Sponsored

Scarcity of This “Golden Gas” Creates a Nightmare Scenario for Semiconductor Chip Makers, the Medical Industry, and Big Tech

But it Could Be the Next Investor’s Dream Commodity...

- The national stockpile has dwindled down to fumes — and the U.S. is forced to depend on imports from countries with unstable geopolitics, such as Qatar and Russia.[2]

- Today’s helium supply shortage is so critical that it could halt the operation of life-saving magnetic resonance imaging machines (MRI’s) — and worsen an already disastrous semiconductor chip shortage.

- The deepening crisis has Google, Netflix and Amazon buying and hoarding massive quantities of helium for their data centers.[3]

- And while Earth’s most rare and nonrenewable resource is running low, its multiple sector demand could make helium the next commodity supercycle — and create a “golden” opportunity for investors. *

- Global Helium (HECOF) was founded at the request of helium end-users who need a dependable North American supply to help solve these crippling shortages.

By James Hyerczyk

The city of Amarillo, along historic Route 66 in the Texas panhandle, is well-known for its mouth-watering steaks.

But few people know that near Amarillo, an unfathomably huge and deep underground salt dome has — for nearly a century[4] — been home to the Federal Helium Reserve, the only helium storage facility in the world.[5]

Since 1966, the Reserve has sold crude helium to private companies and supplied helium to Federal users. It also began providing refined helium back in the 1960s.[6]

And while most folks associate helium with party balloons and Mickey Mouse voices, this rare gas is critical to our modern-day technology.

Helium is instrumental in the manufacturing of semiconductor chips — found in everything from computers to smartphones…[7] from washing machines to automobiles.[8] In short, these chips are found in nearly every device with electronics we use today.[9]

A principle reason for its widespread use is that it’s the only element you can cool down to -450°F — nearly the lowest possible temperature in the universe.[10] With its cryogenic properties, liquid helium is the only way to cool down the superconducting magnets found in medical MRI machines.[11]

Helium even helps cool down orbiting satellites.[12] Elon Musk’s SpaceX uses helium to help maintain pressure in their Falcon 9 rocket’s propellant tanks.[13]

Companies such as Google, Amazon, and Netflix are fighting over dwindling supplies of this rare gas to maintain their heat-generating computing power.[14]

With the growing list of crucial uses for this increasingly valuable, hence “golden gas”, decisions made years ago have led to very unfortunate consequences today.

You Can Thank Congress for the Helium Scarcity

At its peak, the Federal Helium Reserve could hold 45 billion cubic feet of helium.[15]

It became sort of a big pillow of helium that kept supplies in balance and softened the blow of market disruptions.

But with the government’s late 20th century obsession with privatization, the Reserve, controlled by the Bureau of Land Management (BLM), was ordered to sell off its helium to private industry.[16]

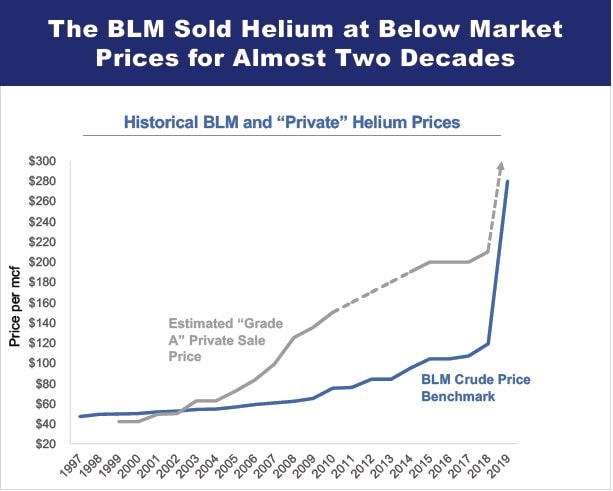

What’s worse, in selling off America’s strategic helium reserves, it did so at well below market prices for decades.

[20]

Now, the reserve only contains a fraction of what it used to hold.[17]

And the BLM was ordered to unload ALL its helium assets by the end of 2021.[18]

As the New York Times points out, shuttering the reserve means that liquid helium will become increasingly scarce — and the price will continue to go up.[19]

In fact, the global helium market is predicted to reach $18 billion by 2025, growing at a CAGR of 11.16% between 2021 and 2025.[22]

That’s bad news for industries that need this gas…

But it’s good news for Global Helium (HECOF), a North American helium exploration company I’ve had my eye on.

Global Helium (HECOF) is well-positioned to attract significant investor interest with its first-mover advantage.*

So while lithium has been sucking up all the oxygen lately, I’m recommending investors take a hard look at this small-cap helium company, which was founded by seasoned veterans at the request of industry. I’ll explain in more detail in this report.

When I look at Global Helium (HECOF), I see a young company with a low, affordable price that could have a long way to run* — for reasons you’ll see shortly.

What is it About Helium, Anyway?

Helium is the second most abundant element in the universe, so how could there be a shortage?

According to Dr. Lee Sobotka, a professor of chemistry and physics from Washington University in St. Louis, “Helium is non-renewable and irreplaceable.”[23]

In fact, helium is the ONLY element on earth that is a completely nonrenewable resource.[24] This means that while it is abundant in the universe, we have a limited supply of this gas on earth.[25]

As a New York Times headline has warned, “Nothing on Earth Can Replace Helium — and it’s in Peril.”[26]

And the companies that need it are smart enough to know this. That’s why they’re fighting over it — and willing to pay top dollar.

Of course, that’s terrible news for those industries that require helium, because it drives prices higher. But it’s welcome news for helium companies as well as their investors.

That’s why the president of IACX Energy says, “It’s a good time to be in the helium business.”[27]

We all know what happens when the supply of a valuable resource goes down, and the price goes up. It creates some very happy investors.

For example, just a few years ago…

When Tesla (and other car manufacturers) started using lithium to create electric vehicle batteries, lithium quickly became one of the most valuable resources on the planet.

That sparked the lithium boom that we saw from 2016-2020. During that time, we saw lithium stocks shoot up by as much as 1,000%.

These Booms Made A Few Smart Investors VERY Rich

And while those opportunities have come and gone…

There’s something even bigger that’s happening right now. And there aren’t many do-overs in life, but the helium “Gold Rush” could give investors a second chance.

In fact, it’s already starting…

Let’s look at a company called Desert Mountain Energy Corp. They’re one of the few companies drilling for helium inside the United States.

They saw their shares skyrocket from 28 cents on May 6, 2020, all the way up to $4.56 on September 10, 2021.[28]

That was a 1,628% METEORIC gain!

Reduce American Dependence on Helium Sources From Politically Unstable Countries

One key to the success of helium exploration companies such as Desert Mountain Energy is their location in North America.

And while these companies already saw their share price spike, there’s another North American company that investors should look at right now. *

And that’s Canada’s Global Helium Corp. (HECOF).

Never forget, when it comes to exporting, Canada enjoys a favorable geopolitical situation, unfettered by political sanctions or export restrictions.[30]

This location offers a significant advantage over reliance on distant, politically unstable countries such as Qatar (in the Middle East) — or adversarial countries such as Russia. Unfortunately, these are areas the U.S. currently depends on for the helium it needs.[31]

A quick look at the past shows the risk.

In June 2017, helium supplies from Qatar were cut off by a Saudi-led blockade.[32] When it comes to such an essential commodity, the U.S. can ill-afford to bumble around with a risky supply chain.

Especially when helium has been listed as one of 35 mineral-related commodities considered critical to the economic and national security of the United States. The Trump administration published this list in 2018 as part of their strategy to break America’s dependence on foreign mineral commodities.[33]

Global Helium (HECOF) Was Established to Meet Industry Demand

Global Helium (HECOF) is in business for a compelling, one-of-a-kind reason.

Companies that were anxious about their unreliable helium supply chains approached Global Helium and said they would buy as much liquid helium from them that they could produce—as long as Global Helium could provide the security of a guaranteed supply.

Hence, Global Helium Corp. (HECOF) was born.

That means Global Helium (HECOF) has the rarest of all marketplaces. It’s one that can be considered price insensitive.[34]

In other words, this marketplace is filled with customers that are essentially begging to pay top dollar. Reasons for this will become clear when you hear about some of the industries relying on this precious gas.

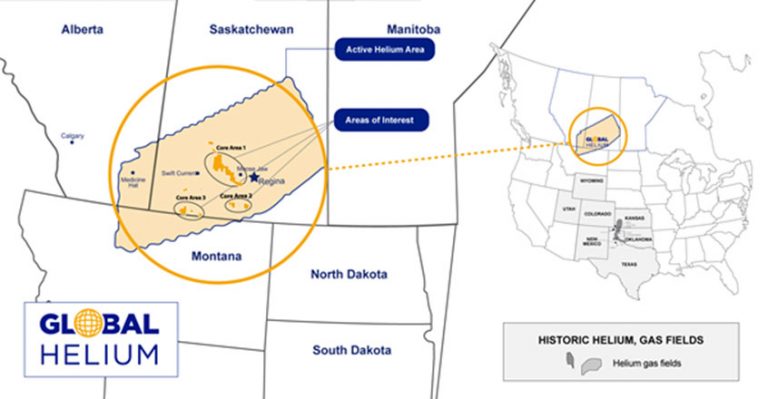

100% Ownership of Over 1.2 Million acres in Saskatchewan’s “Helium Fairway”

To meet rising demand, Global Helium (HECOF) completed a new round of acquisitions in southern Saskatchewan in October 2021, increasing their previous acreage by a whopping 50%.

With this purchase, Global Helium’s (HECOF) has now acquired over 1.2 million acres in the heart of Saskatchewan’s helium fairway.[35]

This makes it Canada’s second largest land holder of helium rights, with 100% ownership combined with royalties of less than 5%.[36]

Within this vast area, Global Helium (HECOF) has established three core zones:[38]

Area One – Swift Current: This core area encompasses almost over 760,000 acres near Swift Current, home to Saskatchewan’s original helium production facility. Large geological structures have been long known to exist in the area and were proposed for helium exploration in 1960. One feature was drilled in 1944 by Imperial Oil. Review of the available data shows the well recovered “non-combustible gas” – indicating the potential for helium.

Core Area Two – Regina: This core area encompasses over 215,000 acres and is in south-central Saskatchewan. A number of adjacent wells have tested helium concentrations ranging from 1.4% to 2.45%.

Core Area Three – Montana Border: This core area encompasses over 235,000 acres on the Canadian side of the Montana/Saskatchewan border. This attractive acreage sits in the middle of two recent helium discoveries at Eastbrook and Climax, Saskatchewan. High percentage helium tests have been recorded in Montana where significant industry activity is also underway.

Global Helium (HECOF) Has a Tremendous Geographic Advantage

It’s not wishful thinking to consider that Global Helium (HECOF) is located in what may well become one of the world’s great natural resource locations.*

That’s because, as you can see, Global Helium’s (HECOF) land position is in the heart of a well-known helium fairway with production, reserves, and significant activity nearby.[39]

Unlike U.S. wells, Saskatchewan helium is unique. It is the rare place in the world that produces helium unencumbered by oil and gas.

In addition, Saskatchewan’s helium wells are deeper and more pressurized.

Yes, being “deeper” may make it marginally more expensive to extract the helium. But to compensate, the pressure pushes the gas to the surface more rapidly.

And, because it only flows to the surface mixed with a bit of nitrogen — no oil, no natural gas — processing is easier, cheaper, and “greener” than that for hydrocarbon distillation.

In fact, helium is a critical element in the new Green Revolution.[40]

There is no direct carbon footprint associated with the use of helium. So non-toxic and non-combustible helium is also a non-issue in environmental politics. And in their role as responsible environmental stewards both above and below ground, Global Helium (HECOF) is committed to remaining carbon-neutral.[41]

All This Puts Global Helium (HECOF) in the Thick of What Could Soon be a World-Class Helium Reserve

A deep exploratory well was drilled on Global Helium’s (HECOF) property by Imperial Oil back in 1944.[45]

The testing equipment of the day did not — or wasn’t advanced enough — to detect helium.

Global Helium (HECOF) recently acquired the data. And in October 2021, they reported on the beginning of an extensive $500,000 seismic and remote sensing program, which includes aeromagnetic and gravity surveys across its three core areas in Saskatchewan. This will better define drilling targets on the Company’s huge land base on the helium fairway.[46]

Drilling for helium is nearly identical to the process of drilling for natural gas, an industry which generated massive data on helium, especially in Canada.

The environment is ripe for a resurgence of the industry in Saskatchewan, which produced helium decades ago before floundering due to slumping prices, said Melinda Yurkowski, assistant chief geologist for the Saskatchewan Geological Survey.

“It’s still a lot of rank exploration right now,” she said, adding “no one knows how much helium — produced by the decay of radioactive uranium and thorium — the province contains.”[47]

The answer to that could come quickly, as Global Helium’s (HECOF) geological and geophysical teams work to rapidly move to the drill stage and advance the geological evaluation of their massive land base.[48]

The next milestone plans for a small plant to separate nitrogen from helium, then compress the raw helium for shipment to a big purification plant, such as the one in Battle Creek, Saskatchewan that just opened in April 2021.[49]

This brand new infrastructure to process the now-precious helium gas is conveniently located just three hours from Global Helium’s (HECOF) assets. And at a cost of $32 million to build, it is Canada’s largest helium processing plant.[50]

Finally, the purified helium may be liquified and sold to eager customers in North America and around the world.

All this is why a young company such as Global Helium (HECOF) could suddenly become such a critical player in modern-day life.*

Global Helium (HECOF) may be a micro-cap, but size does not matter to Big Tech, semiconductor producers, MRI operators, and other helium-dependent industries.

Here’s why…

A Long-Term Crisis Will be a Multi-Trillion Dollar Problem…

But it Could be a Boom for Helium Investors

As you’ve seen, helium is the critical element at the heart of electronic devices. Around $1.3 trillion worth of electronic systems were manufactured in 2018 alone.[51]

You never hear about helium when analysts talk about Apple, Microsoft, Samsung, LG, or other Big Tech companies.

Yet, helium is critical to manufacturing semiconductors, which do the computing, storage, and communication functions in almost all electronic products.

Semiconductor chips are at the heart of the gadgets consumers use constantly — smartphones, tablets, PCs — as well as industrial, medical, automotive, and defense electronics.[52]

The vast majority of chips are created with silicon. It’s how Silicon Valley got its name.

But silicon needs to go through extensive processing to create the specific circuitry for each chip.[53]

This is where helium comes in… and is why Global Helium’s (HECOF) supply could be so important.

Global Helium (HECOF) Could Become A Vital Link In The Semiconductor Manufacturing Process

Because of several crucial properties, helium serves multiple functions in the manufacturing of semiconductor chips.

As an inert gas, it doesn’t react with other elements. So having an inert gas around the silicon prevents any unwanted reactions.

Helium also has a high thermal conductivity, meaning it conducts heat away effectively.

This helps to control the temperature of the silicon during these processes.

This is increasingly important as the dimensions of the circuitry on the silicon continue to shrink.

It would be impossible to drive this miniaturization without the process control that helium provides.

Last, but certainly not least, helium is used because of its cooling properties.

All of this chip manufacturing represents an enormous investment by some of the biggest companies in the world — and all of it hinges on helium.

Right now, the semiconductor chip industry is already suffering shortages due to increasing demand, residual effects from the pandemic, supply chain issues, and other factors.[54]

So with the ever-growing demand for electronic devices, any critical piece of the supply chain, such as helium, represents an excellent opportunity for investors.*

And, while there are no guarantees, Global Helium (HECOF) could soon become a strong link in the helium supply chain thanks to its vast holding in western Saskatchewan, in what could be the world’s most important new helium reserve.

The Cold Hard Truth About Helium Profits

So semiconductors can’t be manufactured without helium…

So semiconductors can’t be manufactured without helium…

But truth be told, the world might stumble along for a few years without new iPhones or Xboxes.

However, lack of access to a ready supply of helium could become a life-or-death problem in medicine.

That’s because helium is at the heart of MRI diagnostic machines.

Here’s why…

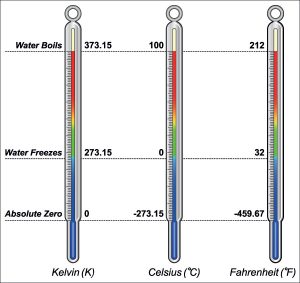

Many metals become superconductors when they are chilled to a point close to absolute zero (minus 459.67 degrees Fahrenheit).

At that ultra-low temperature, electricity flows smoothly through metal without friction.

So, among its other applications, one of helium’s most important uses is to enable functioning of the powerful electromagnets used in magnetic resonance imaging (MRI).[56]

A True Life-Or-Death Crisis That Global Helium (HECOF)

Could Help Solve

It’s not hyperbole to say that MRI technology has revolutionized healthcare — and saved countless lives.[57]

Here’s how it works…

MRI machines use a strong magnetic field and computer-generated radio waves to help create detailed images of the body’s organs and tissues.

This advanced imaging technology allows medical professionals to collect important information about their patient’s condition — without exposing them to radiation.

MRI scans provide an amazing level of clarity and excel at examining soft tissues such as the brain, muscles, or spinal cord.

That’s why MRI scans help diagnose brain tumors, strokes, aneurysms, spinal cord injuries, and other serious or even potentially fatal health conditions.[58]

However, in order to function, MRI scanners require a coolant to give the magnetic coils in the scanner super-conductive properties.[59]

This makes liquid helium the perfect element — cold enough to provide the levels of superconductivity required in MRI scanners.

And this is yet another reason why Global Helium’s (HECOF) supply could become so important.

Soaring Prices Always Favor The Seller

So, helium is critical to the healthcare industry. Yet helium prices spiked to $35 per liter in 2019, more than double the average cost of $14.60 per liter they commanded three years previously.[60]

Moreover, in general, liquid helium can be quite expensive compared to other elements.

In late 2020, scientists at the University of Idaho were paying $35 a liter while University of Florida scientists were paying $25L, but hearing rumors of $60L.[61] [62]

That’s life in a crisis.

When it comes to MRI machines… their need for helium varies.

A typical MRI scanner based on the OR76 magnet will need to be filled to capacity with 1800 liters of helium.[66]

But it loses about 4% of its helium capacity a month… or about 48% per year.[67]

That means over the year it needs to be topped with 864 liters of helium.

Assuming the price of liquid helium is around $30L it will cost the hospital about $25,920 a year to keep a single MRI scanner topped off with liquid helium.

Now consider that, in 2018, there were an estimated 50,000 MRI machines worldwide.[68]

Forbes puts it bluntly: “Since there is currently no alternative to helium to keep these machines running, take away helium and MRI goes bye-bye.”[69]

The necessity for helium in running MRI scanners is a major factor explaining why the global helium market is forecasted to grow at a CAGR of 11.15% between 2021 and 2025.[70]

And keeping MRI scanners up and running isn’t the only medical use for helium.

Because a mixture of helium and oxygen is lighter than air, it can flow through airways more easily. That’s why this gas combination helps patients suffering with lung ailments such as asthma and COPD.[71]

With its link to respiratory health, medical professionals also use helium in lung ventilation and pulmonary function testing.[72]

In addition, it is used in some laparoscopic and open-heart surgeries.[73]

Helium-filled devices are also being looked to as a way to keep vaccines ultra-cold up to 30 days — without electricity.[74]

And not to be outdone, researchers are also using helium beams as a form of cancer radiotherapy.[75]

Helium Helps Cool Down the Heat Generated by Big Data

Between semiconductors, MRI machines, and hundreds of additional uses for this noble gas, you can see why demand for helium should continue to rise around the globe.

Domestically, a significant shortage can be attributed to commitments with government contracts, high international demand, fewer new sources, and waste.[76]

And don’t lose sight of the fact that Google, Facebook, Amazon, and Netflix are working to stockpile helium.[77]

Why?

The reason traces back to 2013, when computer scientists finally perfected the helium hard drive to replace the metal hard drive.

Now Silicon Valley’s thirst for helium may be unquenchable.

After all, some 3.7 billion people are generating about 2.5 quintillion bytes of data on a daily basis.[78]

Those numbers may expand by up to 60% a year, so by 2025, usage will generate a projected 160 zettabytes a year.[79]*

In short, that’s a heckuva lot of data. And without helium drives, that would be an erupting volcano of computer-generated heat.

That’s why investors in a company such as Global Helium (HECOF) might see good news soon*, especially with the company’s veteran leadership.

Global Helium’s (HECOF) Proven Management Team

The Global Helium (HECOF) team brings over two decades of helium-specific experiences, and are uniquely positioned with long-term relationships across the entire value chain.[80]

The Oxford Man

President and Director Wes Siemens P.Eng., began his career in 1993 at Canadian Occidental Petroleum Ltd. He held several technical and management positions over 21 years throughout its evolution to Wascana, Nexen, and the global behemoth CNOOC Ltd.

Wes Siemens has held International and senior management positions including in Operations, Corporate Planning and Business Development, Business Development Africa and Middle East, Oil Sands and Technical Excellence.

He has accumulated extensive experience in mergers and acquisition that involved billions of dollars of transactions.[81]

The Globe Trotter

Vice President Duncan MacKenzie, P. Geol. is a geoscientist with 20+ years’ experience with all aspects of finding and commercializing natural and industrial gases.

His expertise is in western Canada. But he’s also worked as a geoscientist on U.S., South American, and West African projects.

MacKenzie is well versed in gas reserve evaluations and is privileged to be part of a network of skilled and experienced geoscientists focusing on environmentally friendly, non-combustible gases. He has been working on rare gas exploration since 2015.[82]

The Alpha Male

Chairman and Interim CEO Brad Nichol, P. Eng. MBA, is a mechanical engineer with more than 25 years’ experience in oil field operations, business consulting, and as an oil and gas executive and board member in Canada, the United Kingdom, the United States, and South America.

He has worked extensively on producing oil and gas fields in Canada and Colombia and brings access to an experienced network of engineering, operational and finance professionals in Canada, the United Kingdom, the United States, and Switzerland.

Veteran natural resource investors know Nichol as the President and CEO of Alpha Lithium Corp (APHLF), an environmentally responsible lithium explorer and producer that is one of the most actively traded and admired junior explorers in the world.[83]

With all these factors and a growing demand for helium, the biggest winners could be companies such as Global Helium (HECOF),* who are ready to expand immediately.

That’s why I see…

- Dumb Congress Moves Killed The Supply— In retrospect, a lot of the finite helium reserve was wasted by the U.S. selling off its helium reserve at very low prices.[84]

- Multiple Sector Demand — Because helium is used in so many industries, it could become the next commodity supercycle. This report could not begin to cover all the uses of this rare gas, including military defense, welding, commercial diving, nuclear technology, fiber optics, quantum computing, leak detection, scientific research, weather balloons, and so many others.[85]

- A Chip Off Of The Old Block— Helium is vital to manufacturing semiconductors. An existing chip supply crisis has already threatened a $1.3 trillion global electronics market.[86] This could drive industry competition, and ensure paying top dollar for helium.

- National Security and Economic Importance — Helium is listed as one of 35 mineral-related commodities considered critical to the economic and national security of the United States.[87] The U.S. wants to decrease reliance on sources outside North America for this vital resource.

- 50,000 MRI Machines— Most of these scanners need to be topped off with helium to the tune of what could be as much as around $25,000 a year — per machine.[88] It is nearly impossible to overstate the medical community’s collective fear of a crippling helium shortage.

- Too Hot To Trot — Massive computing power means massive heat. That’s why Google, Apple, Amazon, and Netflix are mainlining helium directly into the massive servers that keep their businesses afloat.[89]

- They Came Begging— Global Helium (HECOF) didn’t just hang an “open” sign. Companies desperate for helium came to its door and begged it to develop new helium resources in Saskatchewan.

- Made Market — Global Helium’s (HECOF) customers are price insensitive. They’ll pay top dollar day after day, week and week, year after year for a stable supply.[90]

- A Non-Renewable Resource — Helium is the only element on earth that is a completely nonrenewable resource. And there are no alternatives.[91]

- One Million Acres — Global Helium’s (HECOF) one million acres in the heart of Saskatchewan’s helium fairway[92] make it Canada’s second largest land holder of helium rights, with 100% ownership.[93]

- Juniors Rule — Big name sources such as CNBC, Bloomberg and Yahoo are all telling their readers that the helium crisis is a major deal… and the way to play it is with junior explorers (such as Global Helium (HECOF)).[94] [95] [96]

- Potential Moonshots— The helium crisis has already generated profits for some investors. Expect more to come, because like roofers getting rich after hurricanes, or mattress companies selling out after a flood… there’s always honest opportunities in a crisis.*

Sooner Than Later, the Helium Crisis Should Make Big News…

So the Smart Play is to Look Into Global Helium Corp. (HECOF) Now*

The news loves a crisis. Sooner than later, it will move on from the pandemic and politics to the next big threat…

Millions of people who can’t get their potentially life-saving MRI scan because of the helium crisis would certainly count as huge news.

Or it could be the helium shortage adding to the already-existing semiconductor shortage that causes the electronics sector to crash…

And don’t forget that Global Helium Corp. (HECOF) is in the heart of Saskatchewan’s helium belt.

That’s why now could be the very best time to research this company while it’s priced at this level.*

And it also means it may be time to call your broker or advisor and show him or her this report.

Then discuss these new opportunities in helium and, in particular, with Global Helium Corp. (HECOF).

Check carefully because I recognize that young companies with great stories can carry a significant amount of risk… that risk ranges from being under-funded to having a small number of shares available to the public.

So, I’ll also never shy away from alerting you about the risks associated with investing in young companies, new to the stock market. That’s why I urge you always observe my three rules for accepting microcap investing risk:

Risk Reduction Rule #1: Never invest more than you can afford to lose.

Risk Reduction Rule #2: Do not chase losses. That means if the prices slide you must resist all temptation to “average down.”

Risk Reduction Rule #3: Don’t put all your dreams on one microcap. Allocate your risk capital among a handful of stocks

All that said, I think you and your financial advisor will end up in agreement that Global Helium Corp. (HECOF) could be the coming year’s top headline-making stock.

Still want more information on Global Helium (HECOF)?

I’d like to offer you access to Global Helium’s Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

ADVERTISEMENT DISCLAIMER

THIS PUBLICATION IS AN ISSUER-PAID ADVERTISEMENT. This paid advertisement includes a stock profile of Global Helium] (OTCQB: HECOF). To enhance public awareness of HECOF and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately one million two hundred ninety-nine thousand nine hundred and twenty ($1,299,920.00) USD to cover the costs associated with this advertisement for a period beginning 1 April 2021 and currently set to end 28 February 2022. In connection with this effort, Promethean has paid the author of this advertisement, James Hyerczyk seven thousand ($7,000.00) USD in cash out of the total budget. The website hosting this advertisement, Investing Trends, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Investing Trends have been paid to host this advertisement. As a result of this advertisement, Investing Trends may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. James Hyerczyk is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Investing Trends website, some or all of Promethean, Investing Trends, Summit, or James Hyerczyk, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of HECOF and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of HECOF’s increased trading volume, and possibly an increased share price of HECOF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[2] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[3] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[4] https://www.nytimes.com/2019/09/04/opinion/helium-shortage.html

[5] https://www.blm.gov/press-release/blm-announces-disposal-process-federal-helium-system

[6] https://www.blm.gov/press-release/blm-announces-disposal-process-federal-helium-system

[7] https://www.investopedia.com/ask/answers/042115/what-are-main-types-chips-produced-semiconductor-companies.asp#:~:text=Standard%20Chips%20(Commodity%20ICs),-Standard%20chips%2C%20also&text=Produced%20in%20large%20batches%2C%20these,by%20large%20Asian%20semiconductor%20makers.

[8] https://www.easytechjunkie.com/what-are-the-different-types-of-computer-chips.htm

[9] https://www.asml.com/en/technology/all-about-microchips/microchip-basics

[10] https://www.sciencedaily.com/releases/2008/01/080102093943.htm

[11] https://www.nap.edu/read/9860/chapter/6#30

[12] https://www.mplso2.com/2021/04/20/helium-more-than-just-balloons/

[13] https://www.mvorganizing.org/is-helium-used-for-rocket-fuel/

[14] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[15] https://www.nap.edu/read/9860/chapter/3#5

[16] https://globalhelium.com/about/

[17] https://pubs.usgs.gov/periodicals/mcs2020/mcs2020-helium.pdf

[18] https://pubs.usgs.gov/periodicals/mcs2020/mcs2020-helium.pdf

[19] https://www.nytimes.com/2019/09/04/opinion/helium-shortage.html

[20] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[21] https://en.wikipedia.org/wiki/National_Helium_Reserve

[22] https://www.globenewswire.com/en/news-release/2021/04/19/2212376/28124/en/Global-Helium-Market-Report-2021-Market-is-Forecasted-to-Reach-18-18-Billion-in-2025-Growing-at-a-CAGR-of-11-15.html

[23] https://www.sciencedaily.com/releases/2008/01/080102093943.htm

[24] https://www.npr.org/2019/11/01/775554343/the-world-is-constantly-running-out-of-helium-heres-why-it-matters

[25] https://www.npr.org/2019/11/01/775554343/the-world-is-constantly-running-out-of-helium-heres-why-it-matters

[26] https://www.nytimes.com/2019/09/04/opinion/helium-shortage.html

[27] https://cen.acs.org/business/instrumentation/Help-helium-users-way/97/i46

[28] https://finance.yahoo.com/quote/DME.V/history?period1=1588291200&period2=1634860800&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

[30] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[31] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[32] https://physicstoday.scitation.org/do/10.1063/PT.6.2.20200605a/full/

[33] https://www.usgs.gov/news/interior-releases-2018-s-final-list-35-minerals-deemed-critical-us-national-security-and

[34] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[35] https://globalhelium.com/global-helium-corp-acquires-over-one-million-acres-in-southern-saskatchewans-helium-fairway/

[36] https://globalhelium.com/global-helium-corp-acquires-over-one-million-acres-in-southern-saskatchewans-helium-fairway/

[38] https://finance.yahoo.com/news/global-helium-initiates-extensive-geoscience-130000894.html

[39] https://globalhelium.com/projects/saskatchewan-helium-project/

[40] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[41] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[45] https://globalhelium.com/projects/saskatchewan-helium-project/

[46] https://finance.yahoo.com/news/global-helium-initiates-extensive-geoscience-130000894.html

[47] https://www.cbc.ca/news/canada/saskatoon/sask-helium-drilling-oilpatch-1.5415930

[48] https://globalhelium.com/global-helium-corp-acquires-over-one-million-acres-in-southern-saskatchewans-helium-fairway/

[49] https://globalnews.ca/news/7812927/saskatchewan-helium-plant-battle-creek/

[50] https://globalnews.ca/news/7812927/saskatchewan-helium-plant-battle-creek/

[51] https://www.prnewswire.com/news-releases/global-electronics-manufacturing-services-markets-report-2019-total-electronics-assembly-value-was-1-3-trillion-in-2018-and-will-reach-1-5-trillion-in-2023–300939643.html

[52] https://globalhelium.com/about/

[53] https://www.computerworld.com/article/2576786/making-microchips.html

[54] https://www.bbc.com/news/business-58230388

[56] https://lbnmedical.com/liquid-helium-in-mri-machine/

[57] https://stfc.ukri.org/about-us/our-impacts-achievements/case-studies/technology-for-research-saves-lives/

[58] https://www.webmd.com/a-to-z-guides/when-do-i-need-an-mri

[59] https://lbnmedical.com/liquid-helium-in-mri-machine/

[60] https://globalinvestmentdaily.com/the-helium-boom-is-about-to-take-off-in-2021/

[61] https://physicstoday.scitation.org/do/10.1063/PT.6.2.20200605a/full/

[62] http://www.phys.ufl.edu/~cryogenics/hecost.htm

[64] https://lbnmedical.com/liquid-helium-in-mri-machine/

[65] https://lbnmedical.com/liquid-helium-in-mri-machine/

[66] https://lbnmedical.com/liquid-helium-in-mri-machine/

[67] https://lbnmedical.com/liquid-helium-in-mri-machine/

[68] https://www.magnetic-resonance.org/ch/21-01.html

[69] https://www.forbes.com/sites/brucelee/2019/05/24/there-is-a-helium-shortage-what-you-need-to-know/?sh=75911fa470b3

[70] https://www.globenewswire.com/en/news-release/2021/04/19/2212376/28124/en/Global-Helium-Market-Report-2021-Market-is-Forecasted-to-Reach-18-18-Billion-in-2025-Growing-at-a-CAGR-of-11-15.html

[71] https://medicalgasresearch.biomedcentral.com/articles/10.1186/2045-9912-3-18

[72] https://sciencing.com/everyday-uses-helium-gas-8041697.html

[73] https://sciencing.com/everyday-uses-helium-gas-8041697.html

[74] https://www.businessinsider.co.za/renergen-cryo-vacc-uses-helium-to-keep-covid-19-vaccines-cold-without-power-2020-12

[75] https://www.frontiersin.org/articles/10.3389/fphy.2020.565422/full

[76] https://www.nytimes.com/2019/05/16/science/helium-shortage-party-city.html

[77] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[78] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[79] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[80] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[81] https://globalhelium.com/about/

[82] https://globalhelium.com/about/

[83] https://globalhelium.com/about/

[84] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[85] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[86] https://www.prnewswire.com/news-releases/global-electronics-manufacturing-services-markets-report-2019-total-electronics-assembly-value-was-1-3-trillion-in-2018-and-will-reach-1-5-trillion-in-2023–300939643.html

[87] https://www.usgs.gov/news/interior-releases-2018-s-final-list-35-minerals-deemed-critical-us-national-security-and

[88] https://lbnmedical.com/liquid-helium-in-mri-machine/

[89] https://www.yahoo.com/now/amazon-google-netflix-fighting-over-230000640.html

[90] https://globalhelium.com/wp-content/uploads/2021/03/Global-Helium-Presentation-Oct-20-V26.pdf

[91] https://www.npr.org/2019/11/01/775554343/the-world-is-constantly-running-out-of-helium-heres-why-it-matters

[92] https://globalhelium.com/global-helium-corp-acquires-over-one-million-acres-in-southern-saskatchewans-helium-fairway/

[93] https://globalhelium.com/global-helium-corp-acquires-over-one-million-acres-in-southern-saskatchewans-helium-fairway/

[94] https://www.bloomberg.com/press-releases/2021-05-13/how-a-helium-shortage-could-put-the-brakes-on-the-tech-boom

[95] https://www.yahoo.com/now/helium-shortage-could-put-brakes-230000450.html

[96] https://www.cnbc.com/2019/06/21/helium-shortage-why-the-worlds-supply-is-drying-up.html

AD REFRENCES:

[1] https://www.globenewswire.com/en/news-release/2021/04/19/2212376/28124/en/Global-Helium-Market-Report-2021-Market-is-Forecasted-to-Reach-18-18-Billion-in-2025-Growing-at-a-CAGR-of-11-15.html

[2] https://www.nap.edu/read/9860/chapter/6#30

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and have been providing quality analysis for professional traders for 38 years.