Sponsored

Economists Warn of Inflation Flare-Up!

Now could be a smart time to return to gold. But buying $2,000/oz. gold may not be your best play.

Instead, this “backdoor” gold play into a junior gold exploration stock, Leocor Gold Inc. (LECRF), could make you a small fortune.

It’s hit peak gains of 718% in a little over a year [2] …

More to come!

By James Hyerczyk

President Biden is on a red-hot spending streak!

Within 50 days of taking office Biden signed the $1.9 Trillion Covid Relief Bill.[3]

The bill is “paid for” by cranking up the printing presses in the basement and pouring out freshly-minted crisp dollar bills.

In less than a year, the U.S. government has pumped a staggering total of $5.5 Trillion into the new COVID economy.

And every new dollar printed weakens the spending power of the dollar in your pocket… which then leads to rising prices – the very definition of inflation.

Economists are worried.

For instance… former Obama Treasury Secretary Lawrence Summers wrote in the Washington Post that Biden’s new stimulus…[4]

And if $5.5 Trillion in borrowed, monopoly-money spending isn’t enough to bring on massive inflation, then…

Biden’s NEW $3 Trillion Spending Proposals Guarantees Inflation!

Biden has revealed his new staggering $3 Trillion Spending Bill.

He calls it an infrastructure plan to fix the roads, bridges, and airports. But White House officials say the plan will also spend heavily on climate change initiatives, affordable housing… and eventually include free college and more socialist-style programs.

Biden plans to pay for this new $3 trillion spending spree by raising taxes on corporations, the wealthy and small businesses.

Higher taxes, according to Larry Kudlow, former Trump Director of the National Economic Council, will cut production and shut off the supply of goods, which only increases demand and prices.[5]

Another propellant to ignite an epic inflation flare-up!

But there’s more …

5 Inflation Indicators Flashing Red!

Inflation indicators are flashing red — warning investors we are heading into a danger zone.

Inflation Indicator 1: Weak Dollar

As I already mentioned … Washington’s $5.5 Trillion response to the pandemic has been to fire up the printing press. This new money erodes the value of the dollar in your pocket.

Inflation Indicator 2: Limited Supply

Production has been severely disrupted by COVID shutdowns and lockdowns. Many businesses have closed—some permanently. This restricted supply has caused prices to rise. And Biden’s plan to hit businesses with higher taxes will only further cut back production and increase the pain of inflation.

Inflation Indicator 3: Rising prices

Since November 2020, gas is up nearly 60%. Heating Oil up 50%. Corn up 32%.[6] Beef up 10%.[7] Just to name a few.

Inflation Indicator 4: Pent-up Demand

With COVID vaccinations underway and lockdowns lifted, expect an unleashing of pent-up consumer demand. Demand will outstrip supply leading to sharp price increases and higher inflation.

Inflation Indicator 5: Surging Treasuries

The 10-Year Treasury yield hit a 14-month high of 1.77% [8] on market fears of rising inflation.[9] That’s TRIPLE the rate of just 0.6% in May of 2020. That means bond prices are falling. Warren Buffet took notice and warned investors to say clear of the bond market due to the rising inflation risk.[10]

These indicators reveal a perfect storm brewing for higher inflation… trillions in government spending… a weaker dollar… demand greater than supply… along with rising prices and bond yields.

History has shown that whenever an inflationary flareup occurs, demand for precious metals, such as gold, tend to skyrocket sending their prices soaring.

With inflation warnings flashing, the timing is right for companies such as Leocor Gold (LECRF), a gold resource and exploration company focused on undervalued and underexplored potential gold discovery projects.

Inflation worries are back with a vengeance as all the dominoes fall into play. It’s why in addition to Summers and Kudlow…

More Leading Economists Sound the Inflation Alarm!

“Inflation is on the rise again and is certain to move higher in the next year.” Jeffrey Bartash, MarketWatch

“Investors should be prepared for a potential pickup in inflation.” Morgan Stanley[11]

“U.S. could see a jump in inflation… Investors who’ve seen 10% annual stock market returns in recent decades should expect that gain to go down to 3% to 5% over the next decade.” Bank of America[12]

Thanks to the pandemic – and Washington’s response to it –the economy is sailing into rough unchartered waters.

Investors who ignore these inflation warnings do so at their own peril. Former New York Fed President Bill Dudley says…[13]

My caution for you today is: Signs that typically precede inflation spikes are showing. Don’t ignore them.

The time to find your safe port in the storm is now.

If you want to protect and significantly grow your money in the coming inflationary flare-up, you would do well to look at LEOCOR GOLD (LECRF).

In a moment, I’ll share with you the amazing prospects of Leocor Gold… and why now may be the perfect time to consider this potentially huge upside investment.

But first, let me introduce myself. My name is James Hyerczyk.

I’m a technical analyst, trader, market researcher, and educator based in Florida. I started my career nearly 40 years ago as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange.

Since then, I’ve been providing quality economic and market analysis to professional traders all across the country. That’s why when a perfect storm of inflation warnings began to sound, I urged traders to get into gold.

Your Golden Protector When Inflation Strikes!

For decades smart investors have flocked to gold to protect and grow their wealth.

It’s why Barron’s calls gold “a safe haven asset” [14]

For instance, back in the inflationary 70’s, when the inflation rate quintupled… the price of gold skyrocketed 1,200%.[15]

If you had bought an ounce of gold in 1973 for $65, you could have sold it for $850 in 1980.

Uncertainty often drives the price of gold. During the COVID Crisis, gold skyrocketed to its highest price ever. It reached $2,067.15 an ounce on August 7, 2020.[16]

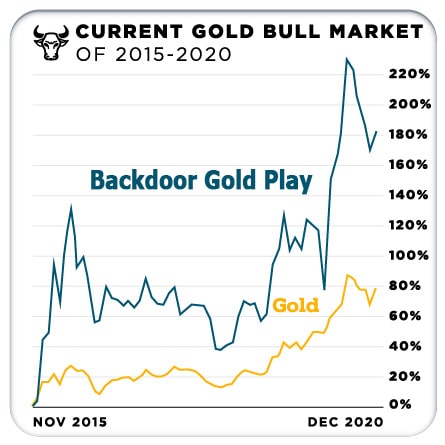

But regardless of events, gold has been enjoying a strong bull run in the past five years. Its price is up an impressive 79%.

[[DESIGN – Chart2: Show price chart from link from 12/31/15 at $1,060 to 1,893.66 on 12/31/20[17] ]]

But Even with Inflation Fears, Ramping Up…

Is Buying Gold the right play now… or is there a Better Gold Investment?

It’s true some economists are predicting gold could continue to climb – soaring to $3,000 or $5,000 an ounce.[18]

We’ve heard these kind of predictions before. And at nearly $2,000 an ounce, it could be more difficult to see fast gains in gold.

But what if I told you that I have a “backdoor” gold play that returned an impressive 180% in the past five years – more than doubling the gains of gold.

And in addition to outperforming gold… returns on this backdoor gold play clobbered just about everything else in the past 5 years.

Leocor Gold (LECRF) may potentially be the best way for interested investors to jump on this exciting backdoor play in gold.

The Backdoor Gold Move That Beats Them All!

Now, you can rush out and buy actual gold bullion or gold coins and hide them in a secret room in the basement or pay through the nose for secure storage.

Or, you can enjoy the lucrative rewards of gold investing – without the hassle –by going in though the back door and invest in gold mining stocks.

These are the companies that hunt for gold and dig it out of the ground. And gold mining stocks have been on a tear.

In addition to more than doubling the returns of gold over the past five years, gold mining stocks have beat the DOW, S&P 500 and the Nasdaq. Take a look.

[[DESIGN – Chart4: Gold Mining Stocks Outshine The Markets!

2015 to 2020

First Bar: Gold Mining Stocks: 180%

Second Bar: Gold 79%

Third Bar: DOW 76%[20]

Fourth Bar: S&P 500 83%[21]

Nasdaq: 155%[22]

[[End Bar Graph]]

As you can see, Gold Mining Stocks are posting some incredible returns – nearly tripling investors’ gains.

Imagine a $25,000 investment in gold in 2015 and you’d have $70,000 at the end of 2020. If you’d put that same money into an S&P 500 index fund you’d have a little over $45,000. Not bad.

But why settle? In the past five years investors in gold mining stocks have seen some mouth-watering profits. For instance[23]:

- Gold Fields Limited (GFI) rose from 3.98 in early 2016 to $10.12 today[24] — a gain of 154%.

- Newmont Corp (NEM), the world’s largest gold mining company, jumped from $26.62 a share in early 2016 to $61.59 today[25] – a gain of 131%.

- Barrick Gold Corp. (GOLD) is up from $13.65 five years ago to $20.36 today[26] – a gain of 49%.

- Polyus PAO (OPYGY) went from $28.25 in 2016 to 90.40 today[27] — a gain of 220%.

I’ve just shown you the gains of four of the biggest gold mining companies in the world. As you can see, they’re impressive and investors have done well.

But you can do better.

Because I want to share with you a better, faster way to invest in gold mining for big potential life-changing gains.

If you’re willing to take on more risk for potentially 10-bagger gains, then I urge you to consider gold stocks known as “junior gold exploration” companies.

These are much smaller companies who haven’t begun drilling for gold yet. Instead they’re exploring for large gold deposits. They’re actively looking and testing for new potential mine sights.

One of these junior gold companies that is hitting the attention of savvy gold investors is Leocor Gold (LECRF). Their stock launched in June 2019 and within 14 months had surged a whopping 718%![28]

Reports are that Leocor has recently hit what many are claiming to be “the sweet spot” in gold discovery.

If this potential discovery pans out, (no pun intended) investors could double their money very quickly… and possibly triple, or even quadruple their money. It’s happened before.

Let me show you.

Making the Most of Golden Times

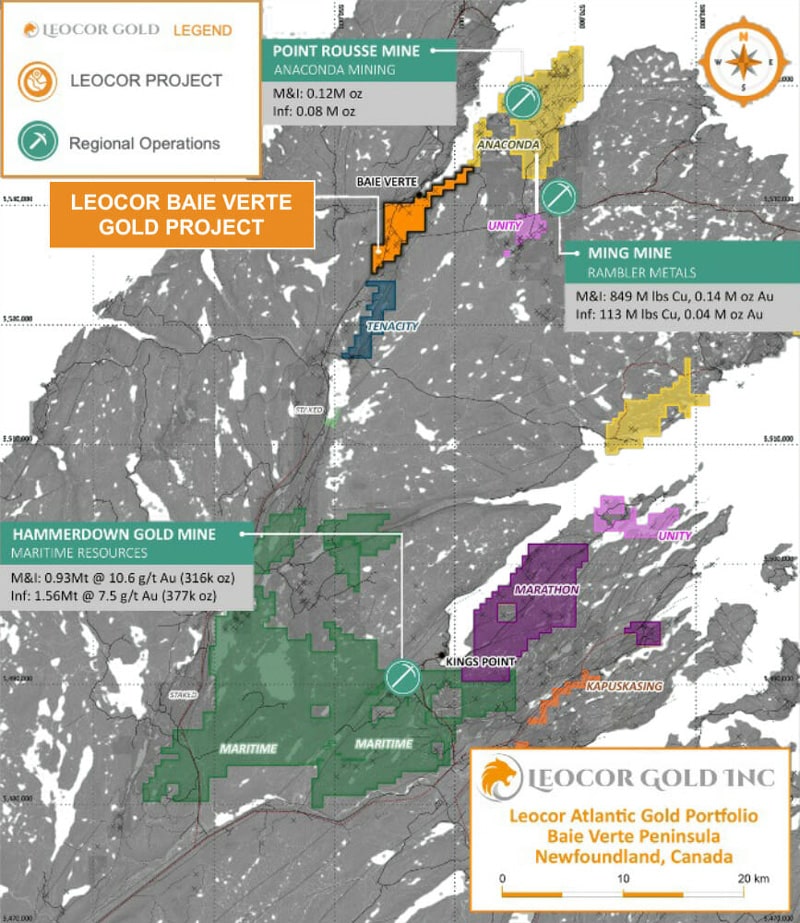

In Newfoundland, a mini gold-rush is underway… thanks to the surging price of gold.

As far back as 2009, The Geological Association of Canada field review of the Baie Verte peninsula noted “significant gold deposits”.[29]

That report, coupled with this new and significant resurgence in gold prices, has mining companies rushing into Newfoundland with new technologies and modern methods to pry the gold from the ground.

In fact, mining for gold is at an all-time high in central Newfoundland. [30]

And more than a dozen gold mining companies are actively exploring and mining in the Baie Verte peninsula. [31]

Perhaps you’ve heard of a few…

For instance Anaconda Mining Inc. currently mines over 16,000 ounces a year according to recent figures.[32] At today’s gold prices,[33] that’s worth about $28 million.

[[DESIGN – Chart 5-7: Show price rise graph for each stock mentioned below.]]

Anaconda stock UP 425%!

Over the past year, Anaconda’s stock price has skyrocketed a staggering 425%. Imagine a $10,000 investment just last year… and today you would have over $50,000!

Another junior gold mine working in the gold-rich Baie Verte Peninsula is Maritime Resources.

Maritime stock UP 250%!

Initial studies show that Maritime could generate $110.5 million when they begin production by 2022.[34]

With such healthy production numbers, Maritime’s stock price has more than tripled—gaining 250%![35] Just $10,000 invested last year and you’d have $35,000 today!

Then there’s Marathon Gold Corp. It’s working to put its Valentine Gold Project into production by 2023.

Marathon stock UP 1,000%!

Marathon has skyrocketed from 20 cents a share to $1.98 a share in the past five years.[36] That’s nearly a 1,000% increase – a rare 10-bagger! Imagine every $10,000 invested in 2016 is worth $100,000 today.

About three-quarters of the gold reserves documented in Newfoundland today are found in this Baie Verte peninsula.[37]

While Anaconda, Maritime and Marathon have staked out claims in the peninsula, a junior gold exploration company controls seven square miles smack dab in the midst of this gold-rich area.

The company is Leocor Gold Inc. (LECRF)… and it’s worth a look if you’re hunting for the perfect gold play to grow and protect your wealth in the coming inflation flare-up.

LEOCOR Gold Inc is a gold exploration and development company focused on leveraging overlooked, undervalued or unexplored gold deposit potential.

Alex Klenman, CEO of Leocor Gold, reports…

“Leocor has increased its land area by 600% in the Baie Verde peninsula, one of the most prolific gold mining districts in Canada. And we’ve bridged the gap between Marathon in the South and Anaconda in the North. Surface samplings for gold deposits are impressive. We’re picking up rocks 10, 20, 30 times the “assay” counts. We’re literally pulling up bucket loads of it on the surface. It’s like someone flew over the property in a helicopter and threw gold out the window.”[38]

What Smart Investors Look for in a Gold Mining Stock

If you’re new to gold mining, let me explain a few of the words gold prospectors throw about.

Gold is often visible as small specks in surface rocks or as nuggets in underground quartz veins.[39] Assay results determine the amount of gold in a deposit. Based on these readings, management determines whether it’s profitable to mine for gold in that area.

Assay results determine the grade (low-average-high quality) and are expressed as grams per tonne (g/t). A higher grade means that it takes less effort to mine the gold. And less effort means more profits.[40]

Investors get very excited about gold mining companies reporting strong grades. Because a high-grade drilling result can send a mining exploration stock soaring.

I think you’ll be very pleased with Leocor’s preliminary assay results in Baie Verde.

In July 2020, Leocor reported that field work was beginning at one of their sites, the Dorset Gold Project.[41] The news was greeted with excitement among gold stock enthusiasts – quickly driving the price of Leocor Gold to peak gains of 718% on August 5th.

Now may be the time to get to know Leocor Gold (LECRF)… and consider it as a part of your inflation-protecting portfolio.

Leocor Gold’s focus in gold exploration right now is in Canada, specifically the Newfoundland area.

According to Resource World Magazine — the Bible for gold miners’ and their investors’…

“The current exploration activity in the Central Newfoundland Gold Belt presents a solid opportunity for mining stock investors.”[42]

Andrew Parsons, the Provincial Minister of Industry, Energy and Technology agrees. He says, “It is a good time now for gold, for mining companies invested in gold and for central Newfoundland.”.[43]

And geologist and Memorial University professor, Derek Wilton, proclaims… “The rocks are good!”

He goes on to explain, “You can’t have gold deposits without having the right rocks. And the rocks in central Newfoundland… have the right geology.”

Wilton said the presence of gold has been known in the region since the 1980s… and the recent surge in gold prices has spurred plenty of interest.[44]

Leocor (LECRF) has snapped up properties with abundant historical data of multiple gold occurrences. These properties also show extensive surface assay counts.

Leocor Gold’s Impressive Portfolio of Properties

Leocor’s flaghip exploration project is the Dorset Gold Project.

This property lies just north of Marathon’s enormous new gold findings.

It’s believed that the same gold trend lines fueling both Marathon and Anaconda’s gold riches also run through Leocor’s Dorset Gold.

And historical assay results are very promising and indicate high-grade deposits.

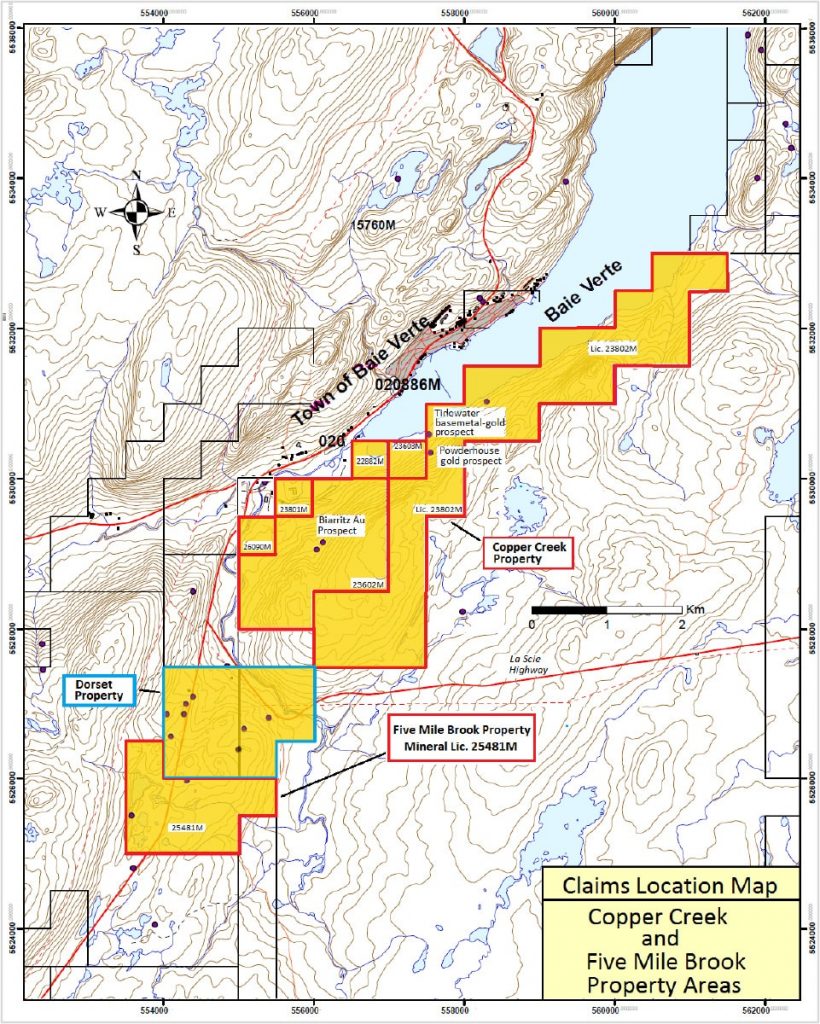

Then in August of 2020, Leocor Gold purchased two new exploration sites in Copper Creek and Five Mile Brook… bringing its total property to 7 square miles of connecting property.

CEO Alex Klenman explains the strategic significance of these properties.

“With these additions we’ve grown our footprint by approximately 600% in one of the most prolific mining districts in Canada. The area is well known for gold, deposits. We plan on conducting some considerable exploration work on the new ground, as well as the Dorset project, in the coming months,”[45]

Historical assay results are quite promising in revealing potential high-grade gold in these new Baie Verte properties as well.

Now of course, Leocor is not making any promises that gold will definitely be found on any of its properties. That wouldn’t be scientific. But the exceptional sampling tests and assay findings are evidence that significant gold deposits are a distinct possibility.

You may certainly want to consider Leocor for your portfolio now – before any discoveries are made and mining operations begin. Because when that happens, its’ stock price may soar as Leocor moves from the exploratory phase and grows closer to production.

Simply go to www.leocorgold.com to get on their mailing lists to be among the first to hear of any new and exciting announcements.

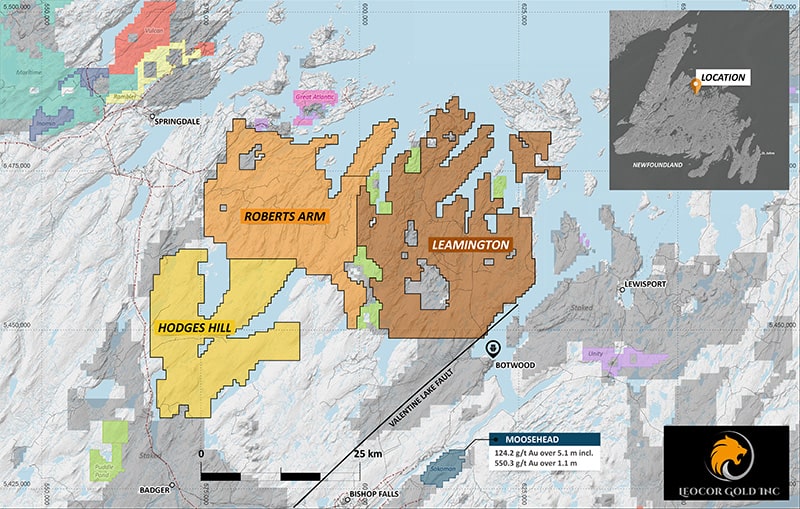

Leocor Expands Further into Newfoundland

Several recent gold discoveries near the town of Gander have prompted Leocor to announce a large new land purchase in December 2020 outside the Baie Verte region.[46]

It’s called the Startrek Property and it covers 27 square miles[47] just east of Gander. More than 50 gold occurrences have been discovered at Startrek through trenching and grab samples.

Historical assay results and test sampling have indicated high-grade gold deposits.

And Leocor’s expansion plans continue into 2021.

As recently as April, Leocor has optioned three additional properties in Newfoundland totaling 556 square miles that they believe are rich in gold mineralization.[48]

CEO Alex Klenman enthused, “This project ground has had limited exploration to date, and we feel the geology, location, historical and recent results all indicate this is a highly prospective, prime target for an aggressive, large scale gold exploration program.”[49]

Leocore Properties 2021[50]

590 Square Miles in Gold-Rich Newfoundland

2018 – Dorset Gold Flagship Property 2.3 square miles

July 2020 – Copper Creek and Five Mile Brook 5.3 square miles

December 2020 – StartTrek 26.4 square miles

April 2021 — Hodges Hill, Leamington and Robert’s Arm 556 square miles

[51] From Atlantic Project portfolio, coverted hectares into square miles.

Leocore Properties 2021

A New Gold Boom!

Everything is falling into place for Newfoundland’s own version of the gold rush And junior miner exploration companies, like Leocor Gold are killing it right now!

Three triggers are fueling this New Gold Boom.[51]

- The surging price of gold on the international markets.

- The promising geology reports about Newfoundland.

- The provincial government’s welcoming role in any current or future mining development. Since February 2017, the government has pumped upwards of $2.3 billion in capital investments to mining companies working in the area.

“It’s been a very big year for us as to acquisitions,” says Leocore’s CEO Alex Klenman. “Recent samplings on the prospects confirmed the high-grade nature of the gold mineralization. We’re moving ahead with geological mapping and sampling with all of our properties.”[52]

10 Golden Reasons Why LEOCOR GOLD (LECRF) May Be Your Best and Most Profitable Inflation Play

Leocor Gold racked up sizzing peak gains of 718% in August of 2020. It’s pulled back from its high but is still showing sizeable triple-digit gains from its stock launch in 2019.

Junior miners like Leocor may hold the key to new supplies in gold as they continue to search for new gold deposits and announce new gold finds.

I do want to tell you that investing in juniors can be more speculative and volatile. But junior miners can also mean big returns… such as Marathon’s 1,000% gains and Leocor’s peak gains of 718% in just 14 months.

Now may be the perfect time to invest in junior gold miners. And if you decide to do so, I hope you will consider Leocor Gold (LECRF).

Simply go their website, www.leocorgold.com, and request to be placed on their mailing list. You’ll find additional and helpful information here.

Or share this report with your broker and consider buying shares in Leocor. It’s that easy.

Leocor Gold, Inc. (LECRF) is selling for under $1 a share as of May 2021 – and could be a very attractive investment for folks concerned about inflationary pressures… or for any investor looking for a more speculative investment with the potential to make strong gains in a shorter amount of time. No guarantees, of course. But with Washington spending out-of-control and gold poised to soar past $3,000 an ounce, Leocor is worth your consideration. Let’s recap why.

10 Golden Takeaways:

- The U.S. government is spending staggering amounts of money it doesn’t have. It’s printing new money and promising higher taxes. Economists are predicting an inflation flareup is coming soon.

- As a result, gold prices are soaring and demand for gold is increasing. Gold experts believe we could be in the midst of a significant gold bull run and predict gold could climb to $3,000 to $5,000 an ounce.

- Gold is one of the best assets you can invest in times of volatility and uncertainty – hitting $2,067 an ounce in the midst of the COVID pandemic in August 2020.

- But instead of buying gold, the smart money is heading for a backdoor move into gold. They’re rushing to gold mining stocks, which have more than doubled the gains of gold over the past 5 years.

- Leocor Gold (LECRF) holds 590 square miles in gold-rich Newfoundland. “Significant gold deposits” have been reported in the Baie Verte peninsula, as well as in the Gander area. Leocor has recently acquired sizable property holdings in both areas.

- The Newfoundland government is offering millions in incentives to draw gold exploration and mining companies to the area.

- Leocor Gold is a notable company situated among other publicly-traded companies in the Baie Verte peninsula with Anaconda to the north (UP 425%)… and Marathon (UP 1,000%) and Maritime (UP 250%) to the south as of May 2021. Gold estimates on these properties are nearly 6 million ounces.

- Leocor’s exploration and assay testing has produced impressive results signifying what may be substantial gold deposits on a number of their properties. \ Exploration and testing continue into 2021 on all their properties.

- Most junior gold miner stocks are penny stocks and Leocor is no exception. At the current price of gold you could buy one tiny ounce of gold[53], or you could buy 3,474 shares of Leocor Gold (LECRF)[54]. It’s the easy way to jump into gold to protect and grow your money in the coming inflation flare up.

- It’s easy to trade too. As of February 1, 2021, Leocor (LECRF) has begun trading on the American OTCQB making it easier for US investors to buy and trade Leocor’s stocks. CEO Alex Klenman calls this move critical to the company’s development and should provide investors with added confidence in Leocor’s future.[55]

Now is the Time to Act on This Promising Opportunity

Results from Leocor’s 2021 exploration could be announced very soon. Newfoundland is already on gold investors’ radar screens and gold discoveries here are creeping more and more into the news!

Any report of a new gold discovery (or other promising news) could send Leocor shares skyrocketing at a moment’s notice.

For instance… in April when Leocor announced its latest acquisition of 556 square miles in the Gander gold region, its’ stock soared 42% in two days![56]

Here’s how to learn more about Newfoundland’s 2021 promising gold rush and Lecor Gold’s (LECRF) prospects for investors.

Simply go to www.leocorgold.com. While on site, be sure to register your email address for future announcements from the company, particularly those that report ongoing exploration results. Click on “Get News Alerts!” at the top of the home page and sign up.

Take Your Position Now in Leocor Gold (LECRF)

If you wish to be among the early bird big winners in Leocor’s golden opportunity, then I suggest you show this report to your investment advisor or broker right away.

Leocor is a junior gold mining company. It has the potential for higher rewards than other gold opportunities, but it also comes with higher risk. So never invest more than you can afford to lose. And to minimize risk, any investment you may make in Leocor should be part of a wider asset allocation strategy in your portfolio.

But with that strong caution to you, I believe my analysis of the potentially huge reward of Leocor Gold Inc. (LECRF) is a good one.

Wishing you success in all your investments.

ADVERTISEMENT DISCLAIMER

THIS PUBLICATION IS AN ISSUER-PAID ADVERTISEMENT. This paid advertisement includes a stock profile of LEOCOR GOLD INC. (LECRF) To enhance public awareness of (LECRF) and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately seven hundred and fifty thousand ($750,000.00) USD to cover the costs associated with this advertisement for a period beginning 21 June 2021 and currently set to end 28 February 2022. In connection with this effort, Promethean has paid the author of this advertisement, James Hyerczyk has been paid ten thousand five hundred ($10,500.00) USD in cash out of the total budget. The website hosting this advertisement, Investing Trends, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Investing Trends have been paid to host this advertisement. As a result of this advertisement, Investing Trends may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. James Hyerczyk is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Investing Trends website, some or all of Promethean, Investing Trends, Summit, or James Hyerczyk, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of (LECRF) and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of (LECRF), increased trading volume, and possibly an increased share price of LECRF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy located here.

[1] https://www.nytimes.com/2021/03/22/business/biden-infrastructure-spending.html

[2] 11 cents on Jun 21, 2019. On 8/5/20 LEOCOR hit 90 cents 718% GAIN. It’s currently at 40 cents (April 7 2021 for a total 263% GAIN in less than 2 years.

[3] https://www.cnbc.com/2021/03/11/biden-1point9-trillion-covid-relief-package-thursday-afternoon.html

[4] https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/

[5] https://video.foxbusiness.com/v/6243900293001#sp=show-clips

[6] https://financialdesignstudio.com/will-we-finally-see-higher-inflation-in-2021/

[7] https://www.agriculture.com/news/business/highest-grocery-price-inflation-in-nine-years

[8] https://www.cnbc.com/2021/03/31/us-bonds-10-year-treasury-yield-rises-ahead-of-payroll-data.html

[9] https://apnews.com/article/coronavirus-pandemic-financial-markets-stock-markets-inflation-prices-96e01a1db876bd4ad7e183e8cb4874e8

[10] https://www.investmentnews.com/buffett-warns-about-the-most-dangerous-of-assets-42135

[11] https://www.morganstanley.com.au/ideas/the-return-of-inflation

[12] https://www.businessinsider.in/stock-market/news/2021-is-a-turning-point-for-inflation-and-stock-investors-should-anticipate-lower-long-term-returns-as-a-result-bank-of-america-says/articleshow/81457207.cms

[13] https://www.bloomberg.com/news/articles/2020-12-07/get-ready-for-the-great-u-s-inflation-mirage-of-2021

[14] https://www.barrons.com/articles/future-returns-why-gold-is-still-a-safe-haven-asset-01584457259

[15] https://dailywealth.com/articles/what-the-1970s-tell-us-about-todays-gold-boom/

[16] https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/highest-price-for-gold/#:~:text=Highest%20price%20for%20gold%3A%20Historical,%2C%20on%20August%207%2C%202020.

[17] https://goldprice.org/gold-price-today/2020-12-31

[18] https://nationwidecoins.com/gold-predictions-what-will-the-price-be-over-the-next-5-years/

[19] https://www.visualcapitalist.com/why-gold-mining-stocks-outperform-gold-bull-markets/

[20] 12/31/15 17,425.03, 12/31/20 30,6060

[21] 12/31/15 2043.94 12/31/20 3,756.07

[22] 12/31/15 5,048 12/31/20 12,888

[23] Companies chosen from 10 Top Gold Mining Companies, https://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/top-gold-mining-companies/

[24] https://www.google.com/search?q=gold+fields+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00amgAHQTn0uYnpG8PAULoKf0rQTg%3A1617305782327&ei=tiBmYKyhE-ys5NoPreOm0Ag&oq=Gold+Fields+stock+price&gs_lcp=Cgdnd3Mtd2l6EAEYADIHCAAQRhD6ATIGCAAQBxAeMgQIABAeMgYIABAFEB46BwgAEEcQsAM6BwgAELEDEEM6AggAOgwIABCxAxBDEEYQ-gE6BwgAEIcCEBQ6BggAEAgQHjoJCAAQDRBGEPoBOgQIABANOggIABAHEAUQHlCNzRhYyf8YYOyKGWgCcAJ4AIABmAGIAa4LkgEEMy4xMJgBAKABAaoBB2d3cy13aXrIAQjAAQE&sclient=gws-wiz

[25] https://www.google.com/search?q=newmont+mining+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00XeZTdJpIAxpjx8Iw6jLRlsbfuAg%3A1617303838898&ei=HhlmYMOtNo6d_QaOsYXgDA&oq=Newmont+mining+stock+price&gs_lcp=Cgdnd3Mtd2l6EAEYADIHCAAQRhD6ATICCAAyBggAEAcQHjICCAAyBggAEAcQHjIGCAAQBxAeMgYIABAHEB4yAggAMgQIABAeMgQIABAeOgcIABCwAxBDOgQIABANOgoIABDEAhBGEPoBOgkIABANEEYQ-gFQqtwdWI-lHmChvh5oAnACeACAAW-IAaYKkgEEMTMuMpgBAKABAaoBB2d3cy13aXrIAQrAAQE&sclient=gws-wiz

[26] https://www.google.com/search?q=agnico+eagle+gold+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk03m8N4ejQ6184BGwtADRJ77tg-QqQ%3A1617305743731&ei=jyBmYP-CLKKl5NoPyIag-AQ&oq=Agnico+gold+stock+price&gs_lcp=Cgdnd3Mtd2l6EAEYADIGCAAQBxAeMgIIADoHCAAQRxCwA1CRgwJY6Y4CYOujAmgBcAJ4AIABrAGIAZkIkgEDMC43mAEAoAEBqgEHZ3dzLXdpesgBCMABAQ&sclient=gws-wiz dhttps://www.google.com/search?q=barrick+gold+stock+price&rlz=1C1CHBF_enUS759US759&oq=Barrick+Gold+st&aqs=chrome.2.69i57j0i67i433j0i67i131i433j0j0i67j0l2j0i457j0l2.13313j1j15&sourceid=chrome&ie=UTF-8

[27] https://www.google.com/search?q=Leocor+Gold+stock+price&rlz=1C1CHBF_enUS759US759&oq=Leocor+Gold+stock+price&aqs=chrome..69i57j33i160j33i299.12034j1j15&sourceid=chrome&ie=UTF-8 https://www.google.com/search?q=polyus+gold+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk002eq2qdcmDHJ3w4OCj25dzrRC-dQ%3A1617306194762&ei=UiJmYMfuLfSg5NoPgfyfkA8&oq=polyus+stock+price&gs_lcp=Cgdnd3Mtd2l6EAEYATICCAAyBggAEAcQHjIGCAAQBxAeMgYIABAHEB5QqJwKWP6oCmDZuQpoAHACeACAAZwBiAHOBpIBAzEuNpgBAKABAaoBB2d3cy13aXrAAQE&sclient=gws-wiz

[28] 11 cents on Jun 21, 2029. On 8/5/20 LEOCOR hit 90 cents 718% GAIN. It’s currently at 40 cents (April 7 2021 for a total 263% GAIN in less than 2 years.

[29] Begin page 21. https://www.gov.nl.ca/nr/files/mines-geoscience-publications-bv-fieldguide-final.pdf

[30] https://www.theguardian.pe.ca/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[31] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[32] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[33] https://www.google.com/search?q=price+of+gold+today+per+ounce&rlz=1C1CHBF_enUS759US759&oq=price+of+gold+today&aqs=chrome.1.69i57j0l9.4978j0j15&sourceid=chrome&ie=UTF-8 $1,732.8

[34] https://seekingalpha.com/article/4371089-newfoundland-gold-mines-2019-production-and-2020-development-prospects

[35] https://www.google.com/search?q=maritime+mining+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01Cmg3KoPPNTXYAOS9sBgGqcGHxDQ%3A1617800817146&ei=ca5tYPWkCNC7ggelgojoAw&oq=maratime+mining+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADIGCAAQDRAeOgcIABBHELADOgcIABCwAxBDOgYIABAHEB46CAgAEAgQBxAeOgUIABDEAjoKCAAQCBAHEAoQHjoHCCMQsAIQJzoECAAQDToFCAAQhgM6CggAEAgQDRAKEB5Q8Il9WOyTfWCvo31oAnACeACAAdkBiAGHCJIBBTQuNC4xmAEAoAEBqgEHZ3dzLXdpesgBCsABAQ&sclient=gws-wiz .14/.04

[36] https://www.google.com/search?q=marathon+mining+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01llVBYkHrEE-wDQwXMLe0yhrNKHw%3A1617800541438&ei=Xa1tYIaKGoyzggeQ1bPYBA&oq=marathon+mining+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADICCAAyBggAEAcQHjICCAAyBQgAEIYDOgcIABBHELADOggIABAIEAcQHjoFCAAQxAI6CggAEAgQBxAKEB46BAgAEA1Q-r4QWPPNEGD83hBoAXACeACAAd4BiAHwB5IBBTYuMi4xmAEAoAEBqgEHZ3dzLXdpesgBCMABAQ&sclient=gws-wiz

[37] Lifted from Daniel’s version.

[38] From phone call with Leocor.

[39] https://investingnews.com/daily/reurce-investing/precious-metals-investing/gold-investing/introduction-to-gold-assaying-whats-in-a-gold-grade/

[40] https://www.investopedia.com/ask/answers/022315/what-does-grade-gold-mine-refer.asp

[41] https://www.juniorminingnetwork.com/junior-miner-news/press-releases/2778-cse/lecr/80977-leocor-gold-announces-initial-exploration-program-underway-at-the-dorset-gold-project-newfoundland-canada-a-name-change-to-leocor-gold-inc-and-options-grants.html

[42] https://resourceworld.com/central-newfoundland-gold-belt-becoming-major-gold-camp/

[43] https://www.theguardian.pe.ca/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[44] https://www.theguardian.pe.ca/business/regional-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[45] Quote reqoerkd from statements in PR releases.

[46] https://www.thenewswire.com/press-releases/1L7OFRlV1-leocor-gold-enters-into-definitive-agreement-to-acquire-hare-bay-resources-corp.html

[47] 7,000 hectares converts to 27 square miles.

[48] https://www.marketscreener.com/quote/stock/LEOCOR-GOLD-INC-114338456/news/Leocor-Gold-nbsp-Signs-Definitive-Agreement-to-Acquire-District-Scale-Exploration-Projects-in-Newf-32915711/

[49] Quote reworked from PR release

[50] From Atlantic Project portfolio, coverted hectares into square miles.

[51] https://www.thetelegram.com/business/local-business/island-gold-central-newfoundland-becoming-hotbed-for-mining-activity-521446/

[52] https://leocorgold.com/leocor-gold-updates-exploration-at-the-dorset-gold-project-baie-verte-newfoundland/ Quotes reworked from press releases.

[53] Price of gold on April 8 is $1,737 dollars an ounce. Leocor is trading at

[54] On April 8, Leocore re trading at 50 cents a share.

[55] https://sec.report/otc/financial-report/275919 and quote reworked from press release… https://leocorgold.com/leocor-gold-upgrades-us-listing-to-otcqb/

[56] On April 7, share price was 35 cents. On April 9th it was 50 cents. 50/35 https://www.google.com/search?q=leocor+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk02Z88d1JfzJhh-kWiIP86OKo4wuqA%3A1618233071808&ei=70Z0YLnUMLSi5NoPksOq0A8&oq=leocor+stock+price&gs_lcp=Cgdnd3Mtd2l6EAEYADIECCMQJzoHCCMQsAMQJzoHCAAQRxCwAzoCCAA6CAguEMcBEK8BOgQIABAKOgQIABANOgoILhCxAxCDARANOgQILhANOgYIABANEAo6BQghEKABOgYIABANEB46BggAEBYQHjoICAAQDRAFEB46CAgAEAgQDRAeOgUIABCGAzoJCAAQDRBGEPoBUOSGvwFYrby_AWD3xr8BaAFwAngAgAGXAYgBsgySAQM4LjeYAQCgAQGqAQdnd3Mtd2l6yAEJwAEB&sclient=gws-wiz

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and have been providing quality analysis for professional traders for 38 years.