Sponsored

The Russia Crisis Exposes Our Increasingly Desperate Need for

“DOCTOR COPPER”

The Red Metal Holds the Key to the Future of Renewable Energy as it Sparks a New Commodity Supercycle[1]…

But Few Understand the Vital Role Copper Plays in the U.S. Military Sector,[2]

Which Includes the Ability to Defend Our NATO Allies if Necessary

J. Daryl Thompson is a self-proclaimed stock trading “addict” who began his investment career by working for a legendary Houston billionaire investment counselor for 15 years. Early on during his professional career, Daryl designed systems for the analysis, testing, and presentation of data. Originally a country boy from the Deep South with a penchant for numbers, Daryl received a Mathematics degree from the University of Oklahoma. While he eats, lives, sleeps, and breathes trading stocks, he also works as a financial and business consultant.

- The red metal has so many uses, copper demand is considered a leading economic bellwether.[3]

- Copper is the second most widely used material by the entire U.S. Department of Defense, making it a critical mineral when it comes to manufacturing the vehicles, aircraft, ships, and equipment needed for a strong military and national security.[4]

- Over the past decade, copper demand has been rising due to electric vehicle adoption, increased focus on renewable energy sources, and “green” infrastructure spending.[5] Russia’s recent invasion of Ukraine has further revved up the timetable when it comes to the EV boom.[6]

- The world needs 10 million more tons of copper to meet the needs of the blooming clean energy sectors. Analysts warn that more copper mine projects are needed,[7] because supply has not caught up with strong demand.[8]

- The U.S. looks to Canada to help develop new North American resources,[9] rather than relying on Chile, with its geopolitical supply issues.[10]

- This makes it a great time to become familiar with CAVU (CAVVF), a Canadian junior mining company currently focused on the exploration of its Hopper-Copper Project in Southern Yukon.[11]

By J. Daryl Thompson

The commodities market calls the red metal “Doctor Copper.”

With such a wide range of applications, demand for copper has become a reliable leading indicator of the health of the economy.[12]

Over the last decade, copper demand has grown steadily, with copper prices skyrocketing in 2021.[13]

Bloomberg suggests that current copper fundamentals are strong enough to support a new commodity supercycle. In addition to being an economic bellwether, the metal is a critical component in the push toward renewable energy and electric vehicles (EVs).[14]

However, Russia’s current military aggression in Europe makes our copper supply even more important – for a couple of important reasons.

First of all, Russia’s war on Ukraine, with its implications for the global oil supply, is projected to further accelerate the transition to EVs and away from fossil fuels.[15]

But even more fundamentally, copper is essential to U.S. national security and defense interests.

Copper’s Vital Role in Military Defense

The U.S. military relies on a diverse range of minerals to defend our nation – and our ability to defend our NATO allies if it should become necessary.

In fact, we need a steady supply chain of critical minerals such as copper to meet our national security needs and reduce any supply dependencies,[16] especially when it comes to adversarial nations such as China and Russia.[17]

It may surprise you to know that copper is the second most widely used material by the entire U.S. Department of Defense.[18]

Because of its ability to resist corrosion, copper is used to manufacture military vehicles, aircraft, and naval vessels.[19]

And because copper is also highly flexible, the metal is often combined with lead and nickel to produce body armor and other military gear that can stand up to heavy impact and degeneration.[20]

The defense industry uses copper plating in missile components and nuclear materials storage.[21]

In addition, tungsten copper alloy is used in aviation, military weapons, navigation systems, satellite communications, and even the space shuttle.[22][23]

Copper beryllium is used in fighter jets, including the F-16, F-35, and others.[24]

I could go on, but I think you get the idea…

A 2015 National Defense Stockpile Requirements Report projected shortfalls in certain metals, including copper.

Calling copper a “gateway metal,” the report notes that copper also provides access to other critically important elements such as molybdenum as a by-product of mining. In addition, in some defense applications, copper can serve as a substitute for other metals in short supply.[25]

The government report goes on to warn:

“Close the door on copper production, and you’re making a difficult situation far worse for national defense planners tasked with securing reliable supplies of critical metals. Given that every crisis is a come-as-you-are event — your options are only as strong as your prior planning — failure today to provide reliable sources of supply will translate into battlefield losses in some unwished-for future.”[26]

However, national defense is not merely a matter of military might.

Another sector important to national and economic security is particularly dependent on the red metal.

That’s why I recommend you look into this up-and-coming North American copper company I’m eager to share with you today — CAVU Mining Corp. (CAVVF).

“Green Copper” Set to Shine

Investors constantly hear the drumbeat about lithium, and how it’s the secret to powering the transition to clean energy.

And yes, lithium is important. But there’s one inescapable fact…

The transition from the internal combustion engine (ICE) to electric vehicles would not even be possible without copper.

In fact, without “Dr. Copper,” there could be NO clean energy future at all.[27]

According to mining magnate Robert Friedland…

“Arguably, the red metal is the most critical of all critical metals, because of its necessity in electrification, and the fact that there is an actual shortage of copper coming.”[29]

Copper is so crucial in electrifying the global economy that finding enough of it has become a true national security issue.[30]

And if the world succeeds at making the transition to clean energy and transport, Friedland notes, “It’s all copper, copper, copper, copper, copper, copper.”[31]

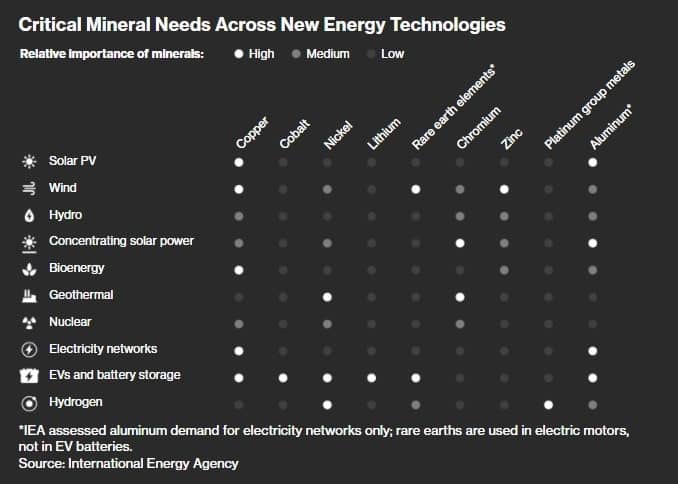

There are some very good reasons for this…

EVs Use LOTS of Copper

Copper is an essential component when it comes to electric vehicles (EVs). The metal is used in electric motors, batteries, inverters, and wiring because of the many properties it possesses: durability, pliability, reliability, and electrical conductivity.[32]

Wood Mackenzie notes that copper will benefit from the fact that it has few to no viable alternatives because of its physical properties in conducting electricity.[33]

And let’s face it…

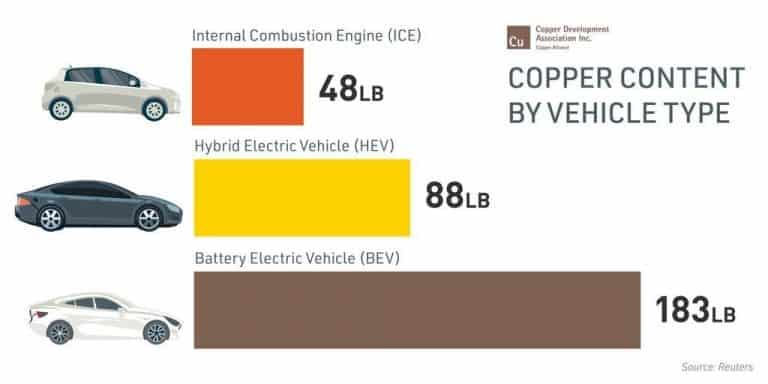

EVs use much more copper than internal combustion engine-powered vehicles – almost 4x more.

While a typical ICE-powered vehicle uses around 48 pounds of copper, hybrid vehicles use around 88 pounds of the metal. Plug-in hybrids use around 132 pounds, and battery electric vehicles use around 183 pounds of copper.[34]

Today, fewer than 1% of the world’s vehicles are electric. However, by 2030, EVs are projected to make up around 11% of new car sales.[36]

And these are just personal vehicles. What about commercial and mass transport?

Well, just consider that a single battery electric bus uses around 814 pounds of copper.[37]

While only 2% of the U.S. transit bus fleet is electrified today, the U.S. wants its entire fleet to transition to zero-emission vehicles by 2035. This includes transit buses, school buses, vans, automobiles, and other vehicles.[38]

That’s a LOT of copper!

Experts believe that, once electric vehicles become popular, the demand for new copper for EVs alone will reach 11 million metric tons — with even more upside in additional green technologies.[39]

And don’t forget the charging stations…

Copper is also an essential part of the infrastructure necessary to support EV charging.

According to Wood Mackenzie, the electric vehicle sector will need 250% more copper by 2030 — just to handle the 20 million expected EV charging stations.[40]

I see this as adding to an already-positive outlook for a company such as CAVU Mining (CAVVF).

And speaking of infrastructure…

Biden Infrastructure Plan a Boon for Copper

On November 15, 2021, President Biden signed a $1.2 trillion infrastructure bill, and it’s great news for copper…[41]

Hundreds of billions of dollars in this plan is earmarked for projects that will require massive amounts of copper.

When it comes to electrifying transportation, the Biden infrastructure bill includes:[42]

- $39 billion to modernize public transit and modernize rail and bus fleets, with an emphasis on zero-emission vehicles

- $7.5 billion to build a nationwide network of plug-in electric vehicle chargers

- $7.5 billion for zero- and low-emission buses and ferries, including electric school buses

Let’s dig deeper into the megatrends of the green revolution that make CAVU (CAVVF) worth taking a serious look.

Because there’s a lot more to this infrastructure plan resource investors should know about…

A Secure Electric Grid Starts With Copper

America’s sprawling power grid is sometimes referred to as “the largest machine in the world.”[43]

And increasingly catastrophic weather events have shown that this “machine” — the entire U.S. power grid — is unprepared for the future.

The fix involves replacing old infrastructure vulnerable to extreme weather with stronger and more resilient upgrades.

Fortunately, the Biden infrastructure package invests $65 billion to rebuild the electric grid. The plan calls for building thousands of miles of new power lines and expanding renewable energy.[44]

Another $50 billion will go toward making the system more resilient — protecting it from drought, floods, and ever-increasing cyberattacks.[45]

Copper is a vital part of grid infrastructure because of its unique characteristics, including reliability, efficiency, and performance. In fact, copper’s properties are critical to the interconnected network of plants, devices, and 600,000 mile circuit of power lines that generate and distribute electricity throughout the U.S.[46]

Copper is particularly important in underground power transmission because of its high electrical and thermal conductivity, long life expectancy, and resistance to corrosion.[47]

Copper is also recyclable, which makes it a vital material for most types of renewable energy — from EVs to wind and solar.[48]

And then there are the microgrids,[49] the small, local systems are being used by hospitals, universities, the military, and others to decrease the odds of major and widespread electrical failure. They can operate independently during disasters or even national security concerns.[50]

According to Zolaikha Strong, director of sustainable energy at the Copper Development Association:

“As advancements in power technology, like microgrids and energy storage systems, continue making electrical grids smaller and more powerful, energy efficient, affordable, and accessible, the copper demand will continue to rise.”[51]

This is yet another reason to put CAVU (CAVVF) on your investing radar.

But before getting into more of the infrastructure/copper nitty-gritty, it’s important to know the details about our present copper supply chain.

Vulnerability of Copper Supply

China is the world’s largest consumer of copper, with a demand of nearly 11.3 million metric tons in 2020 alone.[52]

This is due, in large part, to the fact that China leads the world in its transition to clean energy, including EVs, energy storage, and green infrastructure.[53]

As Mining.com put it:

“Even with expansions at existing mines and the ramp-up of the relatively few new copper mines…it will not be enough to meet the onslaught of demand that is coming from China… Bottom line? We gotta find more copper.”[54]

With China gobbling up the world’s copper supply, the United States has to ensure an adequate and secure supply chain.

So where does the U.S. get most of its copper now?

Thankfully, we don’t get it from Russia, the country with the 4th largest global copper reserves.[55]

But while the U.S. doesn’t import copper from Russia, other countries do. And as the commodities world is heavily interconnected, what happens in one area of the world can affect another.[56] Since a frustrated Putin has decided to ban commodity exports,[57] this could upend markets and create more supply challenges when it comes to the red metal.

Statista reports that, between 2016 and 2019, about 59% of all U.S. imports of unmanufactured copper came from Chile, the world’s top producer.[58]

However, there is growing political uncertainty about Chile’s copper supply. Goldman Sachs warns that a new mining royalty bill could put one million metric tons of copper production at risk.[59] Another danger is the ongoing threat of strikes at South American copper mines.[60]

And Chile’s drought has prompted water restrictions and made more areas off-limits to mining.[61] On top of this, Chilean mine copper grades have declined around 25% over the last 10 years, bringing less ore to market.[62]

With such vulnerability, the United States is looking for copper supply solutions closer to home. One company, CAVU Mining (CAVVF), is exploring for copper in a North American “sweet spot.”

Canada — The 51st State?

Canada’s mining industry is one of the world’s largest. Due to its production of over 60 metals and minerals, Canada is ranked among the top ten worldwide producers of several commodity metals and minerals.[63] In fact, Canada is a key global producer of copper, nickel, and cobalt.[64]

The country is primed to capitalize on the rising global demand for critical minerals and materials that are necessary to power the clean energy transition and advanced manufacturing.[65]

The U.S. government increasingly views Canada as the “51st state” when it comes to mineral supply purposes — and plans to strengthen financial and logistical partnerships with the country’s mining sector.[66]

In March 2021, the U.S. Department of Commerce held a virtual meeting with miners and battery manufacturers to consider ways to boost Canadian production of materials needed by the EV industry. The U.S. seeks to build a solid U.S.-Canada EV supply chain, much like Europe and Asia have been doing.[67]

In addition to being our close neighbors, another reason for looking to Canada for important minerals is that conservationists have strongly opposed some large mining projects in the United States.[68]

Antofagasta’s proposed copper and nickel mine in Minnesota was blocked recently by the U.S. Department of the Interior due to “domestic conservation concerns.”[69]

With all the “pluses” when it comes to Canadian copper mining, it’s little wonder that companies such as CAVU Mining (CAVVF) have gone looking there.

Looking to the Yukon for “Green” Metals

CAVU (CAVVF) is a Canadian junior mining company engaged in the acquisition, exploration, and development of mineral projects containing metals used in green technologies and the renewable energy sector.[70]

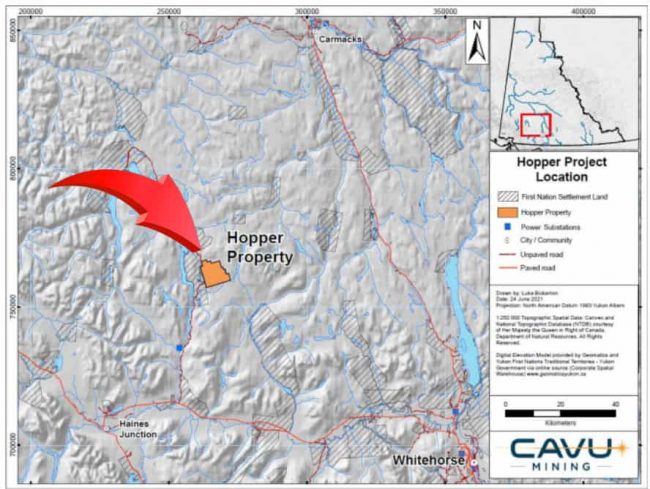

While they recently acquired a property in British Columbia, CAVU (CAVVF) is currently focused on the exploration of its Hopper-Copper Project in Yukon.[71]

The company has set its sights on underexplored and high value targets,[72] which is why I was excited to get the details on CAVU’s Yukon project, which shows some very positive indicators.

The good news is that rocks that host CAVU’s (CAVVF) Yukon Hopper Project are the same age and geologic type of rocks that host the Casino porphyry system to the northwest. This system contains over 14 million ounces of gold and 7 billion pounds of copper[73a] — and has recently seen a $25 million investment by major Rio Tinto.[73b]

Other majors such as Newmont have also had success with porphyry deposits in their project located between the Hopper and Casino claims.[74]

But let me back up a second in case you’re not up on your geology…

Porphyry deposits are large systems that typically contain copper as well as other important minerals including gold, molybdenum, silver, lead, and others.[75] About 60% of today’s copper production comes from porphyry deposits, as does roughly 20% of gold.[76]

The size of porphyries allows for bulk mining and economies of scale — and usually enjoy a multi-decades-long mine life.[77]

CAVU’s (CAVVF) Flagship Yukon Hopper-Copper Project

The Hopper Project in Yukon Territory is a large 28.5 square mile single block claim that is road-accessible and permitted for road and trail building.[78]

This Southern Yukon property is close to existing infrastructure, including power.[79] This cuts down on the need for capital expenditures.

CAVU’s Hopper Project is 200 miles from the deep sea port of Haines, Alaska, 75 miles northwest of Whitehorse, and 12 miles north of the Otter Falls hydroelectric generator.[80]

This copper porphyry–skarn project was acquired when CAVU (CAVVF) entered into an option for 70% interest, through a deal with Strategic Metals Ltd, a renowned Yukon project generator.[81]

And getting back to our geology lesson, skarn rock systems are smaller than other deposit types such as porphyries, but may occur in association with them. Skarn deposits are known to host valuable amounts of metals, including copper, gold, molybdenum, and others.[82]

World-Class Potential With Both Porphyry and Skarn

CAVU (CAVVF) believes the Hopper Project to be a massive copper target. One of the areas they are drilling has copper mineralization at the surface over a length of more than 4/5 of a mile.[83]

Over the past year, CAVU (CAVVF) proved the existence of a porphyry system with their first drilling on the claim.[84]

What’s more, a large skarn zone named Copper Castle was discovered on the claim, with 8 identified mineralized horizons less than 400 meters (1312 feet) deep.[85] These were found to contain copper, gold, silver, and some molybdenum.[86]

Out of nearly 9 miles of drilling, they drilled the highest grade copper intersect on the claim, which also contained significant amounts of gold and silver.[87][88]

Based on geochemical, geological, and geophysical data, the skarn can be further extended southward, with the potential for mineralization over a 1700 meter (5577 feet) strike length.

There are also untested skarn targets to both the north and south of similar size to Copper Castle, which is itself a proven gold and copper skarn zone.[89]

“If you have a porphyry system, that’s great. That can be a world class find on its own, because there’s nothing that excites major mining companies more from our standpoint than discovery of a new porphyry zone. But when you add on well-mineralized skarn around it, then you’re really dancing.”

— Dr. Jaap Verbaas, CAVU CEO & Director

CAVU (CAVVF) is now planning a larger and more comprehensive drilling program, starting in the late spring of 2022.[90] The company filed a National Instrument 43-101 Technical Report on the Hopper Project in February 2022 covering work completed to date as well as a detailed drill plan to advance the porphyry target.[91]

Another thing I should mention is that CAVU (CAVVF) did not approach their work the way most companies would, which is re-drilling the best holes in order to gain publicity and raise more money. Instead, CAVU (CAVVF) drilled new targets, with no twinning of holes.[92]

With the exciting results they’ve shown in this early stage growth project, the company believes that they’ve only encountered the outside edge of a massive porphyry system so far, and that grade will continue to increase as they move towards the source. This could offer investors a great deal of “blue sky” potential.*

Resource Investors Look for ESG Commitment

Today, investors put a higher priority on sustainable projects with high ESG (environmental, social, governance) targets. In fact, during 2016-2018, the value of assets in sustainable investment portfolios grew by 34% in major markets, including the U.S., Canada, Europe, and others.[93]

As CAVU (CAVVF) considers itself an integral piece to the decarbonization of the world, sustainability is in its very DNA.

“Today, mining companies must accurately monitor their environmental footprint so that mining and exploration occurs with minimal disturbance to flora and fauna,” points out CAVU CEO Dr. Jaap Verbaas.[94]

To that end, CAVU (CAVVF) takes their commitment towards low-disturbance work seriously. This means that, if metals are not encountered in significant quantities, flora and fauna will be able to move back in after exploration to ensure there are no long-term negative environmental effects.[95]

Respectful Cooperation With First Nations

CAVU’s (CAVVF) Yukon Hopper Project is located in Champagne and Aishihik traditional territory, which is a progressive and mining friendly First Nation.[96]

And for their exploration programs, CAVU (CAVVF) takes steps to hire locally, so that the benefits of its activity help local communities.

As CAVU CEO Dr. Verbaas points out, “One example of a local company is Castle Rock Enterprises, which is a Champagne and Aishihik First Nations-run company. They have been a tremendous help to our programme and have created all the roads on the Hopper Project since 2015.”[97]

CAVU’s (CAVVF) main high-grade copper skarn zone on the Hopper Project was named “Copper Castle” to give this First Nations-run company recognition for their work.[98]

The company has also appointed Allen Edzerza, a member of the Tahltan First Nation, as an Advisory Board Member.[99] He advises CAVU (CAVVF) on community matters and helps develop ways in which the company can support local hiring.[100]

Mr. Edzerza has broad experience negotiating with and for First Nations, both federal and provincial governments and industry across Canada. His insight and networks with First Nations across Canada could be a game-changer for CAVU’s (CAVVF) future exploration programs, First Nations engagements, and future acquisitions.[101]

But remember… There’s much more to the copper story as it rides the strong tailwinds of the push toward renewable energy and replacing outdated infrastructure.

Replacing Lead Pipes With Healthier Copper Pipes

Who hasn’t heard of the tragedy of Flint, Michigan, the most infamous example of water poisoning by lead in recent U.S. history?[102]

The sad fact is that millions of American homes still have service lines made out of lead, a neurotoxin[103] that kills many of our citizens prematurely — and is particularly dangerous to a child’s developing brain.[104]

Well, here’s some good news….

The Biden infrastructure bill will provide $55 billion to upgrade water infrastructure. It will replace lead service lines and pipes so that communities have access to clean drinking water.[105]

Experts advise that the only long-term solution to protect the health of the public is to remove lead pipes and replace them with new COPPER pipes.[106]

Copper lines are safe, long-lasting, reliable, and also prevent outside chemicals from contaminating the water system.[107]

With all these infrastructure trends coming together right now, you won’t want to miss the chance to take a look at copper companies such as CAVU Mining (CAVVF).

Wind and Solar Technology Depend on Copper

Wind and solar technology offer a clean and renewable alternative to obtaining power from fossil fuels — and copper will play an outsized role in the transition.

Generating clean energy from wind and solar typically requires 4 to 6 times more copper than fossil fuels.[108]

A typical 3-megawatt (MW) wind turbine contains up to 4.7 TONS of copper.[109]

Offshore wind farms use even more copper per MW than onshore wind farms, with copper cables accounting for around 82% of copper usage.[110]

When it comes to solar technology, the wiring, cables, and heat exchangers used in solar power systems use around 5.5 TONS of copper per MW.[111]

Copper usage in North America projects that 1.9 billion pounds of copper will be needed between 2018 and 2027 for 262 gigawatts (GW) of new solar installation alone.[112]

That’s why I’m sharing details about CAVU Mining (CAVVF), a potential North American solution to our growing copper needs and vulnerable supply chain.*

Bullish Copper Forecasts

Copper demand has been steadily growing. However, supply has not been able to keep pace.[113]

Unfortunately, within this decade, the world could face a massive shortfall of this critical metal. The Commodities Research Group (CRU) warns that over 200 copper mines could run out of ore before 2035, “…with not enough new mines in the pipeline to take their place.”[114]

Because of this, CRU projects a potential annual supply deficit of 4.7 million metric tons by 2030. This shortfall could double without the development of new copper mines.[115]

At the same time, market analyst Fitch Solutions expects a surge in copper demand — with the market set to grow 13% annually between 2021-2030.[116]

Copper prices more than doubled from their pandemic lows in 2020, gaining 26% in 2021.[117]

And while prices faltered slightly in early 2022, as of March 14th, copper is over $10,000 per metric ton.[118]

Goldman Sachs also reports that copper prices are “building towards a breakout” with the demand drivers of EVs and electrical grids.[119]

By 2025, Goldman Sachs predicts that copper will average $15,000 per metric ton — about 50% more than current prices.

Bank of America is even more bullish, projecting that copper prices may hit $20,000 per metric ton by 2025 — around double today’s price.[120]

As you’ve seen here in this report, the demand for copper is growing quickly to fuel our green revolution.

And Russia’s invasion of Ukraine may further accelerate the shift to EVs — and away from fossil fuels.[121]

That’s why the biggest winners among the newer companies could be the junior copper miners such as CAVU (CAVVF), who are ready to expand this year.

And that’s why I see…

12 Reasons Why CAVU (CAVVF) Could Be the Best Copper Play for 2022*

The junior copper exploration company CAVU (CAVVF) is well worth your consideration, and here are some major reasons why:

-

Copper Essential to a Strong Military Defense

Copper is the second most widely used material by the entire U.S. Department of Defense.[122] From body armor to the vehicles, aircraft, and ships necessary to defend our nation and its allies, copper is truly an essential mineral to keep our troops safe.[123]

-

Copper’s Vital Role in the Green Revolution

When it comes to a clean energy future, copper is the most critical mineral.[124] Don’t forget President Biden’s $1.2 trillion infrastructure bill, with hundreds of billions earmarked for projects requiring copper.[125] From electric vehicles to electric grids to energy storage, copper plays a crucial role. According to Barron’s, “the green economy will be a gold mine for copper.”[126]

-

The Russia Crisis Has Stepped Up the Timetable on Green Energy

Russia’s invasion of Ukraine has the world seeking an even more rapid transition from its dependence on oil and fossil fuels to sources of clean energy.[127]

-

Soaring Copper Demand With Dwindling Supply

Over 200 copper mines are projected to run out of ore before 2035, including a large Chilean mine.[128] We face a global shortage of the red metal during this decade, with supply unable to keep pace.[129] Some financial experts predict that, by 2025, copper prices may even double due to increasing demand.[130] According to EY Americas, “The strong demand outlook and recent price uptrend provide miners opportunities for aggressive exploration.”[131]

-

Unlimited Applications for Copper

Not even including the specific needs for defense and the green energy revolution we’ve discussed, copper is used pretty much everywhere. The electrical uses of the metal, including power transmission and generation, building wiring, telecommunication, and electronic products, account for about 75% of total copper use.[132] Building construction is the largest market, followed by electronics and electronic products, transportation uses, industrial machinery, and consumer and general products.[133] Copper will always be needed!

-

North American Copper

The U.S. government increasingly plans to strengthen financial and logistical partnerships with Canada’s mining sector. This is all part of a strategy to boost regional production of minerals used to make electric vehicles and counter Chinese competitors.[134]

-

Zero Time Wasted

CAVU (CAVVF) acquired their flagship Yukon property in 2020 and went from acquisition to drilling in only four months. Copper mineralization was encountered in every hole, with no twinning of historic holes.[135] The company is planning a larger, more comprehensive drilling program, starting in the late spring of 2022.[136]

-

Five Potential Salable Minerals in One Claim*

In addition to copper, CAVU’s Yukon porphyry-skarn Hopper Project has shown significant gold, silver, and molybdenum mineralization. Additionally, there is potential for magnetite, an iron-bearing mineral, as an economic by-product.

-

Management Expertise

CAVU (CAVVF) has assembled a top-notch management team, including corporate professionals as well as technical experts with decades of experience. CEO Dr. Jaap Verbaas is an exploration geologist with a Ph.D. from Simon Fraser University. Dr. Luke Bickerton, VP of Exploration, is a geoscientist with a a Ph.D. from Laurentian University with experience in regional mapping, mineral deposit research, and extensive metal exploration.[137]

-

Cooperation With First Nations Groups

With the Hopper Project located in their traditional territories, CAVU (CAVVF) has fostered strong and respectful connections with First Nations Groups. The company has agreed to consultation prior to exploration, and committed over 10% of their exploration budget to First Nation-run companies.[138] CAVU has also appointed Allen Edzerza of the Tahltan First Nation as an Advisory Board Member to represent the indigenous perspective.[139]

-

British Columbia Copper Project Increases Shareholder Value

In addition to their Yukon Hopper Project, CAVU’s assets include the recently acquired Quesnel Copper Project in British Columbia. This early-stage project with discovery potential* was acquired through staking.[140] British Columbia is a major mining region historically, and a leading producer of copper.[141]

-

Ripe for Potential Takeover by Majors*

CAVU’s (CAVVF) goal is to build projects that are advanced and permittable in good jurisdictions, with a friendly stakeholder, preparing them for majors to take over once the supply gap kicks in. Majors can become excited by the discovery of a new porphyry zone, as they tend to be large and sustain a long mine life.

Lock In Your Position With CAVU (CAVVF) Mining Corp. Today

Refinitiv’s Karen Norton reports: “The copper bulls have the bit between their teeth in terms of green energy and demand prospects.”[142]

The push to cut carbon emissions has even led some analysts to call copper “the new black gold.”[143]

According to KITCO, the “copper boom is likely to last for decades, prompting a global hunt for new supply.”[144]

If you wish to have an opportunity to be among the early bird big winners in the coming copper-based clean energy revolution*, you should show this report to your investment advisor or broker immediately.

CAVU Mining Corp. (CAVVF) is engaged in the acquisition, exploration and development of mineral projects containing metals used in green technologies and the renewable energy sector. The company is currently focused on the exploration of its flagship Hopper-Copper Project in the Yukon and continues to evaluate complementary mineral projects in mining-friendly jurisdictions such as British Columbia.[145]

While investing in their company has a potential for higher rewards than other larger mining operations, it also comes with higher risk. And, of course, past performance is no guarantee of future results.*

I am not an investment advisor. But my rule and caution to all my readers is never invest more than you can afford to lose. And do not chase losses. If prices slide, it’s important to resist the temptation to “average down.”*

And to minimize your risk, any investment you might make in CAVU (CAVVF) should be part of a wider asset allocation strategy in your portfolio.

Regardless, I believe my analysis of the potentially huge reward of CAVU Mining (CAVVF) is a good one.*

I wish you much success in all your investments.

– J. Daryl Thompson

Daily Trade Report

P.S. Still want more information on CAVU Mining Corp. (CAVVF)?

P.S. Still want more information on CAVU Mining Corp. (CAVVF)?

I’d like to offer you access to CAVU Mining Corp.’s Investor Presentation, which you can have at no charge.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the InvestingTrends newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

This paid advertisement includes a stock profile of CAVU Mining Corp. (CAVVF). To enhance public awareness of CAVVF and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately two hundred and fifty thousand ($250,000.00) USD to cover the costs associated with this advertisement for a period beginning 26 January 2022 and currently set to end 30 May 2022. In connection with this effort, Promethean has paid the author of this advertisement, J. Daryl Thompson, two thousand five hundred ($2,500.00) USD in cash out of the total budget. The website hosting this advertisement, Daily Trade Report, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Daily Trade Report have been paid to host this advertisement. As a result of this advertisement, Daily Trade Report may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid .J. Daryl Thompson is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Daily Trade Report website, some or all of Promethean, Daily Trade Report, Summit, or J. Daryl Thompson, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of CAVVF’s and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of CAVVF’s, increased trading volume, and possibly an increased share price of CAVVF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended.

To more fully understand the Daily Trade Report website or service, please review its full Disclaimer and Disclosure Policy located here.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

[2] https://mineralsmakelife.org/blog/minerals-and-metals-play-a-key-role-in-our-national-defense/#:~:text=Copper%20is%20the%20second%20most,systems%20and%20other%20defense%20technologies

[3] https://www.investopedia.com/terms/d/doctor-copper.asp

[4] https://mineralsmakelife.org/blog/minerals-and-metals-play-a-key-role-in-our-national-defense/#:~:text=Copper%20is%20the%20second%20most,systems%20and%20other%20defense%20technologies

[5] https://www.ey.com/en_us/mining-metals/long-term-competitiveness-in-the-copper-mining-sector

[6] https://www.legacyresearch.com/the-daily-cut/russias-war-will-accelerate-the-shift-to-evs/

[7] https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

[8] https://www.ey.com/en_us/mining-metals/long-term-competitiveness-in-the-copper-mining-sector

[9] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[10] https://www.mining.com/goldman-sees-copper-price-breakout-risk-of-extreme-scarcity-episode/

[11] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[12] https://www.investopedia.com/terms/d/doctor-copper.asp

[13] https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/copper-price-update:-q2-2021-in-review/

[14] https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

[15] https://www.legacyresearch.com/the-daily-cut/russias-war-will-accelerate-the-shift-to-evs/

[16] https://thehill.com/opinion/technology/594213-our-mineral-supply-chain-is-a-national-security-imperative

[17] https://thehill.com/blogs/congress-blog/homeland-security/238483-got-copper-new-pentagon-report-spotlights-key-role-of

[18] https://mineralsmakelife.org/blog/minerals-and-metals-play-a-key-role-in-our-national-defense/#:~:text=Copper%20is%20the%20second%20most,systems%20and%20other%20defense%20technologies

[19] https://mineralsmakelife.org/blog/the-top-eight-minerals-that-support-national-defense/#:~:text=The%20U.S.%20military%20relies%20on,its%20ability%20to%20resist%20corrosion.

[20] https://mineralsmakelife.org/blog/the-top-eight-minerals-that-support-national-defense/#:~:text=The%20U.S.%20military%20relies%20on,its%20ability%20to%20resist%20corrosion.

[21] https://www.vortexmetals.com/best-industrial-uses-for-copper-plate/

[22] http://www.tungsten-alloy.com/tungsten-copper-military.html

[23] https://www.copper.org/publications/newsletters/discover/1992/Ct73/shuttle_engine.html

[24] https://beryllium.com/uses-and-applications/defense-and-security

[25] https://thehill.com/blogs/congress-blog/homeland-security/238483-got-copper-new-pentagon-report-spotlights-key-role-of

[26] https://thehill.com/blogs/congress-blog/homeland-security/238483-got-copper-new-pentagon-report-spotlights-key-role-of

[27] https://www.mining.com/web/copper-the-most-critical-metal/

[28] https://www.bloomberg.com/graphics/2021-materials-silver-to-lithium-worth-big-money-in-clean-energy/

[29] https://www.mining.com/web/copper-the-most-critical-metal/

[30] https://www.mining.com/web/billionaire-miner-sees-copper-as-a-national-security-issue/

[31] https://www.mining.com/web/billionaire-miner-sees-copper-as-a-national-security-issue/

[32] https://www.copper.org/environment/sustainable-energy/electric-vehicles/

[33] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[34] https://www.copper.org/environment/sustainable-energy/electric-vehicles/

[35] https://www.copper.org/environment/sustainable-energy/electric-vehicles/

[36] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[37] https://www.copper.org/environment/sustainable-energy/electric-vehicles/

[38] https://cte.tv/transition-us-fleet-report/

[39] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[40] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[41] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[42] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[43] https://www.vox.com/recode/22812748/storm-hurricane-heatwave-climate-infrastructure-smart-grid-ai

[44] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[45] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[46] https://www.copper.org/environment/sustainable-energy/grid-infrastructure/

[47] https://www.copper.org/environment/sustainable-energy/grid-infrastructure/

[48] https://www.theguardian.com/us-news/2021/nov/09/copper-mining-reveals-clean-energy-dark-side

[49] https://www.energy.gov/oe/activities/technology-development/grid-modernization-and-smart-grid/role-microgrids-helping

[50] https://www.washingtontimes.com/news/2018/may/20/a-secure-energy-grid-starts-with-copper/

[51] https://www.washingtontimes.com/news/2018/may/20/a-secure-energy-grid-starts-with-copper/

[52] https://www.statista.com/statistics/948036/china-forecasts-for-copper-demand/#:~:text=China’s%20demand%20for%20copper%20amounted,around%203.5%20million%20metric%20tons.

[53] https://www.foreignaffairs.com/articles/china/2020-02-28/how-china-became-worlds-leader-green-energy

[54] https://www.mining.com/web/copper-the-most-critical-metal/

[55] https://www.statista.com/statistics/273637/copper-reserves-by-country/

[56] https://www.cnn.com/2022/03/12/energy/us-gas-prices-russia-oil/index.html

[57] https://www.wsj.com/articles/russia-set-to-ban-commodity-exports-following-western-sanctions-11646768260?mod=article_inline

[58] https://www.statista.com/statistics/254877/us-copper-imports-by-major-countries-of-origin/

[59] https://www.mining.com/goldman-sees-copper-price-breakout-risk-of-extreme-scarcity-episode/

[60] https://www.mining.com/web/copper-the-most-critical-metal/

[61] https://www.mining.com/web/copper-the-most-critical-metal/

[62] https://www.kitco.com/commentaries/2022-01-17/Copper-boom-likely-to-last-for-decades-prompting-a-global-hunt-for-new-supply.html

[63] https://www.statista.com/topics/3067/canada-s-mining-industry/#dossierKeyfigures

[64] https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/minerals-metals-facts/minerals-and-the-economy/20529

[65] https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/minerals-metals-facts/minerals-and-the-economy/20529

[66] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[67] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[68] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[69] https://www.mining.com/antofagasta-profit-dividend-hit-records-on-soaring-copper-prices/

[70] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[71] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[72] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[73a] Measured and Indicated resources, as per Casino Project Form 43-101F1, as filed on SEDAR.ca on August 2, 2022 by Western Copper and Gold. Note that resources on the Casino Project do not indicate resources will be defined on the Hopper Project.

[73b] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[74] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[75] https://www.visualcapitalist.com/everything-you-need-to-know-about-copper-porphyries/

[76] https://www.visualcapitalist.com/everything-you-need-to-know-about-copper-porphyries/

[77] https://www.visualcapitalist.com/everything-you-need-to-know-about-copper-porphyries/

[78] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[79] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[80] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[81] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[82] https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/skarn-copper-deposits/

[83] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[84] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[85] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[86] CAVU Mining YouTube video 2022 https://www.youtube.com/watch?v=NC5ZS7jnrk4

[87] CAVU Mining YouTube video 2022 https://www.youtube.com/watch?v=NC5ZS7jnrk4

[88] https://www.google.com/url?q=https://cavumining.com/2021/09/27/cavu-mining-intersects-184-cueq/&sa=D&source=docs&ust=1647625714228979&usg=AOvVaw3UomlN8CF1El_9-9OGsOCR

[89] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[90] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[91] https://CAVUmining.com/2022/02/16/CAVU-mining-files-hopper-43-101-and-amends-project-portfolio/

[92] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[94] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[95] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[96] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[97] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[98] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[99] https://CAVUmining.com/board/

[100] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[101] https://CAVUmining.com/board/

[102] https://www.washingtonpost.com/outlook/2022/03/06/biden-is-right-americas-lead-pipes-need-be-replaced-heres-why/

[103] https://www.inquirer.com/news/nation-world/biden-led-pipes-removal-drinking-water-20211216.html

[104] https://www.nrdc.org/stories/what-you-need-know-about-lead-service-line-replacement

[105] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[106] https://www.nrdc.org/stories/what-you-need-know-about-lead-service-line-replacement

[107] https://www.copper.org/applications/plumbing/water_service/why_copper.html

[108] https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/#:~:text=Copper%20in%20Energy%20Storage&text=Copper%20wiring%20and%20cabling%20connects,has%20been%20announced%20and%20commissioned.

[109] https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/#:~:text=Copper%20in%20Energy%20Storage&text=Copper%20wiring%20and%20cabling%20connects,has%20been%20announced%20and%20commissioned.

[110] https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/#:~:text=Copper%20in%20Energy%20Storage&text=Copper%20wiring%20and%20cabling%20connects,has%20been%20announced%20and%20commissioned.

[111] https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/#:~:text=Copper%20in%20Energy%20Storage&text=Copper%20wiring%20and%20cabling%20connects,has%20been%20announced%20and%20commissioned.

[112] https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/#:~:text=Copper%20in%20Energy%20Storage&text=Copper%20wiring%20and%20cabling%20connects,has%20been%20announced%20and%20commissioned.

[113] https://www.ey.com/en_us/mining-metals/long-term-competitiveness-in-the-copper-mining-sector

[114] https://www.mining.com/web/copper-the-most-critical-metal/

[115] https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

[116] https://www.mining.com/green-copper-demand-to-average-13-annual-growth-over-next-10-years-report/

[117] https://www.mining.com/antofagasta-profit-dividend-hit-records-on-soaring-copper-prices/

[118] https://markets.businessinsider.com/commodities/copper-price

[119] https://www.mining.com/goldman-sees-copper-price-breakout-risk-of-extreme-scarcity-episode/

[120] https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

[121] https://www.legacyresearch.com/the-daily-cut/russias-war-will-accelerate-the-shift-to-evs/

[122] https://mineralsmakelife.org/blog/minerals-and-metals-play-a-key-role-in-our-national-defense/#:~:text=Copper%20is%20the%20second%20most,systems%20and%20other%20defense%20technologies

[123] https://mineralsmakelife.org/blog/the-top-eight-minerals-that-support-national-defense/

[124] https://www.mining.com/web/copper-the-most-critical-metal/

[125] https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

[126] https://www.barrons.com/articles/green-economy-will-be-a-gold-mine-for-copper-51620424287

[127] https://www.caseyresearch.com/daily-dispatch/russias-war-will-accelerate-the-shift-to-evs/

[128] https://www.kitco.com/commentaries/2022-01-17/Copper-boom-likely-to-last-for-decades-prompting-a-global-hunt-for-new-supply.html

[129] https://www.mining.com/web/copper-the-most-critical-metal/

[130] https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

[131] https://www.ey.com/en_us/mining-metals/long-term-competitiveness-in-the-copper-mining-sector

[132] https://www.usgs.gov/centers/national-minerals-information-center/copper-statistics-and-information

[133] https://www.usgs.gov/centers/national-minerals-information-center/copper-statistics-and-information

[134] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[135] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[136] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[137] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[138] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf

[139] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[140] https://issuu.com/businessenquirer/docs/businessenquirer_issue104_pages

[141] https://www.micromine.com/a-glimpse-into-the-world-of-mining-in-british-columbia/

[142] https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/copper-trends/

[143] https://think.ing.com/articles/listen-why-copper-is-the-new-black-gold

[144] https://www.kitco.com/commentaries/2022-01-17/Copper-boom-likely-to-last-for-decades-prompting-a-global-hunt-for-new-supply.html

[145] https://CAVUmining.com/wp-content/uploads/2022/02/CAVU (CAVVF)-Corporate-presentation-Q1-2022.pdf