Sponsored

The Lithium Wars!

U.S. vs. China

In June 2021, National Security Advisor Jake Sullivan and National Economic Council Director Brian Deese issued their long-awaited report in response to President Biden’s Executive Order 14017.[1]

The report declared lithium “essential” to U.S. economic security,[2] and “critical” to U.S. national security.[3] Global demand for lithium is expected to grow 4,000% by 2040.[4]

China currently controls 80% of the global lithium market.[5]

Sullivan and Deese concluded: The United States must secure reliable and sustainable supplies of critical minerals [such as lithium]… to ensure resilience across U.S. manufacturing and defense needs.[6]

One little-known American lithium exploration company may be one of the keys to the U.S. winning the lithium wars. Get to know Ameriwest Lithium (AWLIF) now — before it becomes a new Goliath in today’s high-stakes energy race.*

By James Hyerczyk

Beneath the dust and heat of the desolate Nevada desert, a fortune lies below the ground. No it’s not gold. And it’s not oil.

Instead, it’s a soft, silver-white metal—the lightest metal in the world… so light it can float on water. Its chemical symbol is Li.

It’s called lithium. Sometimes referred to as “white gold.”[7] Thanks to a volcanic eruption millions of years ago, this patch of the Nevada desert contains the largest known lithium deposit in the U.S. – if not the world.[8]

No doubt, you’ve heard of lithium.

It’s the not-so-secret ingredient in lithium-ion batteries – the batteries that will power our renewable, clean-energy future mandated by President Biden.

Lithium batteries are the leading technology in electric vehicles (EVs), laptops, computers, mobile phones, pacemakers, hearing aids, drones, even remote-control toys… and so much more.

The U.S. military has been using lithium batteries in radios, thermal imagers and other portable devices for over a decade. Over the next five years, the Department of Defense expects to expand the use of lithium batteries into military vehicles, ships, aircraft and missiles.[9]

With the demand for lithium batteries skyrocketing, the U.S. government has officially classified lithium as essential and critical to our economic and national security.[10]

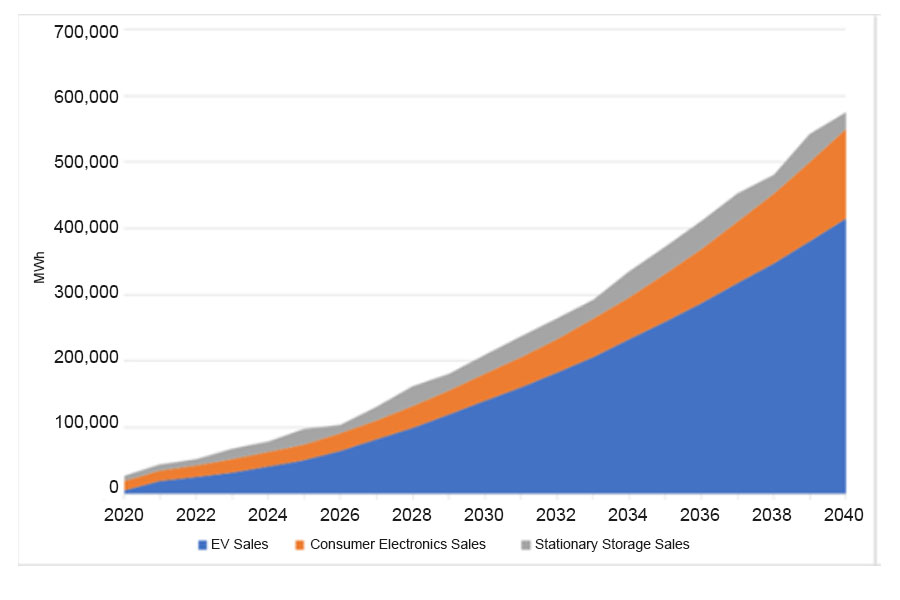

Projected U.S. Battery Demand[11]

Like the oil boom of the last century, the coming lithium explosion could make everyday investors very wealthy.* And one lithium resource company, Ameriwest Lithium (AWLIF), is worth a look.

Hello, I’m James Hyerczyk.* I have spent nearly 40 years as a market technical analyst, market researcher, educator and trader. I began my career in 1982 as a futures market analyst for professional traders. And to be frank, I have never seen such an amazing opportunity for everyday investors to potentially grow significantly richer than I see today… with the world commitment to transition to clean energy, and as a result, the soaring demand for lithium.CE

The Race for Lithium

Make no mistake. A new energy race is underway between the U.S. and China. With echoes of past wars over oil, the U.S. and China are now fighting to procure new sources of lithium – the key to transitioning away from fossil fuels to clean energy.

Thankfully, lithium is not a rare mineral. It’s found in salt-lake brines (the most common source), sediment, clays, hot springs, seawater, volcanic rocks and ash, and other rocks too.

But the explosive growth in EVs, mobile phones, energy storage units for wind and solar energy, and other clean technologies, suggests that lithium will be the hottest in-demand mineral for decades.

The leader in lithium raw material resources and lithium battery production could determine which country dominates economically and technologically in the 21st century.

Both the U.S. and China seem determined to win the lithium war.

Right now, Chinese chemical companies account for 80% of the world’s total output of raw materials for making lithium batteries. China is rapidly buying up stakes in lithium mining operations in Australia and South America.[12]

China also dominates lithium battery production. In fact, 101 of the 136 lithium battery plants are located in China.[13] As a result, Chinese makers of lithium batteries exert a great deal of influence over the global market.

“The high-capacity [lithium]battery market is arguably one of the most critical to our Nation’s interests.” [14]

Jake Sullivan, National Security Advisor and Brian Deese, National Economic Council Director

That’s why domestic lithium sources in Nevada may be so critical to the U.S. in the race for dominance.

It’s why the lithium exploration company, Ameriwest Lithium (AWLIF), is important to the future of clean energy… and could provide investors significant opportunity in the world’s new energy race.*

With the rising demand for lithium, former President Trump in October 2020 declared a national emergency regarding lithium mining operations. He cited lithium as “indispensable” to the country. Trump ordered the U.S. to enhance its mining capacity. He declared the reliance on foreign imports of lithium (as well as other critical minerals) “an extraordinary threat to the economy and security of the U.S.”[15]

President Biden also recognizes the threat China is to the global lithium supply chain… and issued Executive Order 14017 for an in-depth analysis and recommendations from his National Security Advisor and Economic Director to strengthen the lithium supply chain from mining raw materials to lithium battery production.

One thing the pandemic revealed is the weakness of foreign dependence on critical materials such as lithium. The pandemic is forcing the U.S. to look locally for must-have resources.

In addition, Biden has made the transition to clean energy one of his administration’s top priorities. For instance, in one of his earliest Executive Orders, Biden ordered the entire federal fleet of vehicles (645,000 vehicles)[16] to transition to EVs by 2035.[17]

This is a huge boon to America’s fledgling EV market… and a catapult for greater lithium demand. But that’s not all. Automakers are jumping on the EV bandwagon too.

And domestically located lithium properties, such as those owned by Ameriwest Lithium (AWLIF), and their shareholders, could reap the profitable benefits of this skyrocketing EV demand.*

“New EV’s Popping Up Like Weeds!”

The race for lithium is being driven by the worldwide demand for electric vehicles. Lithium is ideal for electric car batteries. Its lightweight, stores lots of energy and can be repeatedly recharged.[18] There’s no question now that the EV market could soar over the next few years.*

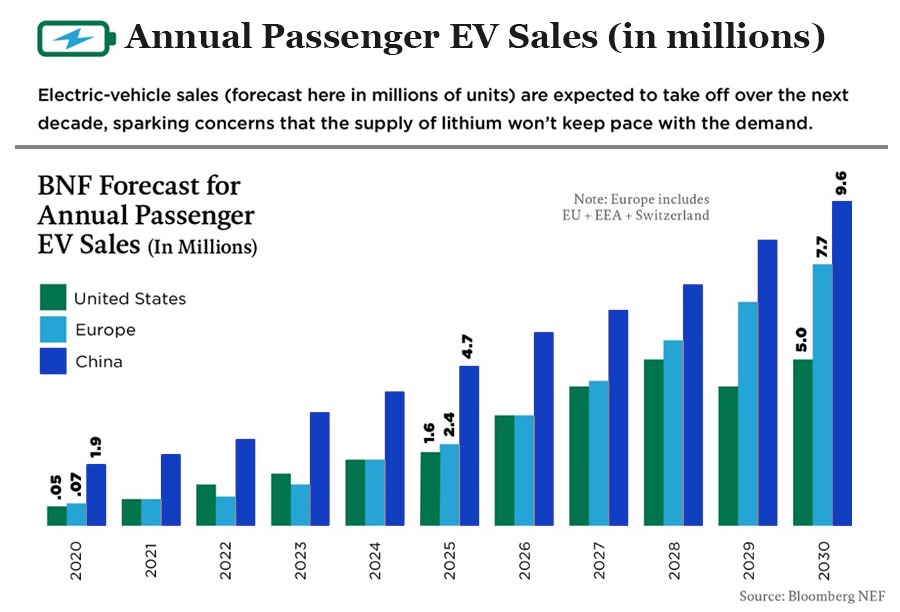

In 2030, the U.S. expected to sell 5 million EVs.[19] Today, China sells the most EVs than anyone else, capturing 50% of the EV market.[20]

Take a look at how fast EVs are projected to spread throughout the world in the next decade.

And energy analysts predict that by 2040, 1 in 2 cars sold in the world will be electric.[21]

Given the aggressive trade battle between the U.S. and China, it’s no wonder that Congress considers the growth in the EV market (and its’ reliance on lithium) as a national security issue. [22] What’s more as Sullivan and Deese warn in their report, “China stands out for its aggressive use of measures—many of which are well outside globally accepted fair trading practices.” [23]

As you can see, China and Europe are already far ahead of the U.S. in demanding electric cars, trucks and SUVs. But U.S. automakers are ramping up their EV production. Tesla is no longer the “oddball” maker of electric cars. Every automaker is hoping to get a piece of Tesla’s EV action.

U.S. automakers see the writing on the wall. More Americans are ready to move away from gas engines (especially with rising gas prices) – and even hybrid cars – to full-on electric vehicles.

It’s why General Motors – the king of U.S. automakers – announced it will transition its entire production to electric vehicles by 2035. Their stated goal is to “put everyone into an electric vehicle” – with every style of vehicle and price point.[24]

This is a big deal. GM sells millions of cars every year – an average of nearly 9 million vehicles every year since 2010.[25] Last year, 3% of GM’s sales were EVs.[26]

Imagine the soaring demand for lithium car batteries now that the U.S. government, GM and other automakers are committing to all-electric fleets.

For instance, Volkswagon is committing $55 billion to electrifying its cars and SUVs – and like GM plans to produce only EVs by 2035.[27] Today, almost 40 automakers are making EVs worldwide.[28] A lot of lithium batteries are needed to keep up with EV demand.

According to MotorTrend Magazine, “we’re seeing new electric vehicles pop up like weeds.”[29] Luxury EV cars are being made by Mercedes, BMW and Jaguar as well. [30]

Corporations are getting on board as well to end reliance on oil and gas and de-carbonize the planet. For instance, Amazon has committed to putting 100,000 EV delivery vans on the road by 2030.[31] And over 100 multinational companies have joined Amazon to target zero carbon emissions by 2040.[32]

Clean energy is here… and like it or not, it is an unstoppable trend. But to get to a clean future, lots and lots of lithium is desperately needed.

Right now, EVs are a critical driver of the demand for lithium batteries. The United States must quickly find new supplies of lithium as automakers ramp up manufacturing of electric vehicles. I believe winning the Lithium War is imperative for the future viability of the U.S. auto industry.

Ameriwest Lithium (AWLIF), with its substantial lithium property holdings in the Nevada desert,[33] may emerge as the critical new resource U.S. automakers need to survive the transition to clean energy.

Smart investors are turning to lithium investments to power their portfolio surges. And I urge you to consider Ameriwest for your portfolio.*

While EVs grab the spotlight in the lithium battery market, another clean energy industry is also exploding and pushing demand for lithium into the stratosphere.

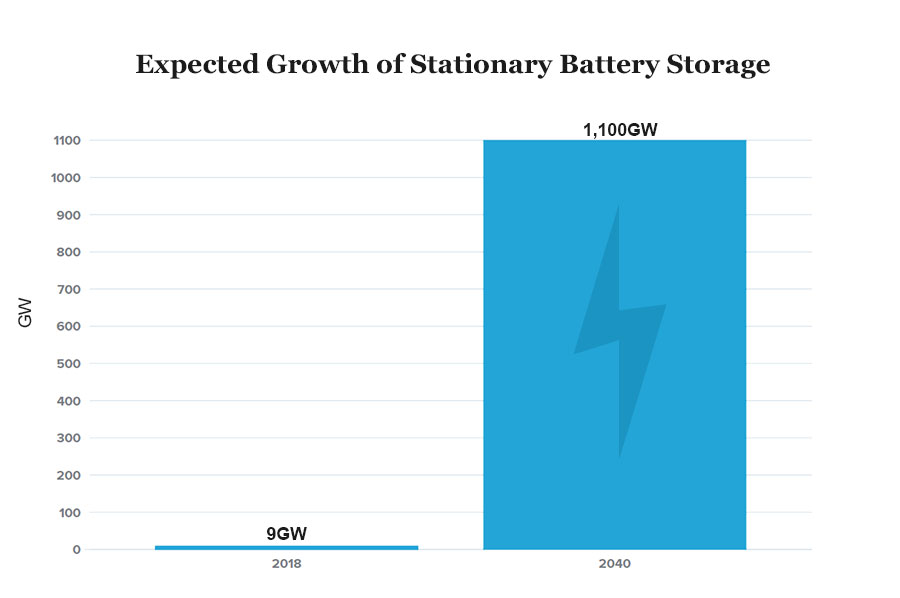

Stationary Battery Storage About to go Seismic

As the popularity of renewable energy – solar and wind – continues to relentlessly rise, the biggest challenge to renewables remains. How do you store energy produced by sunlight and wind to use on calm and cloudy days and also at night?

A solution is energy storage batteries which are made from lithium… and building huge battery “parks” to deliver the stored energy like the one you see here.

Elon Musk of Tesla fame is behind Moss Landing Battery Park in Monterey, California, the largest battery park in the world. Moss Landing stores energy gathered from the sun and wind and transfers electricity into the nation’s electric grid.[34]

Stationary storage systems powered by lithium batteries are seeing record growth all over the world. Plans for new large-scale lithium battery grids are underway in London, Lithuania, Australia, Saudi Arabia and Chile.[35]

China is also on the energy storage bandwagon. It plans to increase its energy from wind and solar 140% in the next decade and be carbon neutral by 2060. Energy storage companies will be racing to keep up with China’s demand and grab market share.[36]

And it seems they will need lithium to build their energy storage grids and battery parks. Lots and lots of lithium.

Bloomberg NEF says that “renewables combined with battery storage are already an economically viable alternative to building new gas peaker plants” that burn natural gas for power.[37]

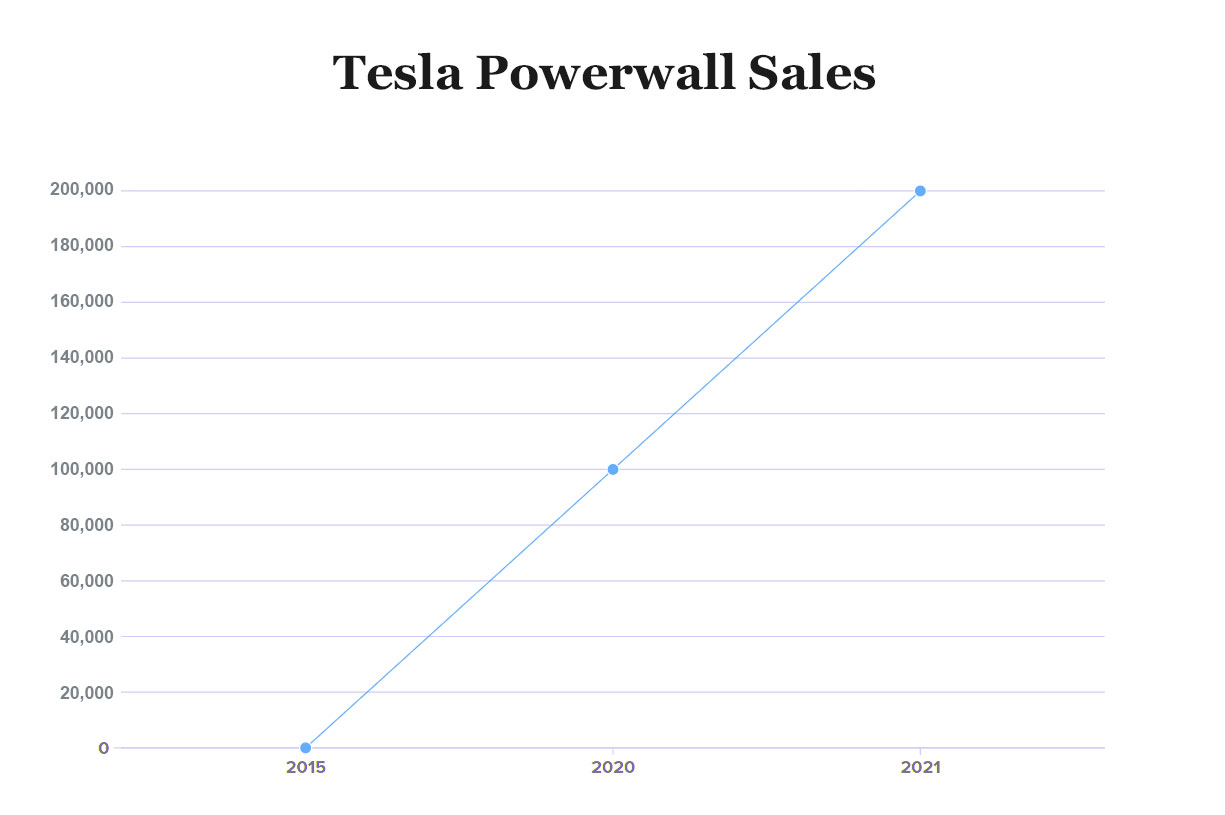

In addition to large battery parks, you can also get home battery packs. Back in 2015, Tesla launched the home battery storage market with a product he called Tesla Powerwall.[38] This large lithium battery stores energy from a homeowner’s solar roof generated during the day for use when the sun isn’t shining.

Musk also created large battery storage for industrial use called the Tesla Powerpack.

Tesla doubled sales of its Powerwall from 2020 to 2021. And Tesla has a substantial backlog of orders according to Tesla’s CFO saying, “the volume of installations will continue to soar in coming months.”[39]

Lithium batteries could play a pivotal role as the U.S. – and the world – transitions to a clean energy future and making fossil fuels obsolete.[40] What’s more, the large-scale battery energy storage will power a more reliable electric grid by integrating renewable energy into the grid.

According to Sullivan and Deese’s report, the U.S. has increased renewable megawatt hours (MWh) by 240% in a single year thanks to battery storage systems. And lithium batteries accounted for 99% of that increase.[41]

Over the next 2 years, the U.S. is projected to become the largest global market for stationary battery storage.[42] And by 2050, China and the U.S. (in that order) are projected to be the top two markets.*

“Large capacity batteries for EVs and grid storage will be essential to U.S. economic and national security.”[43]

Jake Sullivan, National Security Advisor and Brian Deese, National Economic Council Director

For the U.S. to continue its goal of clean, renewable energy, it must find new domestic sources of lithium. Ameriwest Lithium (AWLIF) may soon become a new Goliath in lithium exploration and resource generation that the U.S. desperately needs to win the lithium war with China.*

Sullivan and Deese are confident the U.S. will win the Lithium War. They conclude… “the opportunity for the United States to secure a leading position in the global battery market is still within reach if the Federal Government takes swift and coordinated action.”[44]

With the future of U.S. economic and national security at stake – and China’s relentless lithium-grab – the Biden administration is committed to securing new sources of lithium to secure our clean energy future.

And this is only good news for lithium resource companies like Ameriwest Lithium (AWLIF). With the powerful backing of the U.S. government, all lithium stocks, but especially small lithium stocks, could skyrocket!*

The U.S. Government Jumps In!

In their recent eye-opening report to the president, Sullivan and Deese call for targeted investments in the “domestic extraction and refining of lithium”[45] as well as grant programs and loans to catalyze private capital. (Another boon to lithium exploration companies like Ameriwest.)

After the Sullivan and Deese report was issued in early June, the Department of Energy was quick to announce $200 million in funding to help strengthen the domestic lithium battery supply chain from lithium mining to battery production.[46]

Energy Secretary, Jennifer Granholm declares, “This is a race to the future that America is going to win.” [47]

Since domestic production of lithium has been declared a national emergency, mining companies are pressing Biden to include a $10 billion grant program in his new infrastructure bill.[48]

Biden is also asking for $174 billion to expand the EV national network of charging stations from 100,000 to 500,000 across the country.[49]

Uncle Sam already offers a federal tax credit of up to $7,500 if you purchase an EV. This is a credit not a deduction, meaning you subtract the credit directly from your tax bill… not your income.[50] Sullivan and Deese also recommend revitalizing manufacturing tax credits for lithium batteries to spur domestic production.[51]

Energy Secretary Granholm is more blunt. She urges, “America is in a race against economic competitors like China to the EV market – and the supply chains for critical materials like lithium will determine whether we win or lose. We have to create our own supply here at home in America.”[52]

Junior lithium explorers like Ameriwest Lithium (AWLIF) may hold the key to NEW domestic lithium resources the U.S. desperately needs to transition America to clean energy… and stop China from gobbling up every ounce of lithium in the world.

Let’s take a closer look at this gem of a lithium resource company exploring for lithium right here in the United States.

The U.S. Lithium Hotspot

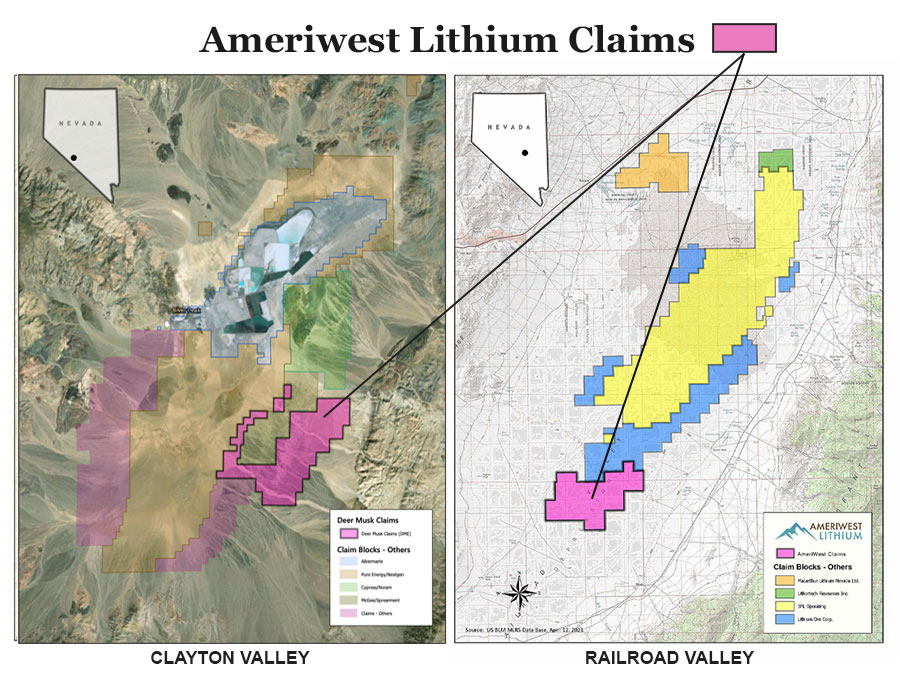

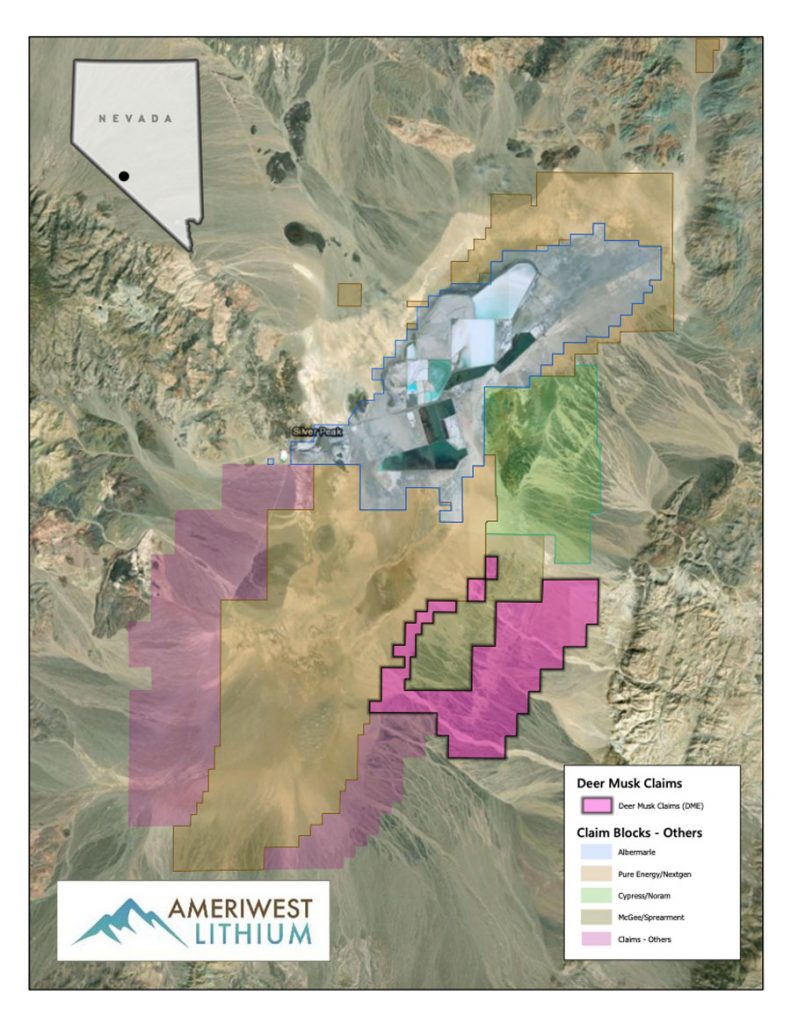

Ameriwest Lithium (AWLIF) is a junior resource company with significant holdings in the hottest area of the United States for substantial lithium discoveries – Nevada’s Clayton Valley and Railroad Valley.[53]

Nevada’s governor, Steve Sisolak pledges to make Nevada vital to the “new green energy economy”… especially Nevada’s potential as the state for lithium mining.

Gov. Sisolak says, Nevada has “the opportunity to become to energy what Wall Street is to finance… or what Silicon Valley is to technology.”[54]

In fact, Nevada ranks #1 in the investment attractiveness index out of 77 regions worldwide according to Fraser Institute’s recent survey of mining companies.[55]

The U.S. Geological Survey calls Clayton Valley “the best-known deposit in the world” for lithium.[56]

Right now, the only lithium-producing operation in America is located in Clayton Valley, Nevada. It’s Albemarle’s Silver Peak Mine, which extracts lithium from salt brine.[57]

And spanning across a massive 5,500 acres located about 5 miles from the active Silver Peak Mine is… Ameriwest’s Deer Musk East project.[58]

“Ameriwest is strategically located in the same lithium-rich basin as Silver Peak and other recent discoveries. We hope to mine lithium from the brines as well as lithium-rich mudstones and claystones, subject to exploration success,” says CEO David Watkinson.

Clayton Valley is what’s known as a closed basin. For millions of years, water has been running off the surrounding mountains and gathering in the closed basin. Over time the water evaporates in the hot desert sun leaving behind lithium.[59]

“Clayton Valley currently hosts the only producing lithium brine mine in North America. That’s why Clayton Valley is such a sweet spot for Ameriwest to explore for lithium. Both brine and sedimentary deposits have been identified there and are being advanced by a number of lithium exploration companies. From a geological point of view, it’s relatively easy to find lithium deposits in Clayton Valley, in part due to the success of our competitors and the knowledge gained from the exploration work they have already done,” CEO Watkinson continues.

Massive Lithium Deposit Potential

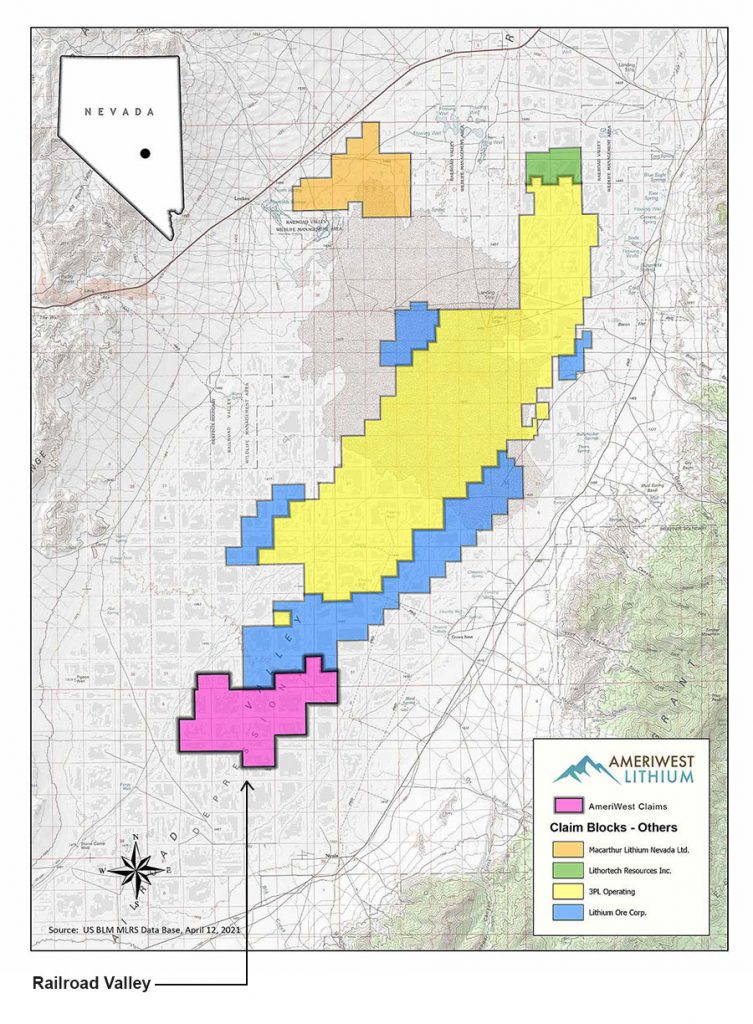

In just the past few months, Ameriwest more than doubled the size of its Nevada Holdings with 6,200 acres of mineral claims in Railroad Valley, Nevada – 124 miles to the east of Clayton Valley.

What makes Railroad Valley so promising is the convergence of factors favorable for lithium brine formation. Lithium brine operations typical have higher margins (almost double) that of lithium hard-rock operations.[60]

For one thing, Railroad Valley has a playa area about 3.5 times that of Clayton Valley (350 sq. km.) and a depth of over two times Clayton Valley (1,200-2,900 m to the base of basin fill), with geologic potential to host both lithium brine and lithium sedimentary deposits.[61] Initial surface samples in the Railroad Valley are testing positive for lithium.[62]

COO Glenn Collick reveals, “Railroad Valley, Nevada is one of the largest trapped drainage basins in the world. Its size compares to that of the Salinas Grandes salt flat in Argentina, one of the largest lithium deposits in the world. Ameriwest’s 6,200-acre (2,500 ha) Railroad Valley Property represents a new and unexplored target which management feels has a high profitability for discovery of lithium rich brine deposits, subject to exploration success – just what the U.S. needs in its race for domestically-sourced lithium.”

Railroad Valley is also surrounded by volcanic rocks – a known source of lithium. Even better, the geothermal activity in the area produces numerous hot springs which are likely to contain high levels of lithium.[63]

CEO David Wilkinson adds, “Ameriwest is in Nevada because Management believes the potential for discovery of major new lithium deposits in North America is the greatest. We’ve put together an amazing technical team skilled in exploration and resource development, with the goal of growing a new junior exploration and development company into a potential lithium producer in the next decade.”

Ameriwest Lithium (AWLIF) – currently selling under $1 as of August 2021 – could put early investors, like you, into the driver’s seat of being a big winner in The Lithium War… as skyrocketing demand for lithium takes on economic and national security importance.*

7 Reasons Why Ameriwest Lithium (AWLIF) Can Help America Win the Lithium War

In the Nevada desert, a quiet frenzy is building over lithium. Domestically-sourced lithium is crucial to meeting the U.S.’ goals to transition to clean energy and halt China’s current dominance in the lithium race.

Lithium, the crucial component in batteries for electric vehicles and renewable energy storage, has mostly been produced in countries like China, Australia and Chile. But with Nevada’s looming white gold rush the winds are shifting to U.S. becoming lithium independent… and perhaps a dominant exporter.

One junior resource company Ameriwest Lithium (AWLIF) is worth your consideration. Here’s why.

- Decarbonization of the Energy System is a Growing, Unstoppable Trend. The world is looking to clean energy to power the future. There’s no turning back now. Lithium is the key.

- Soaring Demand – Global lithium production is expected to triple by 2025,[64] and increase ten-fold by 2030 – driven by the demand for electric vehicles (EV), battery storage systems and consumer electronics.

- National Emergency Declared – Both the Trump and Biden administrations declared foreign dependence (China) on lithium supply chain – from mining to processing to manufacturing – a major threat to our economic and national security.[65] Establishing a healthy domestic lithium supply chain is a top priority for the U.S.

- U.S. Pouring in Millions – The Biden Administration is pouring hundreds of millions of dollars into the private sector to increase the domestic production of lithium – a boon to junior mining operations like Ameriwest.[66]

- Hot Location – Ameriwest Lithium (AWLIF) has almost 12,000 acres of mineral claims within areas of known lithium resources in Clayton Valley and Railroad Valley, Nevada. Nevada is home to the largest-known lithium deposits in the world… and could hold as much as 25% of the world’s lithium.[67] Their Deer Musk mine is within 5 miles of Albemarle’s (NYE: ALB) Silver Peak Mine–the only lithium producing mine in North America.[68]

- Mining-Friendly Nevada – The governor, legislature and officials are committed to the promotion and establishment of mineral exploration and development.[69] Junior exploration and resource companies, such as Ameriwest Lithium, are very welcome in the state.

- Expert Management – Exceptionally talented team with the education, energy and decades-long experience… specifically in lithium mining and production in Nevada. Highly-skilled in engineering, geology and accurately assessing properties through geochemical sampling, geophysics, and drilling. Ameriwest has put together a team of experts adept at discovering lithium deposits from grassroots, as well as having a nose for identifying acquisition opportunities. You can and should read more about their expert team on Ameriwest’s website at ameriwestlithium.com.

Don’t Miss this Historic Opportunity to be a Big Winner in the Unstoppable Clean Energy Revolution with Ameriwest Lithium (AWLIF)*

It’s not often in the course of human events that everyday investors have the opportunity to ride a new energy wave into the future… and possibly make tons of money too. The last major shift happened in the 1860’s when the country shifted from whale oil and candles to oil and gas. Many investors became millionaires.*

Today, we’re experiencing the next major shift… from oil and gas to renewable clean energy. Early investors willing to take on risk could possibly make their own energy fortune.

And for all the reasons I’ve mentioned in this report, the early window of opportunity is open thanks to America’s commitment to lithium mining and manufacturing. Securing a domestic source of lithium is an absolute must for America’s economic and national security. Failure is NOT an option.

Early aggressive investors in lithium exploration and mining companies could be tomorrow’s lithium millionaires.*

Here’s how to learn more about Nevada’s lithium jackpot and Ameriwest Lithium’s (AWLIF) sunny prospects for investors.

Simply go to www.ameriwestlithium.com. While on site, be sure to register your email address for future announcements from the company, particularly those that report ongoing exploration results. Click on “Get News Alerts!” at the top of the home page and sign up.

So far in 2021, Ameriwest’s stock has gained over 600%![70] And I believe that is just the beginning of gains Ameriwest may have in store for early investors. *

What’s more, Ameriwest is affordable. The price for a single share of stock is currently under $1 USD as of mid-August 2021. [71]

Compare Ameriwest’s 2021 stock gains to larger lithium mining companies[72], such as…

- Jiangxi Ganfeng[73] – 18% Gain. Current buy price $15.75/share

- Albemarle[74] – 10% Gain. Current buy price: $168/share

- Tianqi Lithium[75] – 67% Gain. Current buy price: $70/share

- Mineral Resources[76] – 43% Gain. Current buy price: $43/share

- Piedmont Lithium[77] — 138% Gain. Current buy price: $68/share

- Sigma Lithium[78] — 97% Gain. Current buy price: $5.39/share

- Vulcan Resources[79] — 171% Gain. Current Buy Price $5.97/share

As you can see, investing in lithium stocks has been very profitable with hefty gains realized in a few months. And with soaring lithium demand, strong annual gains could potentially be the norm for years to come.*

Take Your Position in Ameriwest Lithium (AWLIF)

If you wish to be among the early bird big winners in the coming lithium explosion, then I suggest you show this report to your investment advisor or broker right away.

Ameriwest Lithium (AWLIF) right now is a junior lithium resource and exploration company exploring in one of the most lithium-rich and mining-friendly locations in the U.S., the state of Nevada.

Investing in their company has the potential for higher rewards than other larger mining operations, but it also comes with higher risk. And past performance is no guarantee of future results.*

And, I’m not an investment advisor let alone your investment advisor. But, my rule and admonition to all my readers is never invest more than you can afford to lose. Do not chase losses. That means if the prices slide you must resist all temptation to “average down.”*

And to minimize risk, any investment you may make in Ameriwest Lithium (AWLIF) should be part of a wider asset allocation strategy in your portfolio.

But with that strong caution to my readers, I believe my analysis of the potentially huge reward of Ameriwest (AWLIF) is a good one.

Wishing you success in all your investments.

James Hyerczyk

Investingtrends.com

* See our Important Notice and Disclaimer below for a detailed discussion on compensation, risks, atypical results, and more.

Still want more information on Ameriwest Lithium (AWLIF)?

Still want more information on Ameriwest Lithium (AWLIF)?

I’d like to offer you access to Ameriwest Lithium’s Investor presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

ADVERTISEMENT DISCLAIMER

THIS PUBLICATION IS AN ISSUER-PAID ADVERTISEMENT. This paid advertisement includes a stock profile of Ameriwest Lithium (AWLIF). To enhance public awareness of AWLIF and its securities, the issuer has provided Promethean Marketing, Inc. (“Promethean”) with a total budget of approximately two million two hundred forty-nine thousand eight hundred and twenty ($2,249,820.00) USD to cover the costs associated with this advertisement for a period beginning 3 June 2021 and currently set to end 22 February 2022. In connection with this effort, Promethean has paid the author of this advertisement, James Hyerczyk, three thousand five hundred ($3,500.00) USD in cash out of the total budget. The website hosting this advertisement, Investing Trends, is owned by Summit Publishing Group, Inc. (“Summit”), an affiliate of Promethean. Neither Summit nor Investing Trends have been paid to host this advertisement. As a result of this advertisement, Investing Trends may receive advertising revenue from new advertisers and collect email addresses from readers that it may be able to monetize. Promethean will retain any excess sums after all expenses are paid. James Hyerczyk is solely responsible for the contents of this advertisement. As of the date this advertisement is posted to the Investing Trends website, some or all of Promethean, Investing Trends, Summit, or James Hyerczyk, and any of their respective officers, principals, or affiliates (as defined in the Securities Act of 1933, as amended, and Rule 501(b) promulgated thereunder) may hold the securities of AWLIF and may sell those shares during the course of this advertising campaign. This advertisement may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of AWLIF, increased trading volume, and possibly an increased share price of AWLIF’s securities, which may or may not be temporary and decrease once the advertising campaign has ended. To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy located here.

[1] BUILDING RESILIENT SUPPLY CHAINS, REVITALIZING AMERICAN MANUFACTURING, AND FOSTERING BROAD-BASED GROWTH June 2021 See accompanying Adobe File: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[2] Page 5: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[3] Page 129: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[4] Page 9: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[5] https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain

[6] Page 9: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[7] https://www.nsenergybusiness.com/features/largest-lithium-mining-companies/#

[8] https://www.kornferry.com/insights/briefings-magazine/issue-42/electric-vehicles-the-race-for-lithium

[9] https://www.epsilor.com/sections/blog/Blog24082017/

[10] https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[11] Chart is on page 108 and sourced to BloombergNEF 2020. Long Term Electric Vehicle Outlook 2020.

[12] https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain China is among the five top countries with the most lithium resources, according to the 2020 USGS, but it has been buying stakes in mining operations in Australia and South America where most of the world’s lithium reserves are found.

[13] https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain “Of the 136 lithium-ion battery plants in the pipeline to 2029, 101 are based in China,”

[14] https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[15] https://www.nsenergybusiness.com/news/industry-news/us-critical-minerals-trump/

[16] https://www.washingtonpost.com/climate-solutions/2021/01/28/biden-federal-fleet-electric/

[17] https://www.washingtonpost.com/climate-solutions/2021/01/28/biden-federal-fleet-electric/

[18] https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html

[19] https://cleantechnica.com/2021/02/08/2020-us-electric-vehicle-sales-report

[20] https://www.kornferry.com/insights/briefings-magazine/issue-42/electric-vehicles-the-race-for-lithium

[21] https://www.voanews.com/silicon-valley-technology/how-china-dominates-global-battery-supply-chain

[22] https://www.kornferry.com/insights/briefings-magazine/issue-42/electric-vehicles-the-race-for-lithium

[23] Page 11: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[24] https://www.gm.com/electric-vehicles.html

[25] https://www.statista.com/statistics/225326/amount-of-cars-sold-by-general-motors-worldwide/

[26] https://gmauthority.com/blog/2021/05/general-motors-sold-over-200000-evs-in-2020/

[27] https://www.forbes.com/sites/neilwinton/2021/07/07/volkswagen-electric-car-sales-lag-but-should-rally-in-2021s-2nd-half/?sh=31299d9c1c07

[28] https://en.wikipedia.org/wiki/List_of_electric_cars_currently_available

[29] https://www.motortrend.com/features-collections/every-electric-car-you-can-buy/

[30] https://www.autocar.co.uk/car-news/best-cars/top-10-best-luxury-electric-cars

[31] https://www.businessinsider.com/amazon-creating-fleet-of-electric-delivery-vehicles-rivian-2020-2

[32] https://www.climatechangenews.com/2021/04/23/100-multinational-corporations-taken-climate-pledge/

[33] https://ameriwestlithium.com/about/

[34] https://www.forbes.com/sites/arielcohen/2020/08/13/tesla-begins-construction-of-worlds-largest-energy-storage-facility/?sh=3cff6f6e4fde

[35] https://www.bbc.com/future/article/20201217-renewable-power-the-worlds-largest-battery

[36] https://www.forbes.com/sites/kensilverstein/2020/12/16/china-is-vowing-to-increase-renewables-triggering-a-race-for-energy-storage/?sh=10f0a1be6e90

[37] https://www.bbc.com/future/article/20201217-renewable-power-the-worlds-largest-battery

[38] https://news.energysage.com/tesla-powerwall-battery-complete-review/

[39] https://techcrunch.com/2021/05/26/tesla-has-installed-200000-powerwalls-around-the-world-so-far/

[40] https://www.environmentalleader.com/2021/01/worlds-largest-utility-scale-battery-energy-storage-system-now-online/

[41] Page 92 https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[42] Page 92 https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[43] Page 9 https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[44] Page 86 https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[45] https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[46] https://www.energy.gov/eere/articles/us-department-energy-announces-new-vehicle-technologies-funding-and-future

[47] https://www.energy.gov/articles/doe-announces-30-million-research-secure-domestic-supply-chain-critical-elements-and

[48] https://www.nytimes.com/2021/05/06/business/lithium-mining-race.html

[49] https://en.wikipedia.org/wiki/American_Jobs_Plan

[50] https://www.kbb.com/car-advice/how-do-electric-car-tax-credits-work/

[51] Page 88: https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[52] https://www.energy.gov/articles/doe-announces-30-million-research-secure-domestic-supply-chain-critical-elements-and

[53] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[54] https://thenevadaindependent.com/article/nevada-is-looking-at-more-lithium-mining-an-industry-executive-talks-about-a-market-driven-by-electric-vehicles

[55] https://www.fraserinstitute.org/studies/annual-survey-of-mining-companies-2020

[56] A Preliminary Deposit Model for Lithium Brines, page 1 https://pubs.usgs.gov/of/2013/1006/OF13-1006.pdf

[57] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[58] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[59] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[60] S&P Global Market Intelligence, Lithium Sector: Production Cost Outlook, 2019

[61] NI 43-101 Technical Report on the Railroad Valley Lithium Property, NV, for Blue Eagle Lithium, Edward Lyons, P.Geo., October 2018)

[62] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[63] https://ameriwestlithium.com/wp-content/uploads/2021/04/Ameriwest-Presentation-V2-Jul-2021.pdf

[64]https://ameriwestlithium.com/about/ Investment Highlights

[65] https://www.whitehouse.gov/wp-content/uploads/2021/06/100-day-supply-chain-review-report.pdf

[66] https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

[67] https://www.nevadamining.org/lithium-ion-batteries/

[68] https://ameriwestlithium.com/about/#management

[69] https://www.leg.state.nv.us/App/NELIS/REL/80th2019/ExhibitDocument/OpenExhibitDocument?exhibitId=36158&fileDownloadName=Nevada%20Governors%20Office%20of%20Economic%20Developement%20Mining%20Brochure.pdf

[70] 1/4/21 price 14 cents. Price on Aug 27 is 87 cents. 87/14=621% https://www.tradingview.com/symbols/CSE-AWLI/

[71] https://www.tradingview.com/symbols/OTC-AWLIF/

[72] https://www.nsenergybusiness.com/features/largest-lithium-mining-companies/# First 4 in list. Last 3 from Ameriwest website.

[73] 13.30 on 1/4/21 and 7/6/21 $15.75 https://www.google.com/search?q=jiangxi+ganfeng+lithium+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00dd7U26eNu2v5i3TQkZzW7xJWSeg%3A1625664121014&ei=earlYJYq19y1BszPnMAG&oq=Jiangxi+Ganfeng+Lithium&gs_lcp=Cgdnd3Mtd2l6EAEYATIECAAQQzIECAAQQzICCAAyAggAMgIIADICCAAyAggAMgIIADICCAAyAggASgQIQRgAUNy1CVjctQlgtM4JaABwAngAgAFwiAHAAZIBAzEuMZgBAKABAqABAaoBB2d3cy13aXrAAQE&sclient=gws-wiz

[74] 152.63 on 1/4/21 and 7/6/21 $168.66 https://www.google.com/search?q=albemarle+lithium+stock&rlz=1C1CHBF_enUS759US759&oq=Albemarle&aqs=chrome.4.69i57j0i67l2j0i20i263i433j0i67j0i433j0i67j46i433j0i457j46i175i199.6684j0j15&sourceid=chrome&ie=UTF-8

[75] 42 on 1/4/21 and 70.19 on 7/6/21 67% https://www.google.com/search?q=tianqi+lithium+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00DT6bcbtJNWcHLnwfNjLwXUfQ50Q%3A1625663844178&ei=ZKnlYIavCsWqtQbS6azwDw&oq=tianqui+lithium+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADIJCAAQChBGEPoBMgQIABAKMgQIABAKMgQIABAKOgYIABAHEB46CAgAEAgQBxAeOggIABAHEAUQHjoECAAQDToICAAQDRAFEB46CAgAEAgQDRAeSgQIQRgAUO_FEFiL0xBgr-gQaABwAngAgAFxiAH8BJIBAzcuMZgBAKABAaoBB2d3cy13aXrAAQE&sclient=gws-wiz

[76] $30 on 1/4/21 and 7/6/21 $43 https://www.google.com/search?q=mineral+resources+lithium+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00zJWwP1N7BDF_YAWywF2b4u3QI5w%3A1625664616008&ei=Z6zlYLP6PI_NtQasnZXAAg&oq=mineral+resources+lithium+stock&gs_lcp=Cgdnd3Mtd2l6EAwyAggAOgcIABBHELADOgQIABANOgYIABAHEB46CAgAEAgQBxAeOgYIABANEB46CAgAEA0QBRAeOgkIABANEEYQ-gFKBAhBGABQ2TtY-1VgzmRoAXACeACAAX-IAbQGkgEDNy4ymAEAoAEBqgEHZ3dzLXdpesgBCMABAQ&sclient=gws-wiz&ved=0ahUKEwjzydfPiNHxAhWPZs0KHaxOBSgQ4dUDCA4

[77] 28.65 on 1/4/21 and 68.05 on 7/6 https://www.google.com/search?q=piedmont+lithium+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk00EGaYOq6X_GXtkQavDxMl9Auueew%3A1625669860613&ei=5MDlYMH0JJTdtQb2k4-YCw&oq=piedmont+lithium+&gs_lcp=Cgdnd3Mtd2l6EAEYADIHCAAQsQMQQzIECAAQQzIECAAQQzIICAAQsQMQgwEyBwgAEIcCEBQyAggAMgIIADICCAAyAggAMgIIADoHCAAQRxCwAzoHCAAQsAMQQzoECAAQDToHCCMQsAIQJzoFCAAQzQI6BQghEKsCSgQIQRgAUOypDFi6zwxgiN4MaAFwAngAgAFtiAHIB5IBBDExLjGYAQCgAQGqAQdnd3Mtd2l6yAEKwAEB&sclient=gws-wiz

[78] $2.74 on 1/4/21 and $5.39 on 7/6/21 https://www.google.com/search?q=sigma+lithium+stock&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk01pX8j-pb1DaWViL39rIhIArR_W6w%3A1625670070731&ei=tsHlYNaULJb0tAbsh5dI&oq=sigma+lithium+stock&gs_lcp=Cgdnd3Mtd2l6EAEYADIHCAAQRhD6ATICCAAyAggAMgQIABAeMgYIABAIEB46BwgAEEcQsAM6BwgAELADEEM6BggAEAcQHjoICAAQCBAHEB46BAgAEA1KBAhBGABQsIkOWOSQDmCpnw5oAXACeACAAV6IAf4DkgEBNpgBAKABAaoBB2d3cy13aXrIAQrAAQE&sclient=gws-wiz

[79] $2.20 on 1/4/21 and $5.97 on 7/6/21 https://www.google.com/search?q=vulcan+resources+stock+price&rlz=1C1CHBF_enUS759US759&sxsrf=ALeKk02g6P_ZvVEmGfnKNgl4XRrzOCpN9Q%3A1625670305301&ei=ocLlYMPdEZmF9PwPosWF2AE&oq=Vulcan+Resources+Stock&gs_lcp=Cgdnd3Mtd2l6EAEYATIHCAAQRhD6ATIGCAAQFhAeMgYIABAWEB4yBggAEBYQHjIGCAAQFhAeMgYIABAWEB4yBggAEBYQHjIGCAAQFhAeMgYIABAWEB46BwgAEEcQsAM6DAgjECcQnQIQRhD6AToECCMQJzoFCAAQkQI6CwguELEDEMcBEKMCOgUIABCxAzoICC4QsQMQgwE6CggAELEDEIMBEEM6BAgAEEM6DQguELEDEMcBEKMCEEM6BwgAELEDEEM6AggAOgcIABCHAhAUOggILhDHARCjAjoMCAAQhwIQFBBGEPoBSgQIQRgAUJCdCliVwApgys8KaAJwAngAgAHCAogBgROSAQgxNi42LjAuMZgBAKABAaoBB2d3cy13aXrIAQjAAQE&sclient=gws-wiz

James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade and the Chicago Mercantile Exchange and numerous brokerage firms, and have been providing quality analysis for professional traders for 38 years.