limited revenues.

That means they can carry a significant amount of risk.

That’s why I urge you to always observe my three rules for accepting microcap investing risk:

Risk Reduction Rule #1: Never invest more than you can afford to lose.

Risk Reduction Rule #2: Do not chase losses. That means if prices slide you must resist all temptation to “average down.”

Risk Reduction Rule #3: Don’t put all your dreams on one microcap. Allocate your risk capital among a handful of stocks.

With that in mind, I stand by my analysis that forecasts Alpha Lithium (APHLF) as having a potentially huge upside.

I offer this analysis respectfully and pray you are in good health and good spirits.

Here’s hoping for your success in the post-pandemic world.

– James Hyerczyk / InvestingTrends.com

Still want more information on Alpha Lithium (APHLF)?

I’d like to offer you access to Alpha Lithium’s Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1a] https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[2] https://joebiden.com/clean-energy/

[4] https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[6] https://www.nytimes.com/2021/08/05/business/biden-electric-vehicles.html

[7] https://www.mikehulme.org/wp-content/uploads/2009/10/Hulme-Carbon-Yearbook.pdf

[9] https://www.nytimes.com/2021/09/03/climate/climate-change-congress.html?referringSource=articleShare

[11] https://sustainabledevelopment.un.org/content/documents/17501PB16.pdf

[13] https://www.visualcapitalist.com/lithium-fuel-green-revolution/

[14] https://www.visualcapitalist.com/lithium-fuel-green-revolution/

[15] https://www.bbc.com/news/business-55391571

[16] https://www.visualcapitalist.com/lithium-fuel-green-revolution/

[17] https://www.bnamericas.com/en/analysis/argentinas-potential-in-the-lithium-business

[18] https://www.statista.com/statistics/452025/projected-total-demand-for-lithium-globally/

[19] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[20] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[21] https://www.millenniallithium.com/_resources/presentations/corporate-presentation.pdf?v=0.096

[22] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[23] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[24] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[25] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[26] https://alphalithium.com/investors/#section-3

[27] https://alphalithium.com/project/

[28] https://alphalithium.com/project/

[29] https://alphalithium.com/project/

[30] https://alphalithium.com/project/

[31] https://finance.yahoo.com/news/15-most-valuable-lithium-companies-144231867.html

[32] https://finance.yahoo.com/quote/PKX/

[33] https://investingnews.com/company-profiles/alpha-lithium-tsxv-alli/

[37] https://www.micon-international.com/ni-43-101-technical-reports-theyre-not/

[40] https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2020.pdf

[43] https://www.arkansasonline.com/news/2016/jul/17/flamingo-fans-fume-as-car-makers-mine-s/

[46] https://investingnews.com/company-profiles/alpha-lithium-tsxv-alli/

[48] https://alphalithium.com/project/

[52] https://alphalithium.com/our-company/

[54] https://eto.dnv.com/2019/electrical-vehicles

[55] https://about.bnef.com/electric-vehicle-outlook/

[57] https://www.cnn.com/2021/01/13/investing/lithium-tesla-electric-vehicles/index.html

[59] https://about.bnef.com/electric-vehicle-outlook/

[61] https://luxe.digital/lifestyle/cars/best-electric-cars/

[62] https://link.springer.com/article/10.1007/s12209-020-00236-w

[63] https://www.marketsandmarkets.com/Market-Reports/battery-energy-storage-system-market-112809494.html

[64] https://link.springer.com/article/10.1007/s12209-020-00236-w

[68] https://www.visualcapitalist.com/lithium-fuel-green-revolution/

[69] https://www.nsenergybusiness.com/features/six-largest-lithium-reserves-world/

[70] https://www.washingtonpost.com/technology/2021/02/11/us-battery-production-china-europe/

[72] https://www.bnamericas.com/en/analysis/argentinas-potential-in-the-lithium-business

[73] https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[78] https://alphalithium.com/investors/

[79] https://www.yahoo.com/now/millennial-lithium-corp-announces-receipt-170300021.html

[80] https://www.spglobal.com/marketintelligence/en/news-insights/trending/v9z-oxbimxb3ycolaum61w2

[82] https://www.marketsandmarkets.com/Market-Reports/battery-energy-storage-system-market-112809494.html

Ad references:

https://www.marketsandmarkets.com/Market-Reports/battery-energy-storage-system-market-112809494.html

https://finance.yahoo.com/news/ford-to-build-two-114-billion-mega-campuses-for-electric-car-production-230016248.html

https://www.marketsandmarkets.com/Market-Reports/lithium-ion-battery-market-49714593.html

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and has been providing quality analysis for professional traders for 38 years.