Sponsored

Carbon-Free 2035

Lithium Revolution to Re-Ignite with Explosive Outcomes!

You could make a fortune from new lithium mining operations!

Now is the time to get in front of this!

By James HyerczykUntil recently only a handful of countries had made the “carbon-free” declaration. Now the United State joins virtually every major country in the world fast-tracking the “carbon free” pledge.

President Biden’s new energy plan calls for 100% clean electricity and has pledged to eliminate carbon emissions from the electric sector by 2035. This aggressive energy goal can only be achieved by electrifying transportation and increasing the supply of electric vehicles.

And this means just one thing. Lithium batteries – batteries that power electric vehicles (EVs)– will fuel our future. Demand for this soft, silvery-white metal will fly off the charts … soaring to a level many never dreamed possible just a few years ago.

This increased demand for lithium-ion batteries is also due to the skyrocketing growth of high- tech consumer electronics. In addition, the lithium-ion battery also provides a huge energy storage capacity, available to use when needed. This creates new possibilities for storing energy from wind, tidal and geothermal sources.

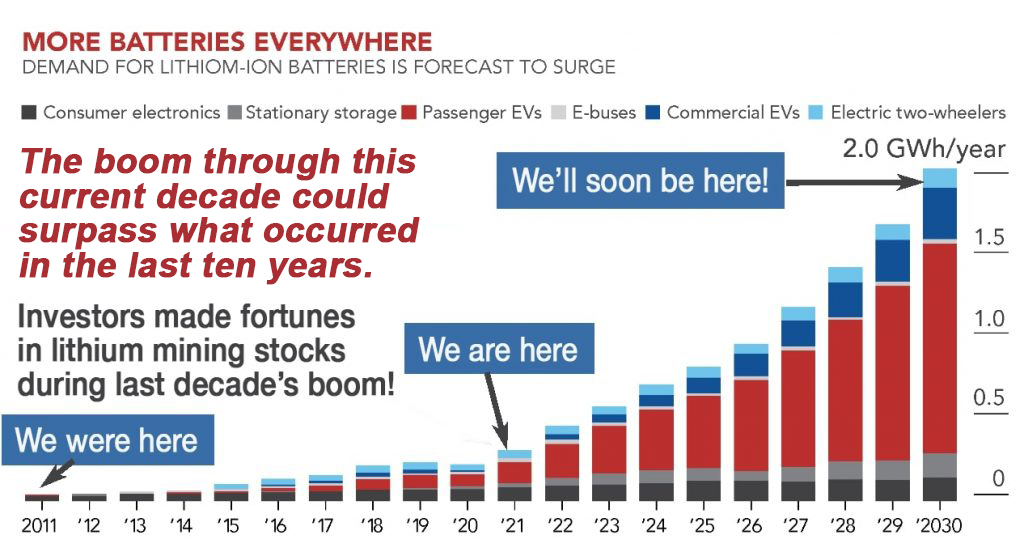

This single chart below says it all.

From 2011 through 2020, the lithium boom triggered explosive gains in lithium mining stocks. Many investors who grabbed early positions in lithium exploration and mining companies saw double and triple-digit returns on their investments. This chart suggests that despite those prior stunning gains, this boom is just getting started. Demand over the last decade compared to the next suggests that staggering new growth can be anticipated for investors who act now to grab entry-level positions.

From 2011 through 2020, the lithium boom triggered explosive gains in lithium mining stocks. Many investors who grabbed early positions in lithium exploration and mining companies saw double and triple-digit returns on their investments. This chart suggests that despite those prior stunning gains, this boom is just getting started. Demand over the last decade compared to the next suggests that staggering new growth can be anticipated for investors who act now to grab entry-level positions.

Similar to the oil boom in the early 20th century, lithium now appears to be the new “fuel” of this century.

Until recently, the pace of this growth was unanticipated, expected to reach its height around 2050. Now it’s on track for 2030.

On January 28, General Motors said it would phase out petroleum-powered cars and trucks and only sell vehicles that have zero emissions by 2035.[1]

And Amazon, the world’s largest retailer and delivery giant, is working toward using 100% renewable energy by 2030 and has placed a big order for electric vans, even for its Prime one-day shipping service.[2]

Who knew?

Analysts yawned at the thought of a lithium supply crisis. But, they were wrong. Now those same analysts are scrambling to update their lithium supply projections. At the same time, industry is scrambling to secure reliable new sources of lithium they’ll depend upon in the decades ahead!

Europe: Ground zero for the coming lithium supply crisis!

You may have seen in the news that lithium battery manufacturing in Europe is exploding. Soaring demand for utility-scale wind and solar backup systems along with accelerated growth of electric vehicles are driving billions of dollars into EU battery manufacturing.

On the heels of President Biden’s announcement, the United States could soon face its own supply challenges. But first, let’s focus on what’s happening in Europe.

Sponsored

European Battery Boom?

United Lithium (ULTHF) is fighting back against China’s stranglehold on lithium. Early geologist findings project that ULTHF could become one of the top lithium suppliers for all of Europe!

Europe is going to need a massive increase in lithium battery production to meet newly updated projections.

Lithium battery production capacity is already climbing ahead of last decade’s forecasts. Investments are pouring into Europe in anticipation of future demand. South Korea based SK Innovation committed $2.3 billion to build Europe’s newest and largest battery manufacturing plant in Hungary, their third in the country.[3]

This is just the start to what appears to be the birth of the European lithium battery industry. And it’s a strategic necessity.

That means companies like United Lithium (ULTHF) that may be able to provide the metal of the future are at the forefront of tremendous demand for domestic supply.

Recent reports suggest that the #1 country of origin for lithium batteries is South Korea.[4] But it’s not clear if South Korean manufacturers can secure the enormous new lithium supplies they’ll need for European battery production.

This may be a serious problem. The data published late last year from the Institute for Energy Research states:

In 2019, Chinese chemical companies accounted for 80 percent of the world’s total output of raw materials for advanced batteries. China controls the processing of pretty much all the critical minerals–rare earth, lithium, cobalt, and graphite. Of the 136 lithium-ion battery plants in the pipeline to 2029, 101 are based in China.[5]

SK Innovation’s expansion into Europe speaks volumes to a lithium supply crisis. After all, China’s strategic objective is to become the world leader in the production of electric vehicles. (More about that later in this report.) And China has no long-term interest in supplying any global competition. All this puts EU automakers up against a wall.

Europe Must Break the Asian Stranglehold on Their Lithium Supply

Across the continent, the EU countries are increasing their commitments toward greener economies. A green economy promotes both sustainability and economic growth. Of course, that includes a complete transition to electric powered vehicles.

Every major EU auto manufacturer has now committed to all-electric vehicle production within a decade. And governments are driving that change. Germany, for example, has outlawed gas and diesel powered new vehicles after 2030. Similar laws have been passed in France, all of Britain, Norway and Netherlands, with other countries in line.[6]

On top of transportation changes, European countries are rapidly transitioning to wind and solar energy, creating enormous new demand for backup storage enabled by lithium battery storage technology. Germany leads the way toward renewable energy production.

On January 25, 2021 Forbes reported:

“Last year, for the first time, renewables generated more electricity than fossil fuels across the EU, spurred on by new solar and wind power projects.”

But there’s a catch. The report also notes (emphasis added):

“…the energy transition is still taking place too slowly to achieve the EU’s target of 55% greenhouse gas reductions by 2030, and consequently carbon neutrality by 2050.”

“Europe will need to add 100 terawatt hours of renewable generation every year to achieve its 2030 target—almost twice as much each year as the amount added in 2020.”

That’s an Achille’s heel in the EU’s significant expansion of utility scale batteries.

This all raises the question … Where will all these battery production facilities secure new lithium supplies? China appears to control over 80% of the world’s lithium resources and production. Do companies like SK Innovation know something most others don’t?

Starting to see why we are looking at opportunities like United Lithium (ULTHF)?

The “inside” story that’s launching a multi-billion European battery manufacturing boom

“Europe is aggressively moving to establish a lithium-ion battery (LIB) industry. Despite the chasm separating European companies from the leading industry incumbents, there are strong grounds for European players to establish themselves in the sector. To be successful, however, they must consider five strategic levers – and act now.”[7]

-Oliver Wyman in Perspectives On Manufacturing Industries Vol. 14

In his report, Mr. Wyman focuses on this one key strategic lever (emphasis added):

“Firms must build strong relationships to ensure access to resources necessary for scaling production and controlling material costs. For this, they will need to cooperate with miners and processors to mitigate supply-chain risk.”

So, European battery manufacturers must cooperate with China? Really? Nobody in their right mind should expect this industry to continue in its current trajectory while dependent on China and their sense of fair play!

Here’s what is being overlooked…and why SK Innovation (and other companies) have committed billions to launching European battery manufacturing.

Eyes move to Sweden.

What could be among the biggest and most valuable of undeveloped European lithium resources has been located near the east coast of Sweden.

United Lithium (ULTHF), got its start with lithium exploration in Thunder Bay, Ontario on the Barbara Lake Lithium Property.

The newly acquired Bergby Lithium Project, located on the coast in central Sweden, is United Lithium’s newest priority for lithium exploration and development.

Early assessment of Bergby lithium shows its potential to become one of the top lithium energy supply sources in Europe. What geologists have discovered at Bergby is stunning…and it’s all reported in detail in this report.

Sponsored

Biden’s Carbon Free Plans Could Be Like Rocket Fuel For United Lithium…

All electric by 2035 means the world is going to need A LOT more lithium. United Lithium’s stunning initial findings coupled with the push for more electric everything could be a recipe for success. Do your homework NOW on the company that could deliver on the world’s increased demand for lithium.

Click Here to Find Out About United Lithium (ULTHF) Before Its Too Late

“Historic mapping and sampling of the Bergby site located an extensive lithium-mineralized surface boulder field.”

Just skimming the surface, geologists analyzed 41 boulders that had Li2O (lithium oxide) grades averaging 1.06% to as high as 4.65%. Those significant gradings hint at substantial resource potential near the surface.

To put this in perspective, one of Australia’s top hard rock lithium mines, Bald Hill, has a cut-off grade of 0.3% Li2O with an average reserve grading of 1.0%![8]

In December 2016, geologists mapped lithium mineralization in multiple outcrop locations that returned assay results averaging 1.71%.

Drilling launched from those surface indicators confirmed below surface potential…which is crucial for cost effective extraction.

Core assay results, which determine the composition and quality of the lithium, identified lithium mineralization in economic ranges as high as 2.71% in 27 out of 33 drill locations. (Cut-off grade for near surface lithium reserve calculations start at around 0.3%.)

This is exactly why I’m recommending you keep your eye on United Lithium (ULTHF). Mining exploration carries significant risk, but it’s always a good idea to read the tea leaves when you can.

That’s not all. Geologists discovered substantial gradings of tantalum at Bergby. Tantalum is a lesser known, but very strong metal that is resistant to corrosion. It is used in the production of electronic components. Mordor Intelligence reports that:

“The market for tantalum is expected to register a CAGR of over 5.5% [through 2026]. Major factors driving the market studied are the growth of the electronic industry and extensive usage of tantalum alloys in aviation and gas turbines.”[9]

Results for tantalum drilling at Bergby were as high as 362ppm (parts per million) with over half the gradings exceeding a cut-off of 100ppm. Combined with surface sampling, tantalum assays averaged 133ppm with a high mark of 803ppm!

Again for perspective, the Bald Hill mine was originally used for mining tantalum and is an excellent reference point. At Bald Hill, which had world -class resource potential, tantalum resources grade at 313 to 336ppm.

Profitable tantalum mines in production have between 200 and 400ppm, so this may hold some promising early results.[10]

Sponsored

Is United Lithium The Hottest Lithium Stock Of 2021?

United Lithium’s Bergby property contains the only lithium that can be quickly scaled to meet soaring demand pressures. More importantly, their lithium is located at or near the surface for cost effective extraction.

This means ULTHF could have the potential to deliver lithium supply fast and cheap!

As the European lithium battery market takes off, United Lithium’s (ULTHF) Bergby mine could quickly become an essential resource for rapid scaling of lithium production…tantalum too!

Here’s why this is important for investors to understand and why United Lithium (ULTHF) has the potential to become a major supplier of lithium into European battery manufacturing.

Cost-Effective Mining of Lithium

Lithium comes from two very different types of deposits– rock and briny underground ponds. To meet anticipated new demand for lithium over the coming years, only hard–rock mining of spodumene– an ore that contains high levels of lithium– can be quickly scaled to meet soaring demand pressures.

Unlike lithium brine which relies on evaporative processes to recover lithium from water, hard rock lithium production can scale quickly by digging faster and deeper!

United Lithium’s (ULTHF) Bergby property is exactly that — hard rock lithium and most important, it is located at or near the surface for cost effective extraction.

This is key to establishing relationships with European lithium customers. United Lithium (ULTHF) is positioning itself as a top resource for these manufacturers to supply needed quantities of lithium at consistent, contract prices for the coming years of very rapid growth.

As Europe continues to search for domestic supply speed and quality could be why they may look to companies like United Lithium (ULTHF).

Established Transportation Infrastructure

This map reveals the optimal location of the Bergby Project. Rather than depend on China to ship lithium halfway around the world, European battery manufacturers can now obtain their lithium supplies from United Lithium’s (ULTHF) Bergby mine located on the coast of central Sweden.

Logistically, it’s close to highways, rail and ocean routes for supplying European battery manufacturers.

In addition, the village of Norrsundet, which lies 5 km east of the Bergby Project, provides an industrial site and port and handling facilities, where processing and shipping of lithium could be easily performed.

For United Lithium (ULTHF) shareholders, its value potential is significant. This mine could become the most important one in all of Europe.

United Lithium(ULTHF) is working quickly to prove up the resource potential at Bergby. Over the last six months, OTC shares in United Lithium(ULTHF) have roughly tripled off of a multi-month 25¢ trading range to test 75¢ resistance. As the company’s exploration results at Bergby begin to become public … especially as news of the European battery industry become more widely known … that 75¢ figure could become a starting block for significant new gains.

Now is an ideal time to look into the growth potential for United Lithium (ULTHF). This could be big … really big… and it’s just getting started.

You may recall the first bull run in lithium. Early investors made fortunes. So much money poured into lithium production that triple-digit and quadruple-digit profits became ordinary.

And it appears to be ready to launch again…only this time it could skyrocket even higher.

Again, consider the headline and industry graph at the top of this article:

Lithium Revolution to Re-Ignite with Explosive Outcomes!

Just last year, analysts were forecasting lithium production as tripling through mid-decade.[11] Will that be enough?

Not likely. New forecasts are for lithium demand to soar three-times higher than that prior forecasts…nine-fold growth by mid-decade.

In Europe, projections for demand growth are off the charts.

On August 31 The Financial Times reported:

“The European Union sounds alarm on critical raw materials shortages. The EU’s over-reliance on imports of critical raw materials threatens to undermine crucial industries and expose the bloc to supply squeezes by China and other resource-rich countries.”[12]

The EU estimates that to meet its climate neutrality goal, it will need up to 18 times more lithium…by 2030. The forecasts rise to 60 times more lithium…by 2050.

Lithium demand for electric vehicle production has recently been raised to nine-times current levels!

The data forecasts a remarkable opportunity unfolding in Europe and for United Lithium’s (ULTHF) Bergby lithium (and tantalum) mining.

But that’s not all.

As mentioned before, United Lithium (ULTHF) got started with its North American asset, the Barbara Lake Lithium Property in Thunder Bay, Ontario.

Similar to Bergby, it’s also a hard rock asset showing enormous production potential. And just in time.

Tesla, North America’s electric vehicle manufacturing giant, has also sounded alarms over its access to lithium supplies.

The company expects significant battery shortages in 2022 and beyond, in large part due to demand for new lithium supplies to outstrip current mine production.

Sponsored

United Lithium (ULTHF) Needs YOU!

Fight Back Against China’s Lithium Monopoly

United Lithium could be one of the few companies who have what it takes to stand up to China.

China controls 80% of the world’s lithium supply. United Lithium (ULTHF) is offering a reliable and western-friendly resource for lithium supply. And that’s great for investors who want to elephant sized returns on their investment…

Projections are that at least 800 thousand tons of additional lithium will be needed over the next five years.[13]

The question has to be asked: How long will Europe continue to allow the future of their union to be at the mercy of a Chinese supply chain?

I would imagine not for long.

China already leans heavily on substantial local lithium reserves that don’t come close to meeting its own needs. World Atlas reports that (emphasis added):

“The majority of the [China’s] lithium comes from the Chang Tang plain in western Tibet. China has to fully ramp up its lithium extraction as the need for the metal is steadily rising. For now, China gets a lot of its lithium supply from Australia.”[14]

Why Australia? Because unlike South American lithium that is mined from brine, Australia’s hard rock lithium resources can be quickly scaled for China’s soaring needs.

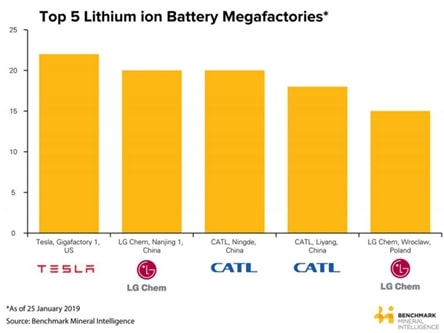

Tesla holds top global position for its lithium ion megafactories. Recent revisions to long-term battery demands places significant pressure on Tesla’s lithium supply channels. Opening North American resources to its supply chain could prove essential to long-term growth strategies.

As was noted above, in order to get more lithium… it is necessary to dig faster and deeper!

That’s why, as the transition to green energy continues to accelerate in the coming years and manufacturing strives to keep up with demand, United Lithium’s (ULTHF) Bergby hard rock lithium assets could be vitally important.

What you should consider right now…

At present, Europe’s need for new lithium resources far outweigh those of Tesla. EU battery manufacturing capacity is set to grow at a pace unmatched worldwide. United Lithium’s (ULTHF) move to become a key supplier to the industry stands to accrue enormous gains in shareholder value. Now is the ideal time to act.

become a key supplier to the industry stands to accrue enormous gains in shareholder value. Now is the ideal time to act.

To start, do your research, contact your broker or financial advisors, and put United Lithium (ULTHF) on your stock watch list. Better still, consider getting some skin in the game. Check the stock chart. Even though shares have posted solid gains these last few months, there still appears to be substantial upside in this stock.

In addition, you can easily access United Lithium’s website. It is rich in detail that can guide your decision making. Once there, be sure to register your email address to get company news releases and updates. It’s the best way to stay in front of the market and identify key buying opportunities.

Newly released!

United Lithium (ULTHF) makes public its 2021 Investor Deck

Download your free copy here!

To recap, here are SIX KEY REASONS to move quickly on United Lithium (ULTHF)

- President Biden’s announcement for the U.S. power sector to be “Carbon-Free by 2035” sets the stage for explosive growth for United Lithium (ULTHF).

- World demand for electric vehicles, electronic devices and utility-scale energy storage are now accelerating faster than was predicted even a few years ago.

- Current world lithium production is far below what will be required to meet surging demand from lithium-ion battery manufacturing.

- Thanks to aggressive policies in green technology, Europe has seen billions of dollars invested in new lithium-ion battery production.

- China now controls over 80% of global lithium resources. For European battery manufacturing to operate independently, reliable lithium resources must be secured from western-friendly sources.

- United Lithium (ULTHF) took control of what could be one of Europe’s most important and significant lithium resources. Its immediate proximity to an established shipping infrastructure puts it in obvious consideration for supplying lithium resources throughout the continent.

Bonus Reason:

With Tesla’s public concern over its own projected lithium needs and China’s iron fist control over global lithium production, United Lithium can emerge as a key player in lithium production.

Now is the time to act. The upside potential is enormous, as lithium mining becomes essential to both American and global energy systems. Don’t miss out.

ADVERTISEMENT DISCLAIMER

This is a paid advertisement and is intended solely for informational and educational purposes. The issuer has provided Promethean Marketing, Inc with a total budget of approximately one million seven hundred forty-nine thousand nine hundred ten ($1,749,910.00) USD to cover the costs associated with this advertisement for a period beginning 1 March 2021 and currently set to end January 1 2022. Promethean Marketing, Inc has paid James Hyerczyk three thousand five hundred ($3,500.00) USD out of the total budget to endorse this advertisement. Promethean Marketing, Inc will retain any excess sums after all expenses are paid. InvestingTrends has not been paid to host this advertisement. As a result of this advertisement, InvestingTrends expects to receive additional website visitors, advertising revenue, and email subscriptions. InvestingTrends is owned by Summit Publishing Group, Inc. Promethean Marketing, Inc and Summit Publishing Group, Inc have shared ownership. None of Promethean Marketing, Inc, InvestingTrends, Summit Publishing Group, Inc, or James Hyerczyk owns shares of the company mentioned. James Hyerczyk is solely responsible for the contents of this advertisement.

For further information, InvestingTrends has a Full Disclosure Policy which can be read by clicking here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.nytimes.com/2021/01/28/business/gm-zero-emission-vehicles.html

[2] https://www.marketwatch.com/story/amazon-aims-to-hit-paris-climate-goals-10-years-early-and-reach-carbon-neutral-on-deliveries-by-2040-2019-09-19?mod=article_inline

[3] https://www.msn.com/en-us/money/other/2423-billion-battery-plant-planned-for-hungary-europe-e2-80-99s-largest/ar-BB1dcw6s?ocid=uxbndlbing

[4] https://seekingalpha.com/article/4289626-look-top-5-lithium-ion-battery-manufacturers-in-2019

[5] https://www.instituteforenergyresearch.org/renewable/china-dominates-the-global-lithium-battery-market/

[6] https://edgy.app/7-countries-planning-to-outlaw-gasoline-car-sales

[7] https://www.oliverwyman.com/our-expertise/insights/2019/nov/perspectives-on-manufacturing-industries-vol-14/new-tech-new-strategies/battery-manufacturing-in-europe.html

[8] http://www.allianceminerals.com.au/projects/

[9] https://www.mordorintelligence.com/industry-reports/tantalum-market

[10] https://www.mordorintelligence.com/industry-reports/tantalum-market

[11] https://www.spglobal.com/en/research-insights/articles/lithium-supply-is-set-to-triple-by-2025-will-it-be-enough

[12] https://seekingalpha.com/article/4376568-lithium-miners-news-for-month-of-september-2020

[13] https://seekingalpha.com/article/4376568-lithium-miners-news-for-month-of-september-2020

[14] https://www.worldatlas.com/articles/the-top-lithium-producing-countries-in-the-world.html#:~:text=The%20majority%20of%20the%20country’s%20lithium%20comes%20from,a%20lot%20of%20its%20lithium%20supply%20from%20Australia.

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and have been providing quality analysis for professional traders for 38 years.