Sponsored

Potentially the Largest Unknown Lithium Deposit in America Is Trading for Mere Pennies at This Moment

Follow this oil magnate who ditched his $2 billion dollar company

Because he believes this desert plot will be worth far more than oil very soon

Buried underneath the tons and tons of sand could quite possibly be the largest lithium deposit in North America.

A Visionary Who Saw the Massive Lithium Opportunity Writing on the Wall

This legendary resource visionary founded what is now a $2 billion dollar Canadian oil company. He built it from scratch and had planned to dedicate his life to the $75 trillion dollar oil industry. But then, suddenly, in 2016, he literally deserted that booming oil company to focus on this empty desert that I just showed you. They’re currently running the necessary tests to determine how much lithium that’s potentially buried in the sand.Is $1.9 Billion Buried at Their Feet?

They’ve determined if they extracted all the lithium they do know is there, if they sold it right now…they’d generate over $1.9 billion dollars. You’d think there’d be some value in that. Here’s the interesting part… None of that value is reflected in the stock price at all. Take a look. The company this ex-oil tycoon founded to secure lithium is trading for mere pennies on the public stock markets right now. In fact, the stock price has never been lower. It’s trading for 1/172th it’s potential revenue of $1.9 billion. Meaning, this could be the very best time to consider this company for a portfolio willing to invest in a speculative company. Again, the company is still running tests to determine their potential lithium reserve…but the potential is they hold the largest lithium deposit in North America. And one man saw it first. The legendary resource visionary’s name is Michael Kobler.

The company he founded with a team working in 101+ degree desert heat…it’s called American Lithium. The ticker symbol is LIACF.

What’s interesting is not only has this company potentially monopolized the largest lithium deposit in North America…

The legendary resource visionary’s name is Michael Kobler.

The company he founded with a team working in 101+ degree desert heat…it’s called American Lithium. The ticker symbol is LIACF.

What’s interesting is not only has this company potentially monopolized the largest lithium deposit in North America…

The ‘Secret Weapon’ Lithium Technology That Could Be the Future in the US

But they’ve also pioneered one of the newest, most efficient and affordable methods to extract lithium out of the ground ever seen on the planet. Better than China. Better than Argentina. Better than Australia…the largest lithium producer in the world. Better than any lithium mining country anywhere. This innovative method extracts lithium at a lower cost these other countries do. Even better, American Lithium can extract lithium at a 50% faster clip than these other countries too. Faster and cheaper means higher profits in the long run if they can keep it up. As you may know — lithium is in a downtrend at the moment. Prices have been dropping with no end in sight.

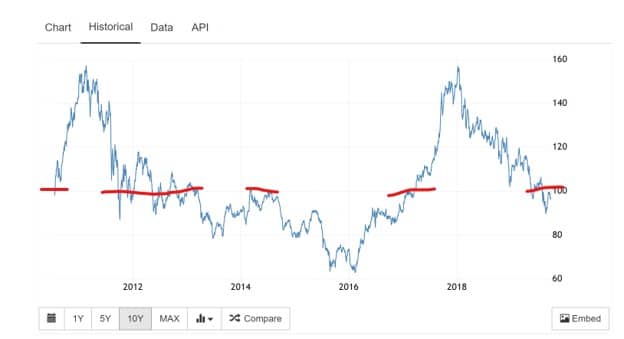

Look, there’s no way to sugarcoat it…lithium prices stink at the moment.

Prices have been dropping with no end in sight.

Look, there’s no way to sugarcoat it…lithium prices stink at the moment.

Why You Should Read About American Lithium Even if You Hate Lithium

That’s why I say it’s worth considering looking at American Lithium for any speculative portfolio at the moment. So, I urge you… Even if you are skeptical about the future of lithium… Even if you were burned by the lithium crash just a year ago… Even if you swore off speculating on any resource mine ever again… Take a few more minutes to see why American Lithium could be different. Take a few more minutes to see why American Lithium could be different. Like I mentioned, they’ve found a way to extract lithium 2X faster…and potentially much cheaper than competitors. All from what could be the largest lithium deposit in North America.The WalMart of Lithium

I like to think of this company as the “WalMart of Lithium.” Once they’re able to ship lithium, they’ll hold the leverage to dictate selling for a lower price if they wish. Much like WalMart buys their products in mass quantities so they can provide lower prices… American Lithium has an opportunity right now to do the same thing. Because if they do indeed sit on the largest lithium mine in North America…plus pulling it out of the ground 2X faster and cheaper than others… It’s like they’re buying lithium in mass quantities and can choose to sell for less. This could then squeeze out competition from others. That puts them in the driver’s seat to potentially dominate the lithium market for years to come if they can achieve this. They’re not there yet. And that’s why their stock has taken a beating for the past year. That’s on top of the beating lithium spot prices have taken. Yet, if American Lithium can indeed become a “WalMart of Lithium”…and that’s a phrase I coined…they could power through this lithium bear market and prosper. Just like during the Great Recession in 2007-2009, when other stocks lost 30-50% in that timeframe… WalMart actually gained 16%.- Kirkland Gold managed to reward shareholders with 3,513% gains from 2015-2019 all while gold was in a stand-still that entire time. Gold is now picking up, but Kirkland was rewarding shareholders even during the down times. Their secret? Low-cost production of gold while also finding more and more gold in their Canadian and Austrailian mines.

- Anglo-American is a platinum company that has handed shareholders gains up to 465% since 2015…and that’s with platinum prices continuing to crater. Their secret? They found and now own a majority of the platinum industry because they mine 38% of the world’s platinum. You can never go broke owning a large slice of the pie.

- If you want to look at a more pitiful drop in resource prices, you could look at uranium. Their spot prices are at their lowest since 2004. Most uranium stocks have sunk or stood frozen. Well, a uranium company called NexGen Energy has handed shareholders up to 543% gains in just two years. Even while uranium wallowed in the mud. NexGen were able to accomplish this, (part of the way) due to having an opportunity at securing ⅕ of all mined uranium from one of their projects. This uranium find would leapfrog NexGen Energy over other large uranium countries.

5 Reasons to Look at American Lithium

Here’s what made me give this company a look despite the turmoil in lithium.- An oil tycoon leaves his now-$2 billion dollar company he founded to speculate on lithium. This is worth a look to study if we’re hitting the bottom soon.

- The Nevada acreage he founded American Lithium on is one completed study away from potentially identifying if they have the largest lithium deposit in North America.

- The stock is trading for as low as it can go. Currently, it hovers around $0.10 – $0.15. There isn’t much capital needed to pick up 100 shares.

- Stocks have proven to grow despite their underlying resources being in bear market…and uncovering the largest deposit in North America could be a catalyst for growth even if lithium stays beaten down.

- Lastly, they’ve developed a unique, more efficient, more affordable way to extract lithium from the ground. This is their secret sauce. Once proven, they could control the price they sell it at. It’s the perfect “WalMart of lithium” position they’ve put themselves in.

American Lithium Overthrowing This ‘Old School’ Method to Extract Lithium

It’s 2X as fast as brining… And it’s potentially more cost effective due to faster processing… Plus it’s also better for the environment. Here’s what they do. American Lithium is able to extract lithium direct from claystones…with less toxins put into the environment. What they’ve found inside their TLC Project site are lithium-rich claystones. Rather than brining and waiting months even years to see if the lithium will be usable… American Lithium can get results in as little as a few days thanks to their new technology extracting lithium from claystone. Here is what a claystone looks like. Their process is fairly simple:

Their process is fairly simple:

- Take the claystones and leach them (adding in sulfuric acid)

- Begin purifying the lithium there to remove iron and aluminum. Involves adding calcium hydroxide

- Purify again

- Crystalize in a low temperature

Their “Secret Weapon” No One Can Steal Even If They Wanted To

And here’s where their secret weapon comes into play. I’m talking besides developing an innovative way to extract lithium. They are in the process of perfecting that. But the real secret weapon is something other companies can’t steal… That patch of Nevada desert Michael Kobler spent three years looking for… It has some of the very best characteristics for extracting lithium from the claystones. From what they told me…they have “the best sedimentary soil for lithium they have ever seen.” The mining, apparently, is so simple as the lithium easily detaches from the clay. It feels as easy as cracking an egg to get the lithium they need as compared to brining where we . Therefore, they can extract at lower energy, lower costs, lower time on the job. Unfortunately, there aren’t many choices for company CEOs needing lithium to except to travel abroad to find their lithium.Companies May Have No Choice But To Turn to American Lithium

American Lithium…with the potential to be sitting on the largest lithium deposit in North America…could be the #1 choice for companies. Competition in the United States for the top spot is thin. The pressure is on as the White House has issued not one…but two Executive Orders that involve lithium. Even if lithium prices don’t turn around, there are many areas of demand to meet. I can say confidently, American Lithium is a company worth considering for any investor portfolio. Their stock price is as low as they’ll ever be…they can’t go any lower. So, any investment in shares will cost very, very little. They are still studying the TLC Project land to determine the magnitude of their deposit. That hasn’t been announced yet. On top of that, they continue to perfect their innovative process to extract lithium in the fastest, most-effective way. That too will take time. Again, with lithium in a down market, many investors will turn away from lithium thinking it is doomed. But, because you read this, you saw:- You discovered a new, innovative way to extract lithium few others are doing

- You discovered what could be the largest lithium deposit in North America

- You discovered why this particular sedimentary soil is a competitive advantage no one can steal

- MOST IMPORTANTLY, you discovered it’s possible for stocks to return large gains even if their underlying asset is in a bear market.

Lee Bellinger / InvestingTrends.com

ADVERTISEMENT DISCLAIMER

This is a paid advertisement and is intended solely for informational and educational purposes. The issuer has provided Promethean Marketing, Inc with a total budget of approximately 4,264,380 USD to cover the costs associated with this advertisement for a period beginning around February 24, 2020 and currently set to end November 1, 2021. Promethean Marketing, Inc has previously managed five hundred seventy one thousand and seven hundred and twenty two thousand dollars. Promethean Marketing, Inc has paid Lee Bellinger 35,000.00 USD out of the total budget to endorse this advertisement and other issuer related advertisements, he also expects to receive subscription revenue as a result of these advertisements. Promethean Marketing, Inc will retain any excess sums after all expenses are paid. InvestingTrends has not been paid to host this advertisement. As a result of this advertisement, InvestingTrends expects to receive additional website visitors, advertising revenue, and email subscriptions. InvestingTrends is owned by Summit Publishing Group, Inc. Promethean Marketing, Inc and Summit Publishing Group, Inc have shared ownership. None of Promethean Marketing, Inc, InvestingTrends, Summit Publishing Group, Inc, or Lee Bellinger owns shares of the company mentioned. Lee Bellinger is solely responsible for the contents of this advertisement.

For further information, InvestingTrends has a Full Disclosure Policy which can be read by clicking here.