Sponsored

Why China's Change to its One-Child Policy Could Triple the Demand for Gold!

- It’s hit peak gains of 718% in a little over a year![1a]

- It may be your best gold play of 2022.

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and has been providing quality analysis for professional traders for 38 years.

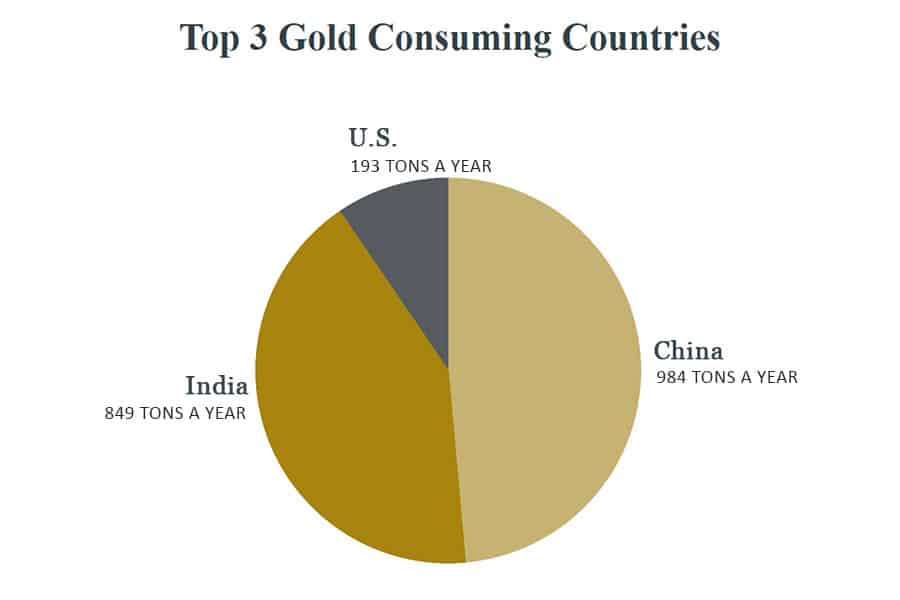

China is gobbling up gold. So is India. Take a look…[1b]

China uses 984 metric tons of gold a year… and needs to import 67% of its gold to meet consumer demand.[2]

India uses 849 metric tons of gold a year… importing 100% of its gold.

The U.S. is a distant third in world consumption of gold… “only” 193 metric tons of gold.

According to the World Gold Council, China is the world’s fastest-growing market for gold.[3]

China’s surging demand is driven by 10 years of rapid growth in middle class affluence.[4] This new, richer middle class believes that not only is gold a sound investment, but owning gold brings good luck.

While in the U.S. we think of gold as more of an investment, things are different in Asia. In China, its tradition to give gifts of gold to new-born babies. And on May 31st, China rescinded its decades-old one-child policy and now says married couples can have 3 children. This change in policy could bring about a surge in demand for gold.

And India is a very close second… driven by “robust retail demand” in jewelry.

Demand for gold in both these countries took a dive in 2020 due to COVID-19. But 2021 has seen a huge surge rebounding to pre-pandemic levels.[5] China’s demand for gold jewelry has nearly doubled.

Many analysts predict that China and India’s insatiable demand for gold could be the trigger for the next surge in gold prices.

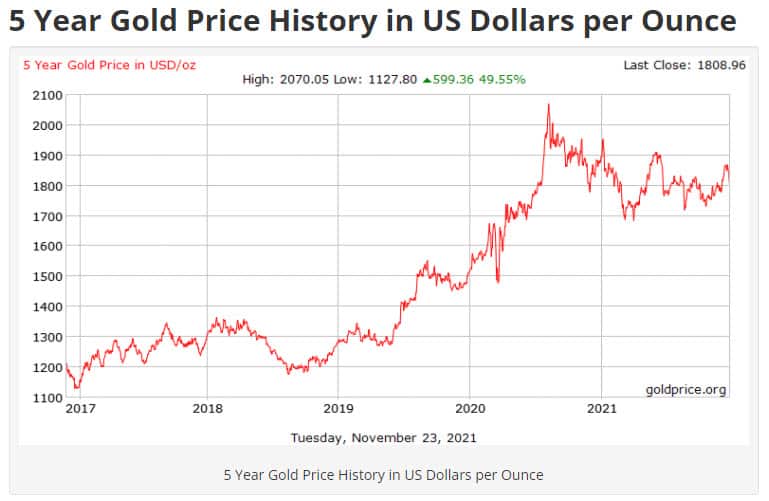

Gold prices are up in the past 2 years.[6]

Goldhub says, “China’s rising birth rates is good news for Chinese gold retailers.[7]

Wells Fargo predicts we could be headed for a new “bull super-cycle.”[8]

Billionaire Investor, John Paulson who made $20 billion during the housing market collapse of a decade ago, says…

“Gold is primed for its moment.”[9]

To take advantage of China and India’s soaring demand for gold, you would do well to look at a “backdoor” play in gold.

Instead of buying gold bars and gold coins, you could consider going directly to the very source of gold — gold mining companies such as LEOCOR GOLD Inc. (LECRF).*

Leocor Gold (LECRF) is a gold resource and exploration company focused on undervalued and underexplored gold discovery projects. [12]

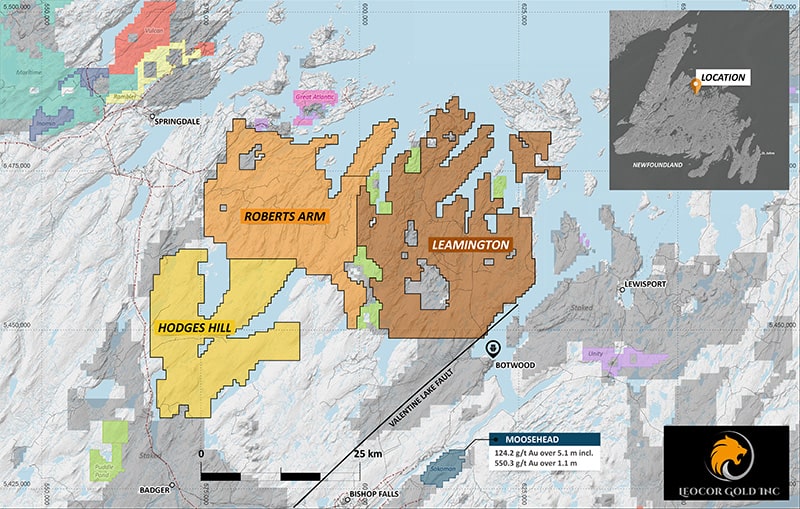

Recently, Leocor Gold (LECRF) teamed up with one of the best prospectors in the business and is currently exploring a massive 356,000 acres in the middle of gold-rich Newfoundland.[13]

In a moment, I’ll share with you the amazing prospects of Leocor Gold (LECRF)… and why now may be the perfect time to consider this potentially huge upside investment.

But first, let me introduce myself. My name is James Hyerczyk.*

I’m a technical analyst, trader, market researcher, and educator based in Florida. I started my career nearly 40 years ago as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange.

Since then, I’ve been providing quality economic and market analysis to professional traders all across the country. That’s why when inflation and out-of-control government spending is running rampant, I urged traders to get into gold.

I think it’s safe to say that right now we are living in a time of great geopolitical tensions around the world… from Afghanistan and the fear of rising terrorist groups… to Russia and China’s escalating superpower capabilities … to the swift return of inflation – at its highest rate in 30 years![10a]

And for decades, gold has been the great protector against inflation and uncertainty.

It’s why I’m urging folks to consider investing a percentage of their assets in gold. It’s important to hold some assets with potentially lower risk, such as gold, in any economic or political environment.

For decades smart investors have flocked to gold to protect and grow their wealth.

It’s why Barron’s calls gold “a safe haven asset”

Uncertainty often drives the price of gold. During the COVID Crisis, gold skyrocketed to its highest price ever. It reached $2,067.15 an ounce on August 7, 2020.

But regardless of events, gold has been enjoying a strong bull run in the past 5 years. Its price is up an impressive 50%.

And with the world’s two largest countries seeing a resurgence in gold demand, now may be the perfect time to consider investing in a gold exploration and mining company such as Leocor Gold (LECRF).

The stock has reached peak gains of 718% in just over a year…and the stock price is up 17% in the past 7 days alone.[10b]

And Leocor Gold (LECRF) just announced a huge addition to their exploration team that gives you an unfair advantage over other gold investors. More about that in a moment. But first, let me ask you this important question.

Even with China and India’s Ravenous Demand for Gold…

Is Buying Gold the Right Play Now… Or Is There a Better Gold Investment?

It’s true some economists are predicting gold could continue to climb – soaring to $3,000 or $5,000 an ounce.[18]

We’ve heard these kinds of predictions before. And at nearly $1,800 an ounce[11], it could be more difficult to see fast gains in gold.*

But what if I told you that I have a “backdoor” gold play that returned an impressive 180% between 2015 and 2020 – more than doubling the gains of gold* — and it might just be set to do it again. And in addition to outperforming gold… returns on this backdoor gold play clobbered just about everything else from 2015 to 2020.

The Backdoor Gold Move That Could Beat Them All — Leocor Gold (LECRF)

Now, you can rush out and buy actual gold bullion or gold coins and hide them in a secret room in the basement or pay through the nose for secure storage.

Or, you can enjoy the lucrative rewards of gold investing – without the hassle –by going in though the back door and investing in gold mining stocks.

These are the companies that hunt for gold and dig it out of the ground. While gold mining stocks are no doubt risky, they have been on a tear.

Imagine a $25,000 investment in gold in 2016 and you’d have $70,000 by December of 2021. If you’d put that same money into an S&P 500 index fund you could have a little over $52,000.* Not bad.

But why settle? In the past five years investors in some gold mining stocks have seen some mouth-watering profits. For instance[19]:

- Gold Fields Limited (GFI) rose from 3.98 in early 2016 to $10.88 today[20] a gain of 173%.

- Newmont Corp (NEM), the world’s largest gold mining company, jumped from $26.62 a share in early 2016 to $55.06 today[21] – a gain of 106%.

- Kinross Gold Corp (KGC) went from just $3.48 a share five years ago to $6.36 today[22] – a gain of 82% .

- Polyus PAO (OPYGY) went from $28.25 in 2016 to $99.31 today[23]— a gain of 252%.

I’ve just shown you the gains of five of the biggest gold mining companies in the world. As you can see, they’re impressive and investors have done well.*

But you can do better.

Because I want to share with you what I believe to be a better, faster way to invest in gold mining for big potential life-changing gains.

If you’re willing to take on more risk for more reward then I urge you to consider gold stocks known as “junior gold exploration” companies.*

These are much smaller companies who haven’t begun drilling for gold yet. Instead they’re exploring for large gold deposits. They’re actively looking and testing for new potential mine sights.

They revel in the thrill of the hunt – finding the gold for miners to mine.

One of these junior gold companies that is apparently hitting the attention of savvy gold investors is Leocor Gold (LECRF). Their stock launched in June 2019 and within 14 months had surged a whopping 718%![24][25]

Reports are that Leocor (LECRF) has recently hit what many are claiming to be “the sweet spot” in gold discovery.[26]

If this potential discovery pans out, (no pun intended) investors could double their money very quickly… and possibly triple, or even quadruple their money. It’s happened before.*

As I said before, investing in junior exploration companies has more risk, but Leocor Gold (LECRF) may potentially be the best way for interested investors to jump on this exciting backdoor play in gold.

Let me show you.

Making the Most of Golden Times

In Newfoundland, a mini gold-rush is underway… thanks to the surging price of gold.

In fact, mining for gold is at an all-time high in central Newfoundland.[27]

According to Resource World Magazine — the Bible for gold miners’ and their investors’…

And geologist and Memorial University professor, Derek Wilton, proclaims… “The rocks are good! You can’t have gold deposits without having the right rocks. And the rocks in central Newfoundland… have the right geology.”[29] More than a dozen gold mining companies are actively exploring and mining in Newfoundland.[30] And many of their stock prices are soaring.

Perhaps you’ve heard of a few…

Anaconda Mining Inc. currently mines over 16,000 ounces of gold a year[31] … worth about $28 million.[32] Stock price has skyrocketed a staggering 425%.

Initial studies show that Maritime could generate $110.5 million when they begin production by 2022.[33] Its stock price has more than tripled—gaining 250%![34]

Marathon plans to put its Valentine Gold Project into production by 2023.

Its share price has skyrocketed from 20 cents a share to $1.98.[35] That’s nearly a 1,000% increase – a rare 10-bagger! Imagine every $10,000 invested in 2016 is worth $100,000 today.*

But one junior gold mining company, Leocor Gold (LECRF) has just snagged 556 square miles (or 356,000 acres) smack dab in the midst of gold-rich Newfoundland.[36]

The CEO of Leocor Gold (LECRF), Alex Klenman, raved, “This project ground has had limited exploration to date, and we feel the geology, location, historical and recent results all indicate this is a highly prospective, prime target for an aggressive, large scale gold exploration program.”[37]

Not only that, but this forward-thinking company has partnered with a renowned gold prospector as he is known by Popular Mechanics.

Mining News North refers to this gold whiz kid as the prospector with the “Midas Touch.”[38]

And this “superstar prospector” as Natural Resource Magazine calls him[39] is heading up gold exploration for Leocor Gold Inc. (LECRF) in one of the largest – and potentially richest – gold source in all of Newfoundland.

If you’re hunting for the perfect gold play to grow and protect your wealth in this time of global inflation and the unending trillion-dollar deficits, then you may want to consider Leocor Gold (LECRF).*

CEO Alex Klenman reports…

“The World’s Greatest Gold Prospector”

In the world of Canadian gold exploration and mining, Shawn Ryan is a legend. He may be the most famous gold prospector in North America, perhaps the whole world.[42]

He almost singlehandedly kicked off a massive second gold rush in the Yukon territories of northwest Canada in 2009. Gold deposits in the Yukon are estimated in millions of gold ounces, which would be worth billions of dollars at today’s gold prices.[43]

The New York Times christened Ryan the “king of the New Yukon Gold Rush.”[44]

Yukon gold mining companies affiliated with Shawn Ryan have done incredibly well – and so have their investors. For instance:

When Ryan inked a deal with Agnico Eagle Mines, a senior Canadian gold mining company back in 2016, Agnico’s stock stood at $28 a share. Today it’s close to $70 – a gain of 150%![45]

And now Ryan has turned his Midas touch to eastern Canada, specifically Newfoundland.

As he says, “Once I started doing my research in there [Newfoundland], I realized there was a lot of potential.”[46]

What makes Ryan such a prolific finder of gold?

Over the past 20 years he has developed an extensive soil sampling program using proprietary machines he invented.[47] He’s known to take thousands of soil samples to analyze the metallic elements present, such as gold.

Ryan is famous for his technical analysis gathered by sophisticated drones he invented and remote control drills he tweaked. He uses satellites to collect data. He’s the only prospector to throw sophisticated cameras down drill holes seeing what no one else sees. His 3D ground maps are forty times more detailed than Google Earth.[48]

He has a nose for gold and he is already a millionaire several times over.[49]

And now, Leocor (LECRF) and Shawn Ryan are partnering to explore 556 square miles of gold-rich Newfoundland.[50] Ryan is Leocor’s Technical Adviser overseeing the company’s exploration efforts over the coming months using his proprietary leading-edge methods.

Shawn Ryan is equally enthused, “Newfoundland is getting ready to go through one the most aggressive gold exploration phases. I’m pleased to work with the Leocor team. With the compilation and interpretation of new data, Leocor will be the first company to directly target and evaluate these new areas.[52]

When news began trickling out at the end of April that Leocor (LECRF) and Ryan would be teaming up to explore the Western Exploit District, shares have quickly doubled![53]

And when soil sample results from Western Exploit start coming in over the next few months, investors could potentially see another doubling, tripling, quadrupling… even 10X or more… on their investment.

CEO Alex put it bluntly, “The size, scale and location of our projects are conducive to attracting significant institutional money.”[54]*

Once institutional investors start pouring in, the price could skyrocket. As an individual investor, I believe the time is NOW to consider Leocor Gold (LECRF) while it flies under the big investors radar… while the price is under $1.00 a share as of December 2021.*

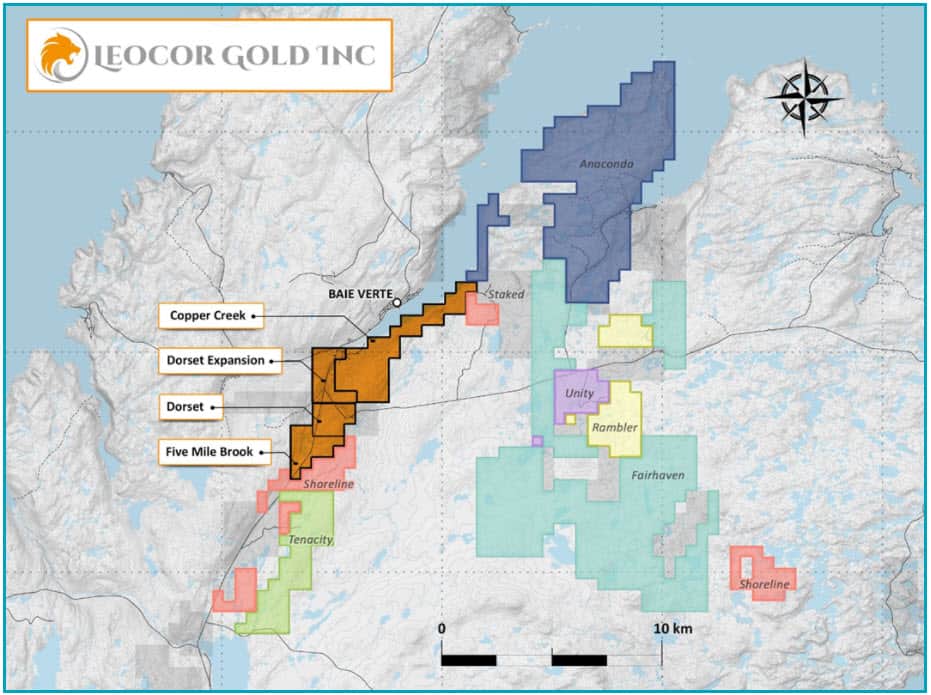

In addition to the Western Elite District, Leocor (LECRF) has snapped up properties all over Newfoundland with abundant historical data of multiple gold occurrences.[55]

The properties are located just south of Anaconda and north of Marathon where nearly 6 million ounces of gold are believed to exist on those properties.[56] And Leocor (LECRF) could well be at the heart of more rich gold deposits.

Leocor Gold’s (LECRF) Impressive Portfolio of Properties

Leocor’s flagship exploration project is the Dorset Gold Project.[57]

This property lies just north of Marathon’s enormous new gold findings in the Baie Verte peninsula in Newfoundland.

It’s believed that the same gold trend lines fueling both Marathon and Anaconda’s gold riches also run through Leocor’s Dorset Gold.[58]

In August of 2020, Leocor Gold purchased two new mining sites in Copper Creek and Five Mile Brook.[59] As CEO Alex Klenman shares…

“The Baie Verte area is one of the most prolific gold mining districts in Canada. And we’ve bridged the gap between Marathon in the South and Anaconda in the North. Exploration results to date are impressive, and show there is high grade gold in the system.”[60]

Along with this purchase in August, Leocor (LECRF) also hit peak gains of 718% in the same month.

Then in December 2020,[61] Leocor purchased the Startrek Property covering 27 square miles[62] just east of Gander. More than 50 gold occurrences have been discovered at Startrek already. Test samplings have indicated the presence of high-grade gold.[63]

CEO Alex Klenman is excited to report, “With our most recent acquisition, Leocor Gold now owns the largest contiguous land package in Newfoundland for a junior mining company. Our probability of meaningful discovery on an impactful scale is significantly raised.”[65]

You may certainly want to consider Leocor (LECRF) for your portfolio now – before any discoveries are made and mining operations begin.* Because if and when that happens, its stock price may soar as Leocor (LECRF) moves from the exploratory phase and grows closer to production.

Simply go to www.leocorgold.com to get on their mailing lists to be among the first to hear of any new and exciting announcements.

Leocor Properties 2022[64]

590 Square Miles in Gold-Rich Newfoundland

2018 – Dorset Gold Flagship Property 2.3 square miles

July 2020 – Copper Creek and Five Mile Brook 5.3 square miles

December 2020 – StartTrek 26.4 square miles

April 2021 — Hodges Hill, Leamington and Robert’s Arm 556 square miles

[51] From Atlantic Project portfolio, converted hectares into square miles./sup>

A New Gold Boom

Everything is falling into place for Newfoundland’s own version of the gold rush And junior miner exploration companies, like Leocor Gold (LECRF) are killing it right now!

Three triggers are fueling this New Gold Boom.[66]

- The surging price of gold on the international markets, especially in China and India…

- The promising geology reports about Newfoundland.[67]

- The provincial government’s welcoming role in any current or future mining development. Since February 2017, the government has pumped upwards of $2.3 billion in capital investments to mining companies working in the area.[68]

Junior miners like Leocor (LECRF) may hold the key to new supplies in gold as they continue to search for new gold deposits and announce new gold finds.

I do want to tell you that investing in juniors can be more speculative and volatile.* With that said, junior miners can also mean big returns… such as Marathon’s 1,000% gains[69] and Leocor’s (LECRF) peak gains of 718% in just 14 months.[70]

China’s New Child Policy May Triple Demand for Gold

China recently rescinded their One-Child Policy. Now, families may have 3 children. It’s customary in China to give new-born babies gifts of gold for good luck. This change could triple the demand for gold in China – already the world’s largest consumer of gold.

Check out this golden opportunity with Leocor Gold today!

Now may be the perfect time to invest in junior gold miners. And if you decide to do so, I hope you will consider Leocor Gold (LECRF).

Simply go their website, www.leocorgold.com, and request to be placed on their mailing list. You’ll find additional and helpful information here.

Or share this report with your broker and consider buying shares in Leocor (LECRF). It’s that easy.

10 Golden Reasons Why LEOCOR GOLD (LECRF) May Be Your Best and Most Profitable Gold Play

Leocor Gold, Inc. (LECRF) is selling for 30 cents a share as of January 2022 – and could be a very attractive investment for folks wanting to take advantage of a potential surge in gold prices due to escalating demand in China and India… or for folks concerned about climbing inflationary pressures… or for any investor looking for a more speculative investment with the potential to make strong gains in a shorter amount of time.

No guarantees, of course. But for the reasons I have outlined in this report, Leocor is worth your consideration. Let’s recap why.

- Demand for gold is surging in China and India. With China now allowing 3 children per family instead of one, cultural traditions of giving gold to newborns could see China gold demand triple. China’s demand for gold is currently 5 times and India’s demand for gold is currently 4 times greater than the U.S.

- Inflation is skyrocketing – the highest rate in 30 years.[12] Investors always flock to gold in inflationary times.

- As a result, gold prices are soaring and demand for gold is increasing. Gold experts believe we could be in the midst of a significant gold bull run and predict gold could climb to $3,000 to $5,000 an ounce.*

- I believe gold is one of the best assets you can invest in times of volatility and uncertainty – hitting $2,067 an ounce in the midst of the COVID pandemic in August 2020.[71]

- But instead of buying gold, the smart money is heading for a backdoor move into gold. They’re rushing to gold mining stocks, which have more than doubled the gains of gold over the past 5 years.[72]

- Leocor Gold (LECRF) has teamed with the renowned prospector Shawn Ryan to start progressive exploration programs in the Western Exploit District in the heart of Newfoundland. This area covers numerous geological corridors favorable to gold mineralization.[76]

- Leocor’s preliminary modelling indicates its project ground is highly prospective for gold deposition on a number of their properties. Aggressive exploration and testing continues on all their properties.[77]

- Most junior gold miner stocks are penny stocks and Leocor Gold (LECRF) is no exception. At the current price of gold you could buy one tiny ounce of gold[78], or you could buy 5,258 shares of Leocor Gold (LECRF).[79] It's the easy way to jump into gold to protect and grow your money during inflationary times. It's pretty easy to trade too. Leocor Gold (LECRF) trades on the American OTCQB making it easier for US investors to buy and trade Leocor's stock.[80]

Now is a Good Time to Act on This Promising Opportunity

While we don’t know when it will happen, results from Leocor’s 2021 exploration could be announced very soon. Newfoundland is already on gold investors’ radar screens and gold discoveries here are creeping more and more into the news!

Any report of a new gold discovery (or other promising news) could send Leocor (LECRF) shares skyrocketing at a moment’s notice. Just like its share price doubling on news of their partnership with Shawn Ryan on the Western Exploit District.

Here’s how to learn more about Leocor Gold’s (LECRF) prospects for investors.

Simply go to www.leocorgold.com. While on site, be sure to register your email address for future announcements from the company, particularly those that report ongoing exploration results. Click on “Get News Alerts!” at the top of the home page and sign up.

Look Into and Consider Leocor Gold (LECRF)

If you wish to be among the early bird big winners in Leocor’s golden opportunity, then I suggest you show this report to your investment advisor or broker right away.

Leocor (LECRF) is a junior gold mining company. It has the potential for higher rewards than other gold opportunities, but it also comes with higher risk. And past performance is no guarantee of future results.

So never invest more than you can afford to lose and do not chase losses. And to minimize risk, any investment you may make in Leocor (LECRF) should be part of a wider asset allocation strategy in your portfolio.*

But with that strong caution to you, I believe my analysis of the potentially huge reward of investing in Leocor Gold Inc. (LECRF) is a good one.

Wishing you success in all your investments.

James Hyerczyk

Investingtrends.com

* See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, atypical results, and more.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1a] 11 cents on Jun 21, 2019. On 8/5/20 LEOCOR hit 90 cents 718% GAIN.

[2] China imports two-thirds of its gold.

[3] https://www.gold.org/about-gold/gold-demand/geographical-diversity/china

[4] https://www.gold.org/goldhub/research/chinas-gold-market-progress-and-prospects

[5] https://schiffgold.com/key-gold-news/gold-demand-continues-to-surge-in-china-and-india/

[11] https://dailytradereport.com/wp-content/uploads/2021/11/GoldPrice-Nov-2021.jpg

[13] https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[14] https://www.barrons.com/articles/future-returns-why-gold-is-still-a-safe-haven-asset-01584457259

[15] https://dailywealth.com/articles/what-the-1970s-tell-us-about-todays-gold-boom/

[16] https://dailywealth.com/articles/what-the-1970s-tell-us-about-todays-gold-boom/

[17] https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/highest-price-for-gold/#:~:text=Highest%20price%20for%20gold%3A%20Historical,%2C%20on%20August%207%2C%202020.

[18] https://nationwidecoins.com/gold-predictions-what-will-the-price-be-over-the-next-5-years/

[19] Companies chosen from 10 Top Gold Mining Companies, https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/top-gold-mining-companies/

[20] $10.88 as of November 23, 2021 https://finance.yahoo.com/quote/GFI/history?p=GFI

[21] $55.06 as of November 23, 2021 https://finance.yahoo.com/quote/NEM?p=NEM&.tsrc=fin-srch

[22] $6.36 as of November 23, 2021 https://finance.yahoo.com/quote/KGC?p=KGC&.tsrc=fin-srch

[23] $99.31 as of November 23, 2021 https://finance.yahoo.com/quote/OPYGY?p=OPYGY&.tsrc=fin-srch

[24] 11 cents on Jun 21, 2019. On 8/5/20 LEOCOR hit 90 cents 718% GAIN. It’s currently at 37 cents as of November 23, 2021

[25] https://leocorgold.com/investors/

[26] https://leocorgold.com/about/

[27] https://www.theguardian.pe.ca/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[28] https://resourceworld.com/central-newfoundland-gold-belt-becoming-major-gold-camp/

[29] https://www.theguardian.pe.ca/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[30] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[31] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[32] https://www.google.com/search?q=price+of+gold+today+per+ounce&rlz=1C1CHBF_enUS759US759&oq=price+of+gold+today&aqs=chrome.1.69i57j0l9.4978j0j15&sourceid=chrome&ie=UTF-8

[33] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[34] https://www.google.com/search?q=maritime+mining+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01Cmg3KoPPNTXYAOS9sBgGqcGHxDQ%3A1617800817146&ei=ca5tYPWkCNC7ggelgojoAw&oq=maratime+mining+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADIGCAAQDRAeOgcIABBHELADOgcIABCwAxBDOgYIABAHEB46CAgAEAgQBxAeOgUIABDEAjoKCAAQCBAHEAoQHjoHCCMQsAIQJzoECAAQDToFCAAQhgM6CggAEAgQDRAKEB5Q8Il9WOyTfWCvo31oAnACeACAAdkBiAGHCJIBBTQuNC4xmAEAoAEBqgEHZ3dzLXdpesgBCsABAQ&sclient=gws-wiz

[35] https://www.google.com/search?q=marathon+mining+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01llVBYkHrEE-wDQwXMLe0yhrNKHw%3A1617800541438&ei=Xa1tYIaKGoyzggeQ1bPYBA&oq=marathon+mining+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADICCAAyBggAEAcQHjICCAAyBQgAEIYDOgcIABBHELADOggIABAIEAcQHjoFCAAQxAI6CggAEAgQBxAKEB46BAgAEA1Q-r4QWPPNEGD83hBoAXACeACAAd4BiAHwB5IBBTYuMi4xmAEAoAEBqgEHZ3dzLXdpesgBCMABAQ&sclient=gws-wiz

[36] https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[37] https://leocorgold.com/leocor-gold-signs-definitive-agreement-to-acquire-district-scale-exploration-projects-in-newfoundland/

[38] https://www.miningnewsnorth.com/story/2018/11/02/news/white-gold-fever-grips-explorer-in-2018/5474.html

[39] https://www.naturalresourcesmagazine.net/article/ryans-fancy/

[40] https://leocorgold.com/leocor-gold-updates-exploration-at-the-dorset-gold-project-baie-verte-newfoundland/,

[41] Phone interview directly with Leocor

[42] https://www.popularmechanics.com/adventure/outdoors/a20066497/shawn-ryan-ground-truth-gold-rush/

[43] https://www.popularmechanics.com/adventure/outdoors/a20066497/shawn-ryan-ground-truth-gold-rush/

[44] https://www.nytimes.com/2011/05/15/magazine/mag-15Gold-t.html

[45] https://www.naturalresourcesmagazine.net/article/ryans-fancy/

[46] https://www.naturalresourcesmagazine.net/article/ryans-fancy/

[47] https://www.popularmechanics.com/adventure/outdoors/a20066497/shawn-ryan-ground-truth-gold-rush/

[48] https://www.popularmechanics.com/adventure/outdoors/a20066497/shawn-ryan-ground-truth-gold-rush/

[49] https://www.popularmechanics.com/adventure/outdoors/a20066497/shawn-ryan-ground-truth-gold-rush/

[50] https://leocorgold.com/about/

[51] May 2021 phone interview directly with Leocor

[52] https://leocorgold.com/leocor-gold-signs-definitive-agreement-to-acquire-district-scale-exploration-projects-in-newfoundland/

[53] On April 29th Leocor was 40 cents. On June 7th it is nearly 80 cents. https://ca.finance.yahoo.com/quote/LECR.CN/

[54] May 2021 Phone interview with Leocor

[55] https://leocorgold.com/investors/

[56] https://thedeepdive.ca/newfoundland-an-unexpected-gold-exploration-destination/

[57] https://leocorgold.com/projects/baie-verte-district/

[58] https://leocorgold.com/projects/baie-verte-district/

[59] https://leocorgold.com/leocor-gold-expands-newfoundland-holdings-acquiring-copper-creek-and-five-mile-brook-gold-projects/

[60] From phone interview directly with Leocor.

[61] https://www.thenewswire.com/press-releases/1L7OFRlV1-leocor-gold-enters-into-definitive-agreement-to-acquire-hare-bay-resources-corp.html

[62] 7,000 hectares converts to 27 square miles.

[63] https://sec.report/otc/financial-report/275919

[64] From Atlantic Project portfolio, converted hectares into square miles. https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[65] Phone interview directly with Leocor

[66] https://www.thetelegram.com/business/local-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[67] https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[68] https://www.saltwire.com/newfoundland-labrador/business/local-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[69] https://www.google.com/search?q=marathon+mining+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01llVBYkHrEE-

[70] see footnote 28

[71] https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/highest-price-for-gold/#:~:text=Highest%20price%20for%20gold%3A%20Historical,%2C%20on%20August%207%2C%202020.

[72] See bar graph “Gold mining stocks outshine the market”.

[73] https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[74] https://www.saltwire.com/prince-edward-island/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[75] https://www.gov.nl.ca/releases/2020/nr/0608n02/

[76] https://mk0leocorgoldin3sn12.kinstacdn.com/wp-content/uploads/2020/09/Leocor-Presentation-V15-May-04.pdf

[77] Phone interview directly with Leocor

[78] Price of gold on November 23 is $1,788 dollars an ounce. https://finance.yahoo.com/quote/GC=F?p=GC=F&.tsrc=fin-srch

[79] Leocor is trading at 34 cents on November 23

[80] https://sec.report/otc/financial-report/275919 and quote reworked from press release… https://leocorgold.com/leocor-gold-upgrades-us-listing-to-otcqb/

Ad Endnote References:

What Can Be Done About Deutsche Bank’s “The Inflation Time Bomb?” – https://www.cnbc.com/2021/06/07/deutsche-bank-warns-of-global-time-bomb-coming-due-to-rising-inflation.html

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_nus_dpg&f=m

https://www.theusdebtclock.com/

https://www.cnn.com/2022/02/01/economy/national-debt-30-trillion/index.html

https://goldalliance.com/blog/buffett-invests-in-goldsay-what/